RIA What is a Registered Investment Adviser

Post on: 16 Март, 2015 No Comment

Definition, Compensation and Advantages of RIAs

You can opt-out at any time.

What are Registered Investment Adviser (RIA)s? What do they do? How do they get paid and why should investors consider use them versus other adviser types?

Definition of RIA

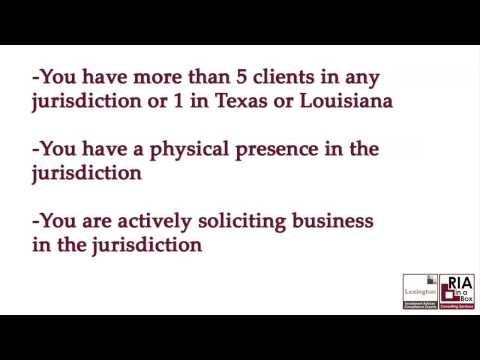

A Registered Investment Adviser (RIA) is a firm that is registered with a State regulatory body, such as the Securities division of the state’s Attorney General’s office, or the Securities Exchange Commission (SEC). RIAs register in the states where their primary office is located and in other states where they do business, if they have a significant number of clients in those states.

RIAs register with the SEC if they have at least $100 million in assets under management (AUM) and firms managing less will register with their respective state.

RIAs are regulated by the Financial Industry Regulatory Authority (FINRA), which is a non-government oversight entity given authority by Congress to protect America’s investors by making sure the securities industry operates fairly and honestly.

Compensation and Advantages of RIAs

RIAs must uphold what is called a fiduciary standard of care, which essentially means that they must manage assets and make investment recommendations in a way that is in the best interests of clients. In different words, RIAs must place the clients’ interests ahead of their own interests.

For this reason, RIAs and the representatives working for them cannot have competing interests and can only be compensated by the client (and not other sources, such as commissions or incentives that may not be in the best interest of the clients).

This can be advantage for investors because they have some assurance that the advisor is not giving advice or making trades for any reason other than advice to serve the client’s needs.

RIAs typically get paid by a percentage based upon AUM or they may do fee-only services, such as financial planning. For example, if a client has $100,000 and the RIA’s AUM charge is 1.00%, the client pays the RIA $1,000 per year for advisory services.

Note on Advisor versus Adviser

An advisor (-or) and an adviser (-er) are the same thing. The ‘er’ suffix is the spelling in Federal law written by Congress and the ‘or’ ending is the more commonly used suffix.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.