Revisiting American Depositary Receipts

Post on: 14 Июнь, 2015 No Comment

In issue 394, Shares Investment (Singapore) has introduced American Depository Receipts (ADRs) in an article to readers and investors. Since then, the 19 ADRs added to the SGX have been traded with much volatility.

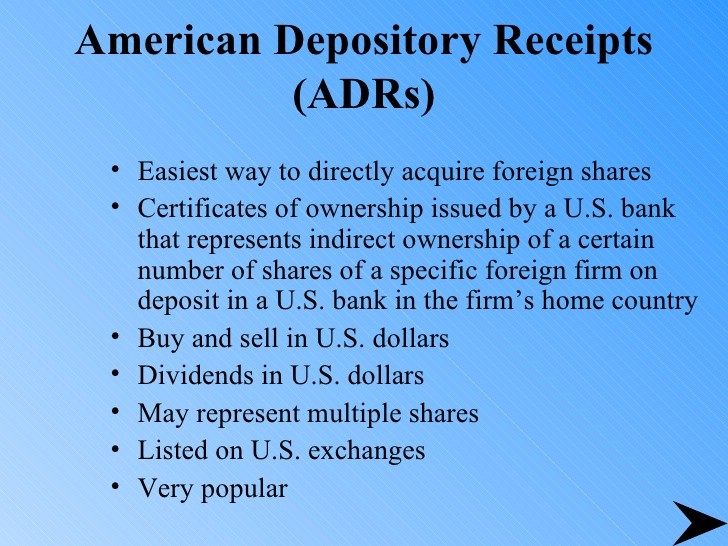

ADR is an entity that trades in the US but represents a specific number of shares in a foreign company. Due to the complexities involved for foreign companies to list their stocks in the US and for investors to purchase foreign shares in the US because of trading restrictions and currency differences, ADR was introduced for such inconveniences to be eradicated.

How does it curb said inconveniences you might ask? The US banks will purchase a mass amount of shares from the foreign companies who want to be listed on the exchange be it New York Stock Exchange (NYSE) or NASDAQ Stock Market (NASDAQ), and bundle them in a different way before introducing to investors. Upon purchasing the mass amount of the foreign shares from the foreign companies, the US banks will then issue “receipts” against these shares, in which each receipt has a prefixed apportionment of underlying shares (e.g 1 ADR=10 shares).

For instance, if one share of company A is priced at US$1, 1 ADR = 10 shares would amount to a price of US$10 for 1 ADR of company A. Therefore, the issuing bank would act as a depository for these shares as it stores the shares on behalf of the receipt holders.

The depository for the ADRs in Singapore is none other than the Central Depository of Singapore (CDP). A transfer process then follows between CDP and Depository Trust and Clearing Corporation (DTCC) of the US.

Single Versus Double Quote

As you have probably noticed, there is a distinction between single and dual listed ADRs seen on GlobalQuote. Dual listed ADRs are listed in the US and an overseas market. An example of this would be PetroChina Company, in which it has common shares listed in Hong Kong and ADRs listed on the NYSE. Thus, such issuers are required to abide by the securities laws and listing regulations in both the overseas market and the US. Single listed ADRs represent ownership of shares in an issuer not listed in any overseas market. For instance, Baidu Inc does not have listed common shares but its ADRs are listed on NASDAQ.

[Single listed ADRs are quoted with a “+” sign on GlobalQuote behind their counter name for example, (CTRP.com International ADR 10US$+)]. The ADRs quoted on GlobalQuote are fully fungible with the ADRs in the US, which means that the ADRs are the same securities and it could be freely transferred, at a fee across borders between Singapore and the US. In addition to that, the dual listed ADRs can be converted into common shares listed in the overseas market through a process called “Issuance and Cancellation”.

ADR Conversion And Risks

In short, the “Issuance and Cancellation” process involves the conversion of common shares into ADRs and vice versa. CDP however charges a transferable fee of $10.70 per transfer instruction, the ADR depository (DTCC) also charges an issuance of $0.25 per ADR issued. The entire conversion process, if done correctly, takes about 24 hours. This means that besides paying your normal brokerage fee (0.00275% or $25 minimum), the transfer fee, and the ADR issuance fee have to be factored in.

However, do remember that single listed ADRs have no common shares listing in the overseas market and it would not be encouraged for investors to convert them into unlisted common shares. Adding onto the risks mentioned in our earlier article “Introducing American Depositary Receipts ”, the additional risks for ADRs are harbored heavily around the fact that so many parties are involved in the conversion process.

For instance, miscommunication between the broker and the issuance could result in a less optimal price that you were hoping to transact at. Political risks of the country that the foreign company trades in could affect the reactions of its particular ADR, as ADR tracks movement from the primary company it was based on for benchmarking. This is followed by currency risks, which could make your transactions more expensive, or lessen your profits due to currency volatility.

Lastly, if an ADR delists from the US exchanges, the company need not seek any approval from ADR holders’ for any consensus. This makes it very disadvantageous for ADR holders’ if such event does happen, as they will not even be paid a premium for their ADR upon delisting.

Different folks have different strokes. Make sure yours is the most suitable one.