Review of Technology sector funds India

Post on: 20 Август, 2015 No Comment

Savvy investors who have been following the equity markets would have surely observed that in the last one year certain industry sectors have outperformed the market. IT and Pharmaceuticals are two such sectors. In this article we will review opportunities to generate superior returns by investing in the IT sector. The chart below shows the daily price movements of the S&P BSE IT Index (the Index for IT stocks) and the Sensex, indexing prices of both the indices on Feb 15 2013 to zero.

The chart clearly shows that the IT sector has outperformed the Sensex, on a consistent basis since July 2013. The primary reason for the outperformance has been the depreciation of the Rupee versus the US dollar which made the Indian IT sector competitive, in addition to the organic growth in dollar terms for the IT companies. In terms of returns, the BSE IT Index has delivered 43.7% returns in the last one year, while the Sensex has delivered only about 4.6%. It is only natural that savvy investors, invested in diversified equity funds may want to consider investing in IT sector focused funds to exploit the potential of superior returns. The future outlook of the IT sector remains very positive due to:-

- High current account deficit and lower capital inflows imply that the rupee will continue to be under pressure, which will ensure the continued competitiveness of the IT sector

Should mutual fund investors consider Technology Sector Funds

When we examine this question, we should first revisit the objectives of financial planning. For our long term financial objectives, diversification is the best strategy. Diversification limits our downside potential, only to systematic risk or market risk. Diversification prevents exposure to sector risks or company specific risks. Therefore for long term goals like retirement planning and children’s education, one should always choose diversified equity funds through a systematic investment plan. Sector funds are more risky than diversified equity funds, since it exposes the investor to sector risks. Changes in government policies, industry specific issues and technological developments may impact sectors, either in a positive or a negative way. However, for well informed active investors, sector funds can be good investment opportunities in the short to medium term, especially if the broader market returns are weak in the same time horizon. The chart below shows the annualized returns over one, three, five, seven and ten years time horizons, from the top performing diversified equity and technology sector funds

Advertisement

While the technology sector funds have clearly outperformed diversified equity funds in the one to five years time horizon, over a longer time frame the performance levels out. Therefore technology funds are suitable for well informed investors who can get in and exit at the right time, to generate maximum returns on their investments. However, it is important to reiterate that these funds should supplement systematic plan investments in diversified equity funds.

Top Performing Technology Sector Funds

As with selection of any mutual fund scheme, fund manager track record is very important, since fund management performance generates superior returns. The chart below shows the differences in the investment returns generated by the top performers in the Technology Sector Funds category and the category in general, over one, three, five, seven and ten years time periods.

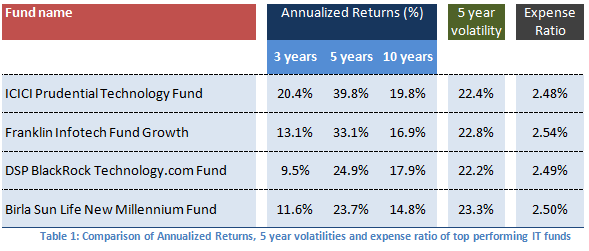

The table below lists the top performing technology sector funds, based on five year annualized returns.

ICICI Prudential Technology Fund: This is the best performing scheme in the IT sector, with consistently high returns, across different time periods. The fund has a large to mid cap bias with a high growth focus. It is reasonably well diversified across the IT sector. Infosys, Mindtree, Wipro, Persistant Systems and Tech Mahindra account for nearly 70% of the portfolio value. With over Rs 2.1B assets under management, the expense ratio is 2.48%.

Franklin Infotech Fund Growth: This fund has Rs 1.6B assets under management, with an expense ratio of 2.54%. The scheme has performed consistently well and has predominantly a large cap focus. Infosys, TCS, Wipro, Infotech Enterprises and Oracle Financial Services comprise more than 92% of the portfolio value.

DSP BlackRock Technology.com Fund: This fund has a large cap bias, with Infosys, TCS, HCL Tech, NIIT and Bharti Airtel accounting for more than 85% of the portfolio value. The scheme has Rs 486 million assets under management, with an expense ratio of 2.49%.

Birla Sun Life New Millennium Fund: The fund has nearly Rs 670 million assets under management. The expense ratio of the scheme is 2.5%. The fund has a large cap focus, with Infosys, TCS, HCL Tech, Tech Mahindra and Bharti Airtel comprising 75% of the portfolio.

( Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)