Reverse Dollar Cost Averaging

Post on: 13 Август, 2015 No Comment

I dug this paper out of the archives because it presents an extremely valuable lesson for anyone thinking about withdrawing investment assets for retirement income. And that means everyone. Most people understand the benefit of dollar cost averaging during the saving years. Few people realize, however, that those principles work against you when taking income from your nest egg. The result is a phenomenon called reverse dollar cost averaging. Lets take a look at the problems this could potentially cause and some possible solutions.

This study was completed by Henry K. Hebeler in January of 2001 and can be found here. It is a quick read with a very important thesis

In the authors words:

The message is loud and clear. The returns for retirement planning are far too high for a retiree who wants a fair chance of financial survival.

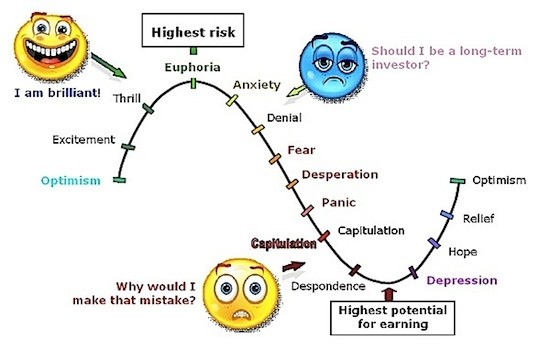

Why is this? Please allow me to paraphrase some of the information. The principle of dollar cost averaging shows that buying a large number of shares at low prices when the market is down more than offsets the cost of buying fewer shares at higher prices when the market is up. This leads to greater than average returns over the long run and offers a major advantage to systematic savers. All major financial institutions have marketed this to the maximum extent to teach consumers the value of regular investment contributions and long-term strategies.

But there is another side to this story. For every buyer of securities there must be a seller or as Hebeler puts it, for every winner there is a loser. The loser in this case is the person selling stocks for income purposes. Selling stocks systematically presents the exact opposite effect on long-term returns, also known as reverse dollar cost averaging.

Over time, returns for buyers and sellers will average out. Theres no win/win. Historical data proves that regular withdrawals produce less than average returns just as regular deposits produce higher than average returns. This presents a major challenge for advisors and consumers who are looking to manage assets for the traditional 4% annual retirement income withdrawal.

So, is it possible to combat the negative effects of reverse dollar cost averaging? Yes it is, and the basic approach is simple. All you have to do is separate income assets from growth assets in order to optimize your portfolio throughout retirement. It is an actuarial fact that a portfolio cannot be optimized without a source of guaranteed lifetime income.

When your retirement income source is insured and stable, you can more easily afford to ride out low points in the market. If you know that no matter what happens your paycheck is guaranteed, you can wait to sell shares when the market returns to normal levels. This is an important lesson because you need to be prepared for every opportunity to do better than average.

Guaranteed income does in fact offer far more benefits than just guaranteed income. As crazy as that sounds its an actuarial, mathematical and economic fact, as illustrated in Hebelers study. Ill do more in the future to drive this point home.

Are you interested in protecting yourself from the phenomenon of reverse dollar cost averaging? That should be an easy question to answer. Call, email or make an appointment now to give yourself every possible advantage for a solid retirement income plan.