Return on Assets Ratio

Post on: 16 Март, 2015 No Comment

Every company makes investments in assets as part of its adopted business growth strategies. Goods based industries such as vehicle manufacturers, are very asset intensive, as they require huge investments in assets like machinery in order to make optimum profits. Service based industries such as advertising agencies are asset light industries, as they require very less investments in assets. The Return on Assets (ROA) ratio shows how much profit a business makes for every $1 invested in assets. In short, it shows how profitable a company’s assets are. It is also referred to as Return on Investment (ROI) ratio.

ROA Ratio Calculation

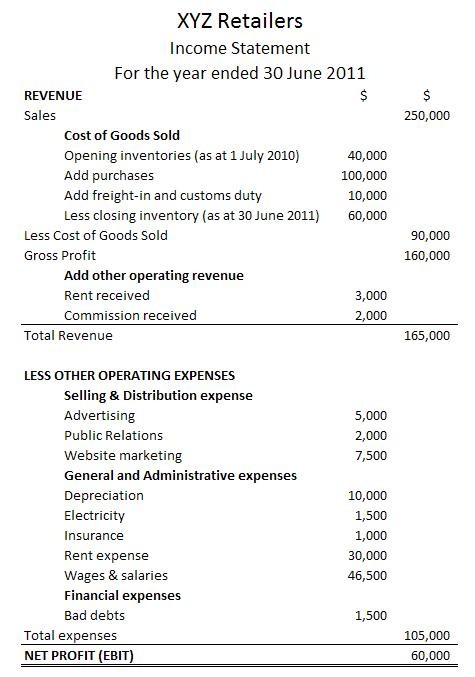

This ratio is calculated in percentage, by dividing a company’s net earnings by its average total assets.

ROA = Net Income ÷ Average Total Assets

Average total assets are calculated by adding the total assets that a company has, in a given period, and dividing it by two. If a company ABC had $1 million in assets in 2012, and has $2 million in assets in 2013, the average asset value for the period would be calculated as $1 million + $2 million = $3 million, divided by 2 = $1.5 million. As far as net income is concerned, some investors add interest expenses to the income while calculating it.

In such a case, the formula for calculating ROA ratio becomes:

ROA = (Net Income + Interest Expenses — Interest Tax Savings) ÷ Average Total Assets

A high ratio indicates that the business is earning more money and investing less on assets. It is an indicator of the asset intensity of a company. Manufacturing firms usually have lower return on assets, as they require huge investments in assets as compared to the service industries. A low ratio shows that the company is more asset-intensive. A high percentage indicates that the company is less asset-intensive. It also means that lesser investments are needed in assets to make profits. In the industry, as a general rule, ROA ratio below 5% indicates that the company is asset-heavy, and above 20% indicates that it is asset-light.

Uses of Calculating ROA Ratio

ROA helps determine a lot of factors, as well as aids in taking certain decisions related to business and investment.

Assessment of Asset Management

ROA gives an idea as to how efficiently the management of a company is utilizing its assets to generate income. Let’s take an example to understand this better. Say a company has a net income of $2 million and total assets worth $10 million. Its ratio would be 20%. Now, take another example of a company which has the same income, i.e. $2 million, but its assets are worth $ 20 million. In this case, the ratio would be 10%. The higher ROA ratio of the first company shows that its management is making the right investment decisions, as the same amount of profit is being earned and the investment in assets is almost half to that of the second company.

Determination of Investment Decisions

The ROA ratio percentage is used by investors to gauge how effectively a company is converting the money it has in debt and equity, to invest in net income. A higher ratio attracts more investors, and they readily buy stocks of such companies.

Profit Indication

It is used to make comparisons between two companies or within two time periods in the same company. A comparison of the figures within the same company will give an idea of whether investment decision amendments incorporated by the company have been successful in generating more earnings or not. A comparison of figures of two companies indicates which company is better at utilizing its assets for generating profits. The figures should always be compared between companies belonging to the same industry. It should not be used to compare two unrelated businesses, as requirements of asset investments vary from industry to industry.

Determination of Shareholders’ Profit

ROA is of top priority to shareholders. A high percentage shows that the company’s assets, which include the capital invested by shareholders, have been utilized in the best possible manner to generate high earnings. It is a means to determine the amount of return earned by the shareholders.

ROA ratio is very easy to calculate. It is also very essential, as it’s an important part of the financial management of a company, and helps in the financial planning for the future. Business managers, investors, and shareholders, all look at these figures to ascertain the returns of investments, and thus, adopt a future course of action accordingly.