Retirement savers should ladder bonds

Post on: 25 Апрель, 2015 No Comment

RobertPowell

No matter whether you’re sitting at the kitchen table with your spouse or in a board meeting at a big money management firm, it is unquestionably the question of day. With the stock market at all-time highs and interest rates rising (albeit slowly), is it time to sell your bonds?

As with all things money, the correct answer is that it depends. And it depends mostly on the reason why you are holding bonds in the first place. If, for instance, you bought bonds with a specific purpose in mind and the reasons for that purchase are still in place, then there’s no reason to dump your bonds, say experts. But if you’re trying to time the market, which we might note most experts advise against, now is probably as good a time as any to sell.

That’s right. If you bought bonds with designs on holding the bonds to maturity to fund some future expense there’s no reason to change course, especially if in the selling you might suffer a loss because of what’s called interest rate risk. The value of a bond tends to move in the opposite direction of interest rates. When interest rates rise, the value of a bond declines and when rates fall the value of a bond increases. And the longer the maturity of the bond, the more pronounced the swings in value will be when rates rise or fall.

TAXES

Big tax bills can devastate your retirement savings. MarketWatch’s Robert Powell and Andrea Coombes talk about strategies to employ before and during retirement to lower your taxes.

RetireMentors: In-the-trenches advice

Ways to boost Social Security payout

Retire here, not there: California

10 things your 401(k) plan wont tell you

In recent months, by the way, the interest rate on the U.S. 10-year Treasury note has risen from its 52-week low of 1.38% hit last July to 2.06% Monday. Read more in the Bond Report .

“With regard to selling bonds, the most important thing to consider is why the bonds were purchased in the first place,” said David Zuckerman, the chief investment officer at Zuckerman Capital Management. “If an investor’s bond allocation is part of a long-term financial plan that will meet financial needs and provide a secure retirement, then selling bonds due to the current interest rate environment is not advisable.”

Others agree. “Making extreme moves out of bondholdings, such as from a long position into stock or cash, seems unlikely and ill advised,” said Greg Gocek, an independent consultant and financial industry arbitrator. “The risk characteristics of stocks are typically greater and the current returns from cash are basically zero or slightly negative after inflation.”

In fact, Gocek said selling bonds just because stocks are hot or in fear of interest rates rising is anything but prudent. “Such a strategy would seem to be driven by market timing. Anticipating a long-term decline in bond prices as economic activity and inflation rises and the Fed reduces its low interest policies seems pretty speculative for the bond portion of the typical individual investor’s asset mix.”

Others are in the same chorus line.

“If a person were properly allocated in the first place then they would be holding the right amount of bonds to match their important liabilities, that is, those liabilities that are really crucial to them,” said Kent Smetters, a professor at the Wharton School at the University of Pennsylvania. “Any reason to change that allocation or style, including shifting to equities, suggests that investor believes in the cult of market timing, mispricing or beating the market. I generally don’t. Hence, I would suggest that investors consider whether their allocation still makes sense in light of recent market changes but not their strategy—unless they belong to the cult.”

What to do then? Well, here are some scenarios which that can help you decide what to do with your bond portfolio.

Do have a bond ladder?

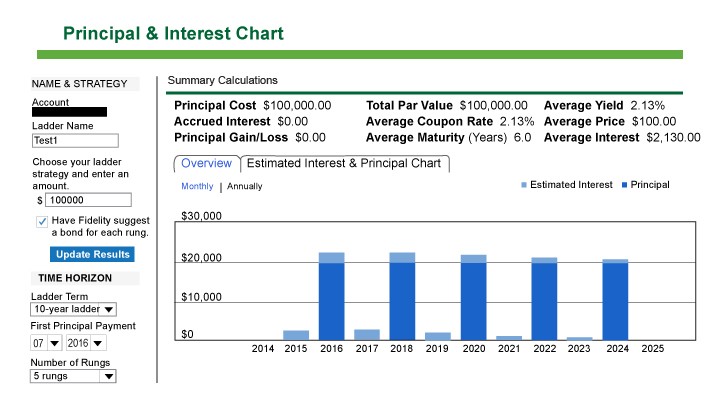

For much of these zero-interest-rate-policy (ZIRP) years, experts have been telling those saving for retirement and living in retirement to use what’s called a bond ladder for the fixed-income portion of their investment portfolio.

Bond laddering is a technique for generating current income while reducing the effect of rising and falling interest rates on the fixed-income portion of your portfolio, said William O’Donnell, the head of U.S. Treasury strategy at RBS, who along with Lee Munson, founder and chief investment officer of Portfolio LLC. spoke at a MarketWatch event on the topic of bonds. last year along.

With a bond ladder, you would allocate a portion of fixed-income portfolio along the yield curve, with your money invested in mix of short-, intermediate- and long-term bonds. And more sophisticated investors with more assets could further using something called duration matching with a bond ladder to further reduce risk, said Smetters.

Now in recent years, some experts have told investors to invest the lion’s share of their money earmarked for fixed-income to cash, and short- and intermediate-term bonds and not so much in long-term bonds. That way, when interest rates rose, they could start to move some of the money they had in low-yielding money market accounts or CDs or short-term bonds into high-yielding intermediate and long-term bonds.