Retirement Investment Strategies by Age

Post on: 19 Июль, 2015 No Comment

Saving and investing for retirement ideally should begin the moment you start working — if not before — and continue well into later life. That said, your investment strategy is not static, and will be different throughout every stage in life. Of course, you should discuss your particular situation with your investment professional, who is attuned to your individual goals and tolerance for risk, and can help identify the most appropriate strategies for you.

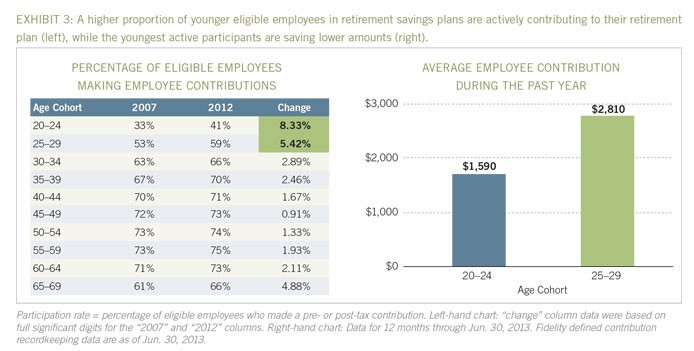

- Time is on your side, and generally you might consider being more aggressive with your investment approach. because you have many years to weather market fluctuations.

- You might want to consider equities at this stage, which typically have provided greater long-term growth potential than bonds and cash instruments. They are a popular choice early on — especially when laying a solid foundation for your retirement portfolio (one that can compound over time) is the main goal.

- Consider using a growth and income investment approach to help balance retirement planning and other larger financial commitments, such as a child’s college education.

- You still have time to grow your nest egg but may require occasional capital outlays to meet more imminent obligations.

- A growth and income investment approach, with an allocation still favoring equities for capital appreciation, can be a prudent option to consider at this stage. Also, consider investing in dividend-paying stocks that can help serve both purposes.

- As you approach retirement and seek to reduce risk in your portfolio. there typically will be little time to recover any losses.

- Investors generally have allocated more of their assets to fixed income investments, which tend to be less volatile but historically have offered lower returns than stocks.

- Bonds and dividend-paying stocks are popular choices to consider because they may offer the income needed once you quit getting a regular paycheck.

70s and Beyond

- Ensure your accumulated assets continue to work for you through retirement.

- Your portfolio will likely be more conservative than ever.

- While this typically means a heavy weighting in bonds, you might want to consider not completely abandoning equities, as you seek to keep your portfolio growing ahead of inflation.

- Being too conservative, particularly in today’s low-interest-rate environment, can be as risky as being too aggressive.

Investopedia and BlackRock have or may have had an advertising relationship, either directly or indirectly. This post is not paid for or sponsored by BlackRock, and is separate from any advertising partnership that may exist between the companies. The views reflected within are solely those of BlackRock and their Authors.