Retirement Asset Allocation to Maximize Lifetime Income

Post on: 24 Май, 2015 No Comment

A New Way Of Looking At Asset Allocation In Retirement

You can opt-out at any time.

Please refer to our privacy policy for contact information.

A traditional retirement asset allocation approach will tell you much you should have in stocks vs bonds. and based on that allocation you’ll determine your withdrawal rate ; the amount you can reasonably expect to withdraw each year without ever running out.

As an alternative, some books and advisors will recommend that instead of following an asset allocation model, you should use your money to buy guaranteed income with an immediate annuity.

New academic studies support a retirement asset allocation model that gives you the best of both worlds.

New Retirement Asset Allocation Model Gives You More Consistent Results

Ibbotson, a company that is a leader in the investment allocation research field, has put together a white paper that concludes that you can maximize your lifetime income by replacing a portion of your bond allocation with a variable annuity that offers a guaranteed minimum withdrawal rider (GMWB) .

The Goal: To Maximize Lifetime Income

This research reflects a new way of thinking; to design a retirement asset allocation model that has the primary goal of maximizing lifetime income and reducing the risk of running out of money. This sounds like exactly what every retiree would want.

So how do you create your own maximum lifetime income portfolio? You start with the traditional asset allocation approach of how much should be in stock vs bonds, and then you make some adjustments.

The adjustments to the allocation involve taking a portion of your portfolio and investing in a variable annuity with a guaranteed minimum withdrawal benefit. What such a rider does is insure your retirement income by providing a guarantee that you can always withdraw a specified amount, regardless of the investment performance.

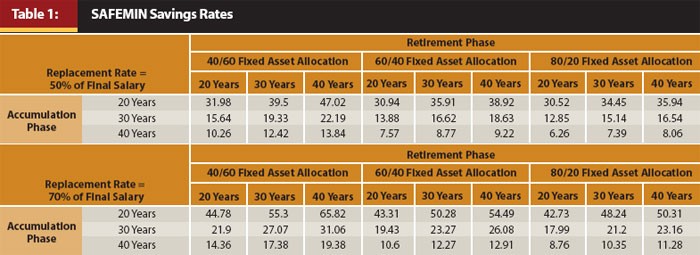

Below are the suggested retirement asset allocations using a blend of traditional assets with a product that has a lifetime income rider.

Retirement Asset Allocation Models To Maximize Lifetime Income

- Conservative

Instead of having a portfolio that was 20% stocks, 80% bonds, you would create portfolio that was 20% stocks, 60% bonds and 20% variable annuity with a GMWB rider.

Instead of having a portfolio that was 40% stocks, 60% bonds, you would create portfolio that was 40% stocks, 45% bonds and 15% variable annuity with a GMWB rider, or to create additional guaranteed income, you would allocate 40% stocks, 25% bonds, and 35% variable annuity with the GMWB rider.

Instead of having a portfolio that was 60% stocks, 40% bonds, you would create portfolio that was 60% stocks, 30% bonds and 10% variable annuity with a GMWB rider.

Why Does The New Retirement Asset Allocation Strategy Deliver Better Results?

This retirement asset allocation works because inside of the variable annuity you are allocating a higher percentage to stocks than you would be if you didn’t use the annuity. You can feel comfortable doing so because the amount of income you can withdraw is guaranteed.

The strategy reduces the odds that you will run out of money and also reduces the odds that you will have to take a decrease in income due to poor market performance.

Asset Allocation Ideas For The Stock/Bond Portion Of Your Portfolio

Once you’ve figured out how much to allocate to a product that guarantees lifetime income, you then decide how to invest the stock and bond portion of your portfolio. Here are a few ideas, with each idea getting slightly more aggressive.

- You could ladder your bonds and buy dividend paying stocks. or use a dividend income fund for the stock allocation.

- You could use a retirement income fund that automatically allocates across stocks and bonds for you, and sends you a monthly check.

- You could layer in some high yield investments with your traditional stock/bond portfolio to maximize current income.

Retirement Asset Allocation Guidelines to Keep In Mind

- The shorter your life expectancy. the more you will want to choose investments and strategies that maximize current income.

- The longer your life expectancy, the more you will want to choose strategies that maximize lifetime income, which may mean they produce less income now, but the income would be expected to keep pace with inflation.

- You can change strategies to meet lifestyle needs. For example, you may want to maximize current income for your first ten years of retirement while you are healthy, with an intentional plan to take less income later when you slow down.