REITs V

Post on: 19 Июнь, 2015 No Comment

About REITs

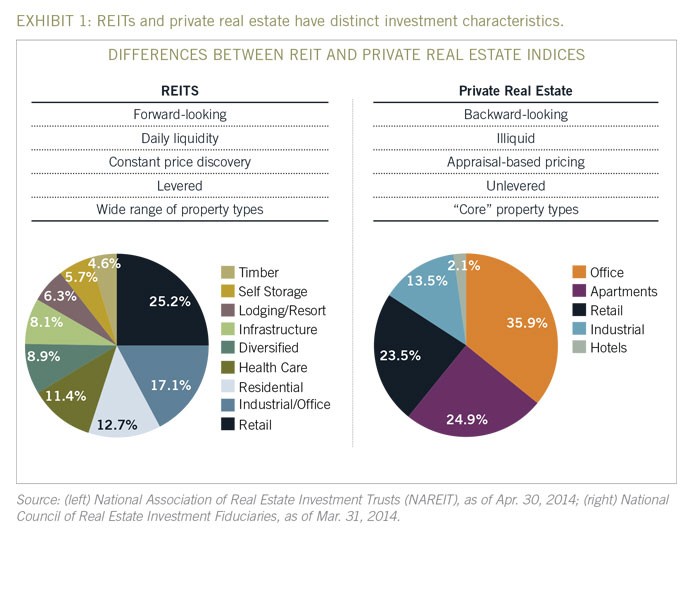

REITs are companies that invest in real estate, real estate financial instruments (such as mortgages) or a combination of both. Like other public companies, public REITs must file quarterly and annual financial reports with the Securities and Exchange Commission. Many REITs trade on major exchanges alongside stocks. Unlike other companies, REITs must distribute at least 90 percent of their taxable income to shareholders, and they do not pay corporate income tax on the distributed dividends.

REIT Advantages

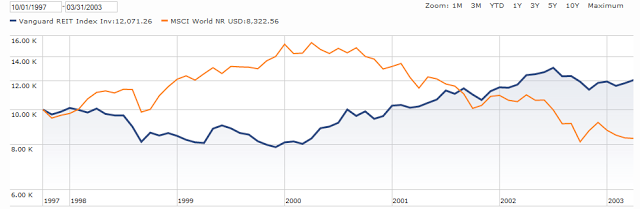

There are several advantages to investing in REITs. Because of their payout requirements, REITs typically provide a consistent stream of dividends. Investing in REITs also provides diversification through exposure to the real estate asset class, which can benefit an investment portfolio. Because many REITs are publicly traded, they offer diversification with the benefit of liquidity, or the ability to sell quickly, that isn’t typically found in traditional real estate investments.

References

Resources

More Like This

Are REITs Safe Investments?

What Is a REIT’s Value?

You May Also Like

Building a solid and diversified portfolio means looking at a number of different asset classes, including stock mutual funds, dividend-paying stocks and.

REITs are real estate investment trusts that either invest in real estate properties or provide mortgage loans to property owners and developers.

Real estate is often considered a relatively reliable investment option. Real estate investment trusts (REITs) can provide an investor with income and.

With savings accounts and money markets hardly paying any interest, you may want to look for alternative forms of high-yielding investments to.

Value and growth stocks are two categories of stocks that reflect the financial metrics of the underlying companies. Investors consider value stocks.

The stock market and real estate can be considered the two major asset classes for growth investing. They both allow investors to.

By investing in Real Estate Investment Trusts (REITs), you can take an ownership stake in the real-estate market without investing directly in.

One of the best ways to invest $200 is to get involved with a dividend reinvestment program or a direct stock purchase.

Several reasons make Real Estate Investment Trusts a safe asset class. Investors can buy and sell shares in REITs as they would.

ETFs and REITs are both types of stock market investments, but that is about the only thing they have in common. Each.

There are many types of investment vehicles where people place their money in the hopes that it grows over time, so that.

Stock and mutual fund dividends can be divided into two classes for income tax purposes. Qualified dividends are taxed at a lower.