Registered Investment Advisor Registered Investment Advisor Registration Series 65

Post on: 16 Март, 2015 No Comment

Definition:

A Registered Investment Advisor (RIA) is an entity who, for compensation (in any form), engages in the business of advising others, either directly or indirectly, of the value of securities or of the advisability of investing in securities. They receive a management fees and do not receive commissions (RIAs receive fees, stockbrokers receive commissions). Incentive fees can be charged if certain conditions are met.

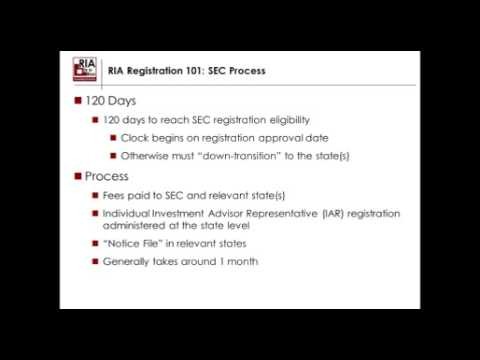

To become an Registered Investment Advisor you must register with the Securities and Exchange Commission (SEC), if you manage $25 million or more. If you manage less than $25 million you are still under the regulatory control of the Securities and Exchange Commission but you must register with the State Securities Commission (or other regulatory agency) in your state of domicile and with each state where you will solicit business (subject to diminimus exemptions).

Usually, Investment Advisor Representatives (IARs) of any Investment Advisor must register in each state they solicit or do business in.

Registration as a Registered Investment Advisor is oftentimes a prerequisite to setting up a Hedge Fund. RIA’s also often register as a Commodity Trading Advisor .

Exam Requirements:

There is no exam requirement by the Securities and Exchange Commission at the federal level for the RIA entity. IARs (Investment Advisor Representatives), however, may have to pass an exam; each state has its own specific requirements.

Although State requirements are becoming more uniform, you must contact the respective state agency that supervises investment Advisors; ask them for the proper registration forms and procedures, and which, if any, exam is required.

The state agency will provide the test application form (generally a U-4 or a U-10 form) along with a registration packet for your completion.

Generally, states require NASAA’s Series 65 Uniform Investment Advisor exam. Some states require the principal of the RIA to pass the exam with a score greater than 70%.

An alternative to the Series 65 is the combination of the Series 7 and Series 66 exams. The Series 66 is only good in conjunction with the Series 7 ; most states will not sponsor a candidate for the Series 7. The 7/66 combination is generally used by an employee of a brokerage firm who is also registering as an investment advisor. Essentially, the Series 66 equals the combination of the Series 65 and Series 63 exams.

A sponsor is not required to take either the 65 or 66 exams — but just passing the exam is only one step in the procedure. You must complete the registration process before you can solicit accounts! Note that the Series 66 is not valid until you pass the Series 7 exam.

Exams are administered Monday through Friday on computers by the Prometric and Pearson VUE testing centers located in cities throughout the U.S. and in certain overseas locations.

The exam requirement may be waived if the applicant holds certain professional designations, i.e. Certified Financial Planner (CFP). Accredited Personal Financial Specialist (APFS), Chartered Financial Consultant (ChFC), Chartered Financial Analyst (CFA). or Chartered Investment Counselor (CIC).

If you are going to register in more than one state you must meet the minimum requirements of each state.

Click here to order Series 65 study program or

Click here to see a description of other FINRA study programs.

Need a test application form U-10? Click here