Reduce Your Capital Gains Tax through Tax Loss Harvesting

Post on: 17 Август, 2015 No Comment

If you are investing in the stock market you probably heard about tax loss harvesting and tax loss sell off which usually happens at the end of the year.

Tax loss harvesting is an investment strategy where an investor sells a security to realize a loss and invests the proceeds from the loss sale into a “replacement” security which provides a similar market exposure to the investor. There are certain rules investors should follow to avoid the loss to be disallowed by IRS. To make sure that the loss realized is tax deductible investors should follow special rules set by IRS. Specifically, it is the “wash sale rule”. (You can read about it in IRS Pub 550).

Many retail investors avoid the tax loss harvesting as they think that the strategy is complex and hard to implement. In this article I will try to show that if someone sticks to the basic guidelines and avoids “special” situations the strategy can be very straight forward and beneficial. I will also provide real life examples from trades I am considering doing myself around this time of the year.

So, let’s first overview the relative regulations we should consider.

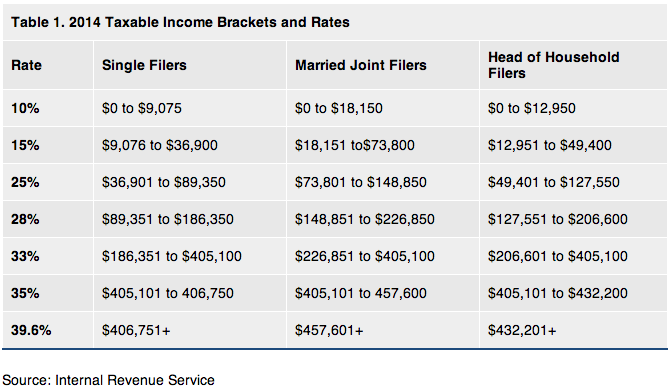

The first thing to consider is the capital loss deductibility. The capital loss is the difference between the purchase price you paid for the security and how much you sold it for – this is quite straightforward. Capital losses can be used to reduce your taxable capital gains. When someone has more capital losses than gains (or no gains at all) the capital loss can be used to offset ordinary income. The maximum amount of capital loss which can be deducted from ordinary income is 3,000 per year for married filing jointly and 1,500 for singles. The excess capital losses can be carried forward and used in future years.

Keep in mind that capital losses are only deductible if you incurred them in your taxable account. Losses in IRAs, Roth IRAs and 401ks are NOT DEDUCTIBLE in this case. Tax loss harvesting strategy only works in regular taxable accounts.

The next thing to consider is the “replacement” security. The assumption for this strategy is that the investor who has unrealized losses still wants to own the stock as he or she thinks that the stock price is down only temporary and will rise. The investor could sell the stock to realize the tax benefit and replace the original stock with another security with highly correlated price to the original stock. Now this is where we should be very careful. IRS regulations clearly state that the loss is not deductible if someone buys “substantially identical stock or security”. When some one does this it is called a “wash sale” and the loss from it can not be deducted. The gains from wash sale, if any, are fully taxable. Furthermore, there are no regulations or rules explaining what exactly “substantially identical security or stock” means. It is a grey area.

In general tax professionals agree that you can safely swap:

- Stock in one company for stock in another company. Even if both companies are in the same industry and are almost identical they still will be considered substantially different for tax purposes. Thus for example you can swap: Rio Tinto (RIO ) for BHP Billiton (BBL ) or Southern Copper (SCCO ) for Freeport-McMoRan (FCX ) – nobody will ever argue with that.

- You can swap stock for ETF or vise versa. This will be allowed even if ETF holds substantial amounts of the stock you sold. Good example would be: if you own gold mining stocks like: Newmont Mining (NEM ) or Kinross Gold (KGC ) and have a loss on them consider selling them and buying gold miners ETF (GDX ). You would realize tax loss deduction and still have your exposure to the gold miners.

Tax professionals advise that investors avoid replacing one ETF or mutual fund with another one which tracks the same index. Also replacing stock with an option will obviously be considered a wash sale transaction.

The wash sale rule covers all taxpayer assets and accounts, so selling and simultaneously buying the same security in different accounts won’t work, even if you buy in IRA or 401k it will still be disallowed.

The third criterion to consider is timing: Per IRS regulations the wash rules only apply for the period of 30 days before and/or after the loss harvesting transaction. To be on the safe side always allow at least 31 days. The timing rules will be easier to understand with an example.

Let’s say I have ABC stock which was beaten down and lost 40% since I bought it. I don’t want to sell in because I believe the market is just irrational and the stock will appreciate sooner or later. So I could do two things:

- Sell the stock and buy an acceptable replacement investment. After 31 days I can sell my replacement investment and buy back into the original stock if I want too. Or I could just stay with the replacement and save on trading fees. That’s what I would usually do.

- Otherwise, I could purchase a second lot of the same stock I have a loss with. After 31 days I would sell the first lot to book the tax loss.

As you see the tax loss harvesting strategy is not that complex if you stick to the basic variant outlined above. The strategy is suitable for retail investors and in my opinion everybody should constantly evaluate his or her investments for potential tax benefits.

A brief summary of how someone should plan for tax loss harvesting transactions:

- Evaluate your tax situation, your investments and try to estimate the tax savings you could realize. Make sure that the tax savings are substantial enough to justify the risk and trading fees.

- Do your stock research for replacement investments unless you want wait out in cash. Make sure you are not using “substantially identical securities and stocks”. Read IRS Publication 550. (Hint: wash sale rules and examples are described on page 60)

- Make sure you understand 30 day rule. Check if there are any significant events scheduled for the next month and how they could affect the stock markets.

- If you have a substantial position consider breaking the selling and buying into smaller transactions over a period of time.