Real Estate Investing Are REITs Right For Your Investor Type

Post on: 30 Март, 2015 No Comment

Stay Connected

For most Americans, all the exposure to real estate they need is above their heads and under their feet. For those who want more, owning and managing income-producing real estate often comes with headaches that far surpass staring at an online portfolio of stocks and bonds. The question then becomes, is owning real estate even worth it, and if so, what’s the best way to diversify one’s portfolio by investing in property?

In a new series, Minyanville will dissect the often opaque world of the real estate investment trust, or REIT (pronounced reet). Our goal is to educate and inform, helping investors decide not only whether REITs should be a part of their portfolio, but if so, how to go about choosing a REIT investment that makes sense for them.

In the first two pieces of the series, we will cover REIT basics, focusing on their characteristics as investment vehicles as well as the technical aspects that makes REITs unique in the world of not just real estate investment vehicles, but investment options in general.

REITs have grown in popularity since their introduction by the REIT Act of 1960. Recognizing that large commercial properties were most commonly owned by financial institutions and the wealthy, Congress devised a way for individual investors to own their very own slice of shopping malls, office buildings and other expensive real estate. REITs can be thought of as companies established for the exclusive purpose of owning real estate-related assets. By making shares in the REIT itself available for public investment, these once-unattainable investments became available in bite-sized chunks.

In just the past decade, the equity market capitalization of REITs has ballooned from $90 billion to around $200 billion, according to NAREIT, an industry trade group. There are over 100 publicly traded REITs, and hundreds more that do not trade on public exchanges.

Historically, REITs have fallen somewhere between stocks and bonds in terms of risk profile. In other words, they should be thought of as a bit riskier than bonds, but not quite as risky as stocks. And since they have qualities of both, understanding and valuing REITs take analysis used for both stocks and bonds. REIT dividend payments can be thought of like bond payments, and like bonds, higher cash flow is often equated with higher risk. But REITs directly own real estate assets, so the fundamentals of the properties and markets in which the REIT invests will impact appreciation (or depreciation) and ultimately the movement of REIT shares. Well go into more detail later about what metrics to use in valuing REITs, but for now, this basic understanding should suffice.

In theory, REITs provide investors several advantages when compared to direct ownership of real estate.

Publicly traded REITs are highly liquid, meaning investors can buy and sell shares in seconds just like stocks. Not so with physical properties, which not only take months (if not longer) to buy or sell, but are also laced with transaction expenses like brokerage commissions, transfer taxes, escrow fees, and other costs.

Diversification

Because shares are sold at a relatively low value ($20 per share rather than $20 million per property), investing in REITS makes it easy to balance portfolio diversification and allocate away from stocks and bonds. And since most REITs focus on a specific property type or geographic region or both, returns aren’t tied to a single property or single neighborhood’s performance.

Cash Flow Plus Appreciation

As we will explain in more detail later, REITs distribute most of their net income to shareholders via dividends. This means REIT investments – provided they are doing well – kick off consistent cash flow to investors, much like bonds. In addition, if real estate prices rise and properties are sold for a profit, investors can receive equity distributions back, cashing in on appreciating markets. The knife, however, cuts both ways: REITs saw fantastic losses as the real estate market tumbled from 2006 to 2009.

Ease of Management

Owning REIT shares is as easy as owning a stock. No late-night calls from tenants, no bursting pipes. Those events still happen, of course, so their cost still impacts REIT performance, but the headaches of owning real estate do not come along with owning REITs.

Tax Benefits

While REITs do carry some negative tax implications (discussed below), REIT income is not taxed at the corporate level. As a result, REIT investors often own shares in tax-shielded retirement accounts that allow returns to compound tax free.

But in investing, as in economics, there ain’t no such thing as a free lunch. REITs also come with several drawbacks relative to acquiring properties themselves.

Taxable Income

The US Tax Code is laden with benefits for holders of real estate, most of which do not apply to REIT shares. REIT dividends are taxed as regular income, as REITs are considered pass-through entities where income flows directly to shareholders without being taxed at the corporate level. Importantly, however, whereas tax losses generated by direct ownership of real estate through partnerships and LLCs can be taken to the benefit of investors, tax losses cannot be passed on to investors in REITs.

Out of Sight, Out of Mind

One oft-touted benefit of REITs is the chance to invest alongside some of the smartest real estate minds the investing world has to offer. REITs are often run by successful real estate industry experts who literally spend their lives trying to make good real estate investments. But if these experts are so savvy, why did precious few of them see the real estate collapse coming, resulting in millions of dollars in losses for REIT investors? Owning an apartment building that you drive by on the way to work may be a hassle, but you aren’t relying on someone else to notice when the roof needs fixing. And if your own backyard turns out to be a great place to buy real estate, diversification away from your core market isn’t a positive at all.

Dumping Grounds

As we will discuss in greater depth later, REITs often become the dumping ground for unwanted or underperforming assets. Selling shares to the public is a way for real estate operators to raise capital, and as Minyanville’s Peter Atwater is apt to say, companies only raise capital when they’d be crazy not to — or when they have to.

So now that we know some of the positives and negatives of investing in REITs, let’s take a step back. What is a REIT, anyway?

As mentioned previously, Congress established the rules governing REITs in 1960 by identifying a series of criteria companies could meet in order to gain favorable tax status. By passing the following four tests, a real estate investment company could qualify as a REIT and avoid corporate taxes.

1. 90% of taxable income, excluding capital gains, must be distributed to shareholders as dividends. These dividends are tax deductible, so most REITs pass through 100% of taxable income and thereby avoid corporate taxes altogether.

2. 75% of assets must be invested in real estate assets such as real property or mortgages secured by real estate.

3. 75% of gross income must come from rents, mortgage interest, or gains from sale of real property. Further, 95% of gross income must come from those sources together with passive income, such as interest and dividends from nonreal estate sources (bank deposits, for example).

4. The company must have a minimum of 100 investors, and five or fewer individuals cannot own more than 50% of the value of the REITs stock.

In addition to meeting the above tests, there are additional REIT reporting requirements that make running a REIT an administratively costly endeavor. REITs, as a result, generally must achieve a certain scale (read: size) in order for it to make sense to jump through the requisite hoops.

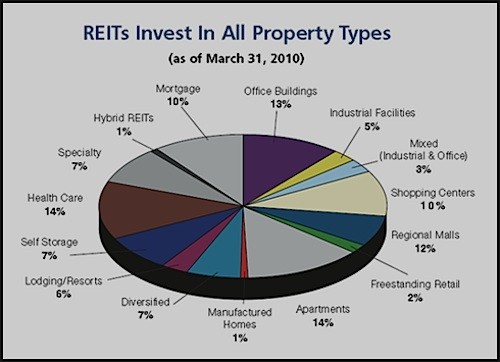

There are three primary types of REITs, and each one pretty much does what its name suggests. Equity REITs own real property, mortgage REITs own mortgages, and hybrid REITs own a combination of property and debt. Each one still has to meet the four tests mentioned above to retain its REIT status, but the nomenclature helps investors know what type of assets the REIT owns and hints at what sort of risk-reward dynamics they can expect.

REITs are also identified by the types of real estate assets they hold, which include residential (apartments), retail, office, industrial, health care, self-storage, hotel, and resort. Further, many REITs have a geographic focus, allowing investors to pick and choose not only what type of properties they are investing in, but also in what locations. Of course, some REITs are so big that they own properties all over the country, but most are focused to some degree in both property type and geography.

Public Storage (PSA ), for example, is a REIT that is almost entirely focused on self-storage facilities in the US and Europe. The story of public storage as a real estate investment is one of the truly innovative examples of repositioning seemingly worthless properties in recent history. Since spring 2009, PSA is up over 300% and well above the highs seen at the height of the housing boom.

Equity Residential (EQR ) is one of the largest REITs in the country and owns primarily apartment buildings. EQR was founded by the legendary real estate mogul Sam Zell, who famously sold Equity Office Properties for $37 billion to the Blackstone Group (BX ) in 2007.

Operating in yet another segment of the market, HCP Inc. (HCP ) is a health care REIT, operating health care real estate, and provides financing to health care providers. HCP, while up significantly from its 2009 lows, is still hovering at levels just below its peak in 2007.

By focusing on specific product types, REIT managers can hone their operating skills and tell investors a story about real estate experts operating within markets they understand extremely well. Track record, as any real estate operator will tell you, is perhaps the most important aspect of attracting investor money.

Within the three types of REITs (equity, mortgage, and hybrid), there are three classifications that govern who may invest in REIT shares. Private REITs are available only to accredited investors, and if your investment advisory doesnt know how to find them, chances are youll never have a chance to invest in one. (For more about accredited investors, review the Securities and Exchange Comissions definition here. )

One of the most important aspects of a private REIT is its lack of liquidity. REIT managers can place restrictions on investor redemptions, even going so far as to prohibit them. Private REITs also have limited reporting requirements to investors but have less administrative overhead to worry about, since they dont have to register with the SEC.

Public REITs are traded on public exchanges and have the major benefit of being as liquid as stocks: Investors can trade in and out of shares on a daily basis. Reporting requirements are also much more stringent, and the cost of generating voluminous SEC disclosure requirements together digs into earnings.

Nonexchange-traded REITs marry public and private REIT characteristics. Investors are able to buy and sell shares, but theyre not available on the open market; rather, sponsors operate private markets for shares. So while there is some liquidity for investors, the buyer pool is more limited.

The last topic to be covered in this piece is one of the major criticisms of REITs, which we touched on earlier. Critics believe that some REITs become dumping grounds for bad assets. Think about it this way. REIT managers are real estate professionals who buy and operate properties for a living. When they come across a property to buy, if it is truly an amazing deal, what incentive is there for them to put the asset into their REIT rather than get together a couple of rich friends and buy it themselves? Far better to unload that money pit that isnt generating any rental income to REIT investors who may not know any better and keep that gold mine for themselves.

Of course REIT managers would deny this charge, and ultimately running a lousy REIT is a quick way to be out of a job, but the incentives of fund managers are not always well-aligned with those of investors. But that is a topic for another time.