Real Estate as a Hedge Against Inflation

Post on: 12 Май, 2015 No Comment

Why do houses appreciate? It’s not because they get better with time because they most certainly don’t. They can actually get pretty worn out and require substantial repairs. So then what causes the famous appreciation so many people buy houses for?

Inflation .

The CNN news headline on TV this morning was “America’s economy held hostage!” Merry Christmas everyone, we’re all doomed. At least that seems to be the talk now that the holidays are over and consequently we have nothing better to focus on except this thing they call the Fiscal Cliff. If you haven’t heard that term you are obviously living in hole. It’s on every news channel, in every paper, and I’m actually surprised more sitcoms haven’t made fun of the potential loom that hangs over us.

What is Inflation and Why Do We Need a Hedge?

What does the Fiscal Cliff mean for all of us? I really don’t know nor am I going to try to analyze it here. I am certainly going to hope for the best but I wouldn’t question you if you say we are all doomed either. I do know one thing though: more than ever, I know it’s time for me to be in control of my money. I don’t claim to be a financial expert by any stretch but I do know that if inflation is going to continue, which follows right along with this Fiscal Cliff idea, I want to be smart with my money by keeping it as protected against inflation as I can.

Thinking in terms of Inflation for Dummies, inflation basically means:

- More money is created

- The value of the dollar goes down

- Therefore prices go up

I have $100. The government prints more money. What I can now buy with my $100 is what I could have bought with only $80 before the new money was printed. Translate that to a real-world example: A gallon of milk in 1970 cost roughly $1.15. Today a gallon of milk is about $4.00.

Hello, inflation, it’s nice to meet you.

There are a lot of factors in thinking about where the safest places for your money are. Stocks, CDs, banks, real estate. commodities, under your mattress, in outer spaceeveryone has different opinions. I’m not here to say what is right or wrong about each option, but I am here to explain how real estate can protect against this little witch we call inflation.

How Real Estate Can Fight Inflation

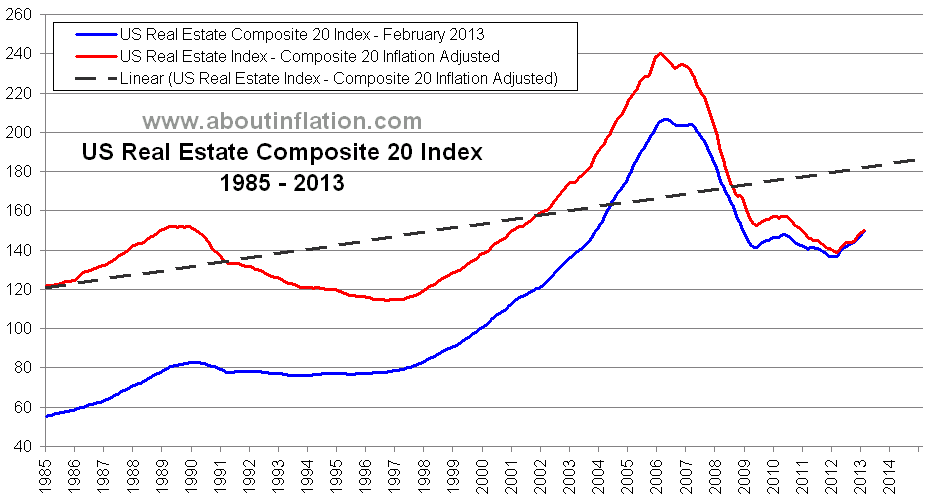

Real estate is one of the few assets that react proportionately to inflation. As inflation occurs, housing values go up and rents go up. Can you then see why owning real estate may be a good thing? If not, let’s put this into perspective with a simple hypothetical example.

In 2012, you buy a house for $100,000. After the world doesn’t end that year and the government begins to drive off the Fiscal Cliff, the financial markets become a mess and inflation is in full-bloom for the next 10 years. Now 10 years later, because of inflation, this same house is worth $180,000. You now own an $180,000 house that you only had to pay $100,000 for! Sounds like a deal to me. You basically have $80,000 in free dollars now.

Inflation: The Landlords Friend?

Let’s take this up another notch. Instead of living in the house yourself, you decide to rent it out and you begin collecting $1,000/month in rent. At $1,000/month you net $300 after the mortgage and other expenses. At the end of a 10-year stint with no inflation, you would have pocketed $36,000 in passive income (woot!). However, thanks to the same inflation that jumped the house’s value over those 10 years, you had to increase the monthly rent by $100 every other year. This would put the amount of passive income you pocketed at $50,000 instead of $36,000 (double-woot!). Although that $50,000 doesn’t take into account any increases to property taxes, insurance, etc. so l am going to put it back down at $45,000 before someone argues me on that one. Regardless, inflation has just put a nice extra chunk of cash in your pocket! $9,000 specifically in this case.

One property in only 10 years, thanks to inflation, has put $89,000 in your pocket you wouldn’t have otherwise had. Actually, it would be more than that once you consider how much you reaped in tax benefits as well, but I’m trying to keep it simple.

Note: Going along with the idea of trying to keep it simple, I acknowledge that I have ignored a lot of factors here associated with appreciation. taxes, income and expenses, but the point is to focus solely on the impact of inflation and nothing else. I also didn’t go with any particular % inflation either but rather used simple numbers to show the point.

If inflation occurs, real estate is one of the only inflation-adjusted assets other than commodities. While most of the population believes real estate is a risky investment, I believe real estate is one of the only safe investments left given our continuing financial crisis.

What about you? Does the Fiscal Cliff drive you more towards investing in real estate or further away from it?

Free eBook from BiggerPockets!

Get The Ultimate Beginnner’s Guide to Real Estate Investing for FREE — read by more than 100,000 people — AND get exclusive real estate investing tips, tricks, and techniques delievered straight to your inbox twice weekly!

- Actionable Advice for Getting Started,

- Discover the 10 Most Lucrative Real Estate Niches,

- Learn how to get started with or without money,

- Explore Real-Life Strategies for Building Wealth,

- And a LOT more

Sign up below to download the eBook for FREE today!