Read Market Trends With ConvergenceDivergence Analysis (SPY QQQ UNH)

Post on: 19 Апрель, 2015 No Comment

Modern markets have evolved into complex machines that can overwhelm even the most careful trading strategy. Fortunately, we can break down this massive data flow into components through convergence/divergence (C/D) analysis. Convergence refers to dynamic conditions with which major indices move in step while divergence signals conflict, with market numbers pulling in opposite directions. (For related reading, see: How reliable is using the Moving Average Convergence Divergence to create or follow trading strategies? ).

Charles Dow brought convergence/divergence into the 20 th century when he insisted that popular averages had to move in the same direction at the same pace to confirm an uptrend or downtrend. (For more, see: Why The Dow Matters ). So if the Industrial Average printed a series of higher highs and higher lows, the Railroad Average had to follow suit to confirm a bull market. Alternatively, one average charging higher while the other sells off indicates divergence or “non-confirmation ”, warning of an impending trend change. Market wizard Linda Bradford Raschke noted in the 1990s that the relationship between any two data sets created convergence or divergence which may impact security analysis. (For related reading, see: 7 Outstanding Female Investors ). Not surprisingly, this is the foundation for modern algorithmic strategies that buy or sell thousands of instruments across numerous cross markets, attempting to match risk-on or risk-off exposure to current conditions.

Convergence/divergence analysis can be used in many ways but let’s concentrate on those that offer the greatest benefit to your bottom line: market tone, position choice and tape reading .

Equity markets are primarily made up of stocks, sectors and indices with C/D relationships dictating the oscillation between trending and range-bound conditions. The S&P 500. Nasdaq 100 (QQQ ) and Russell 2000 now fulfill the same purpose as Dow’s Industrial and Railroad averages, with interplay between indices generating a broad spectrum of market conditions. (For more insights, see: How Stock Market Indexes Changed Investing ). The relationships track two primary themes: relative percentage change and the sequence of higher highs, lower highs, higher lows and lower lows.

Generally speaking, expect the following market conditions based on relative performance:

- S&P 500 leader – tepid institutional activity.

- S&P 500 laggard – cash moving to sidelines

- Nasdaq 100 leader – enthusiastic institutional activity.

- Nasdaq 100 laggard – slow growth fears

- Russell 2000 leader — growing speculative fervor.

- Russell 2000 laggard – flight to safety

- High performance correlation — large-scale capital reallocation, into or exiting equities, depending on direction.

Position Choice

Follow these simple C/D rules when choosing equities for long or short risk taking:

- Find stocks that match or exceed sector performance for long positions and those lagging sector performance for short sales.

- Take long positions in sectors and stocks that are acting better than broad indices and short in sectors and stocks that are lagging in them.

- Avoid long positions in stalled or failing uptrends and short positions when indices lock together in bullish convergence.

- Avoid short positions in stalled or failing downtrends and long positions when indices lock together in bearish convergence.

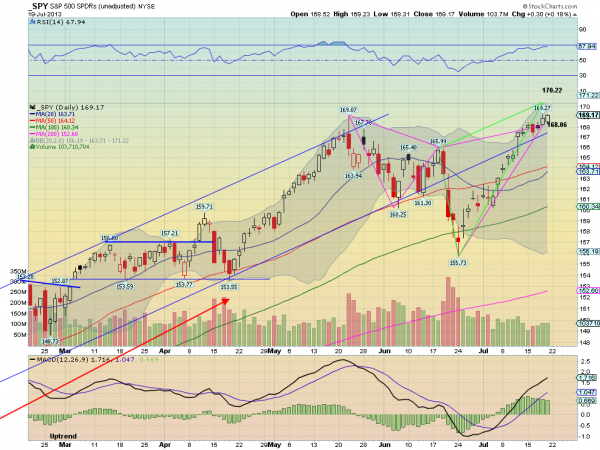

SPDR S&P Trust (SPY ) entered a major decline, breaking the August low in October. The S&P 500 component UnitedHealth Group (UNH ) outperformed the fund, holding above the August low and posting a bullish divergence. Both instruments returned to September range highs and broke out at year’s end but UNH posted much stronger percentage gains, in line with the relatively stronger price pattern.

Finally, learn to read the ticker tape using intraday C/D relationships. (For more, see: Understanding The Ticker Tape ). To get started, keep the following data close at hand during the market day:

- Three main indices or futures market counterparts.

- Secondary indices and instruments, including DJ Transportation Average (DJTA), DJ Utility Averages (DJUA) and PHLX Semiconductor Index (SOX).

- Commodity tickers or underlying funds for crude oil, gold, copper and agricultural products.

- A selection of ETFs that covers a broad range of sectors.

- NYSE and Nasdaq advance vs. decline, up vs. down volume and TICK indicators.

- Popularly held issues in all major market groups.

Your task is to uncover themes that could persist for the entire session. Complete an index leader-laggard analysis and perform a series of reality checks, seeing whether other sectors are lining up with similar patterns and percentage changes. A lack of noticeable pattern means you’re observing divergent conditions that favor narrow ranges as opposed to trend days. It gets more interesting when other tickers line up with index convergence because the tape is then positioned for a trend you can play through sectors that match or exceed index performance. (For related reading, see: Can Small Cap Low Volatility ETFs Continue Their Hot Streak? )

The Bottom Line

Convergence points to dynamic conditions that may elicit strong trends while divergence suggests confusion and conflict, more typical of range-bound action. In truth, there are thousands of convergent and divergent data points but most have little impact on your results. Context is the key, therefore set your focus on relationships that impact trading strategies you’re undertaking on a particular day, week or month.