Rate of Change Versatile Indicator Helps Spot Turning Points

Post on: 14 Май, 2015 No Comment

Momentum in its simplest form is the Rate of Change (ROC). the percentage change in price over a specified time frame. Many other momentum measures have been developed but all modify this basic calculation in some way.

To calculate the ROC, you divide the current price by an earlier price, subtract 1 from that value and multiply by 100 to convert to a percentage:

Rate of Change (ROC) = [P/P(t)] -1 x 100, where P(t) is an older price point

For example, the current price could be divided by the closing price six months ago to find the 6-month ROC. This calculation can be applied to any type of data series, including stocks, ETFs, mutual funds or even economic data. In fact, the widely followed Consumer Price Index (CPI) is a 12-month ROC calculation of price change.

How Traders Use It

ROC can be used by itself as a complete trading strategy. Traders could buy when the ROC is positive and sell when it falls below zero. This is illustrated in the chart below where two large gains would have been attained while a large loss would have been avoided.

Some traders add a moving average to the ROC and trade based only on that. Buy signals would occur when the ROC crosses above the moving average and sell signals would be taken when the ROC falls below its moving average. Any time period could be used for the indicator or the average, and a 26-week ROC with a13-week moving average are common settings.

Bull and bear markets can be identified by the value of ROC. Bull markets will have a positive value and downturns will be accompanied by a negative ROC.

Why It Matters To Traders

A number of studies have shown that high-momentum stocks tend to outperform over the next three to twelve months. Traders can screen for the stocks with the highest ROC and buy them. ROC will often turn lower and fall below its moving average ahead of a price decline, offering a timely sell signal. It is also helpful to see when ROC turns negative since that is often a signal that more price declines are ahead.

ROC can be used to spot possible bubbles. Before it collapsed, the price of iShares FTSE China 25 Index Fund (NYSE: FXI ), shown in the example, had doubled in only six months and the ROC was above 100%. Price advances like this are generally unsustainable, and by following ROC, potential crashes can be avoided. Whenever the 6-month ROC is above 50%, for example, the advance is unlikely to continue.

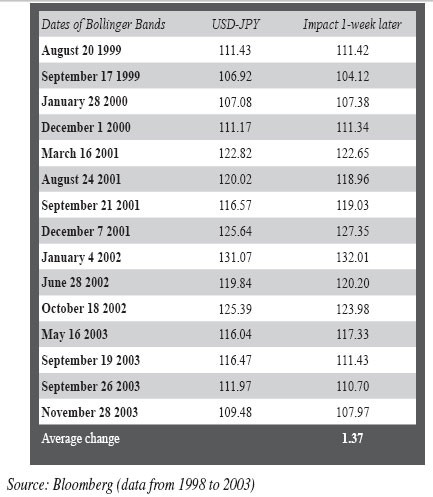

Traders could also add Bollinger Bands to the ROC to help spot turning points. When ROC is above the upper Bollinger Band it is more than 2 standard deviations above average, something that is expected to happen less than 2.5% of the time. This is a warning that prices have advanced quickly and a reversal could be near. An upward move in prices would be expected when ROC falls below the lower Bollinger Band, which is also expected to occur only 2.5% of the time.

By setting the Bollinger Bands to be 3 or more standard deviations from the average, something that is easily done with almost any trading software, you can spot even rarer market extremes. Only 1% of all ROC readings should be more than 3 standard deviations from the average. These rare opportunities will generally represent low-risk entry points for trades.

ROC is a versatile indicator that can be used for trading or bubble spotting.