Random Walk Theory

Post on: 7 Май, 2015 No Comment

The idea behind the random walk theory or as it is often called — the efficient market hypothesis. is that information is unpredictable and random and accordingly stock prices also move unpredictably. Let us for a moment assume that some formula with great confidence predicts that the share price of Company X which is currently at Rs. 100, will rise dramatically in three days and reach Rs. 110.

On such a confirmed news investors would clearly place buy orders to take advantage of the forthcoming increase in the stock price and it would be hard to find sellers. The net effect would be an immediate jump in the stock price until it reaches the predicted price of Rs. 110.

The forecast of a future price increase leads to an immediate price increase. In other words, stock price immediately reflects the good news implicit in the forecast and it leads to an improvement in the current performance, as all market participants get in on the action before the price increase.

The notion that the price of stocks reflect all the publicly available information is referred to as the Efficient Market Hypothesis (EMH ) or the Random Walk Theory. This notion was first developed by Eugene Fama in 1960. According to the theory, it is believed that security markets are extremely efficient in reflecting all the available information about the individual stocks and about the stock market as a whole. Thus, as soon as new information arises, it gets fully incorporated in the price of the securities.

The Chart above shows Bank of Barodas share price response to new information (- the announcement of Q3 FY 2013 results on Feb 04, 2013 ). The stock price declined dramatically as the Q3 results of the Company became public (which were of course below expectation). The Company reported 21.6 % dip in net profit for the quarter ended December 2012. However, there is no further drift in prices after the announcement, suggesting that the price reflected the new information by the end of trading day. Even more dramatic response to new information may be found in the intraday price movements. For example: stock price response to corporate dividend, earnings announcements, Merger & Acquisition related news etc.

20finance%20magazine.png /%

Forms of Market Efficiency

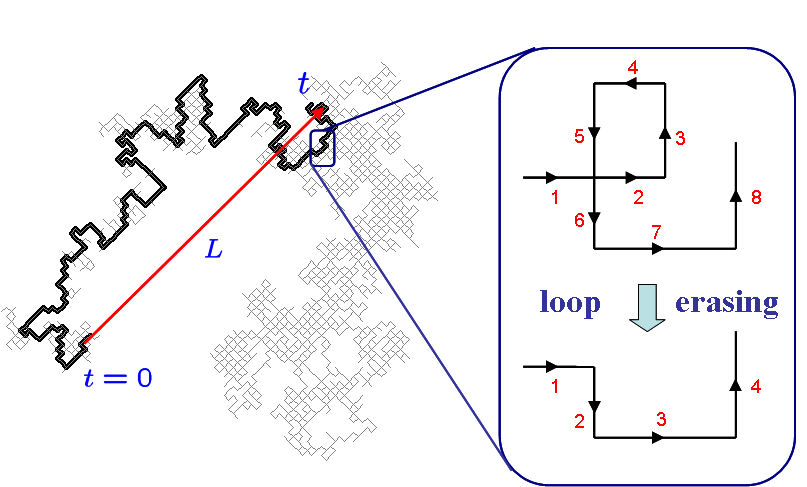

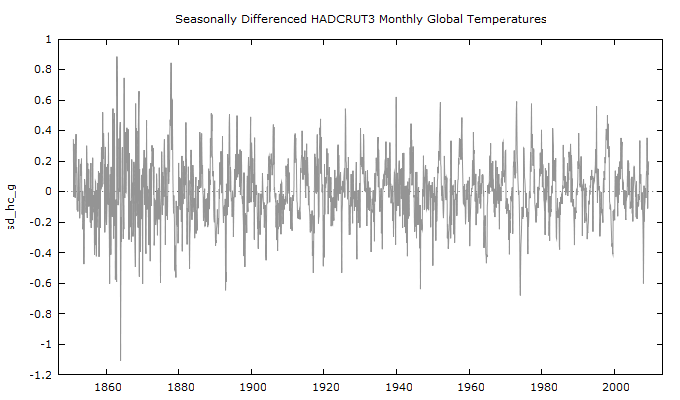

► Weak form of market efficiency. All information impounded in the past price of a stock is fully reflected in the current price of the stock. Therefore, information about recent or past trends in stock prices is of no use in forecasting its future prices.

► The semi-strong form. All publicly available information is fully incorporated in the current price of the stock. Additionally, besides past stock prices, public information also includes the companys financial statements, its corporate announcements, research reports issued by various analysts, other economic factors etc. All this also gets reflected in the current price of the stock.

► Strong form. Both public and private information (insider information) is reflected in the in the current price of the stock and even insiders would find it impossible to earn abnormal returns in the stock market.

According to the Random Walk Theory neither technical analysis, which is the study of past stock prices in an attempt to predict future prices, nor fundamental analysis, which is a study of the overall financial health of the economy, industry and the business of the company, would enable an investor to outperform the market. Accordingly, any attempts to outperform the market are essentially a game of chance rather than one of skill. However, the theory has met with a lot of opposition.

Our View on Efficient Market Hypothesis

Even if you believe that investors have access to all the available information, it may not be true that all investors perceive that information in precisely the same manner. This always leads to different growth predictions for the company and its share price.

More often than not, market participants get over optimistic or extremely negative when a news hits them. It is this very difference of perception which causes companies to become undervalued and overvalued. Those who believe in value investing try to spot these opportunities and exploit these market inefficiencies.