Quantitative Investing Consumer Staples Strategy

Post on: 6 Апрель, 2015 No Comment

After a few introductory posts (part 1. part 2. part 3 ) on quantitative investing its time to get down to some real current portfolios. In this post I want to look at the first half one of the best risk adjusted return strategies presented in What Works On Wall Street and how an investor can implement it in their own portfolio.

The Combined Consumer Staples/Utilities Strategy is one of the best strategies ranked by risk-adjusted return with annual returns of 16.56%, a Sharpe ratio of 0.84 and also with a maximum drawdown of -34%. This strategy leverages investing in the two lowest risk sectors of the market; the consumer staples sector and the utilities sector. The consumer staples half of this strategy is a pure value strategy that invests in an equal weighted portfolio of the top 25 stocks in the consumer staples sector ranked by shareholder yield. Thats it. Hold for a year and re-balance. Rinse and repeat. It doesnt get much easier. I ran the screen based on Friday closing prices and below are the results.

Note that the list contains 26 stocks. The second stock on the list Smithfield Foods (SFD) recently received a buyout offer from a Chinese company. One of the rules I discussed in my pervious post is one for acquisitions. You sell or dont buy if the share price reaches 90% of the buyout offer. SFD is trading within 90% of the $34 buyout offer so we add the next stock on the ranked list, Con Agra Foods (CAG). Ive usually put the group of stocks into an equal weighted portfolio in the portfolio tracker at finviz.com.

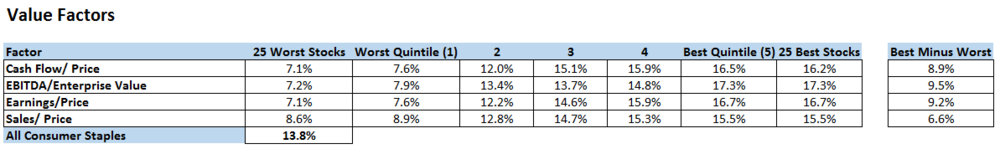

But this does highlight a couple of important topics I want to highlight. First, its important to note that the consumer staples is a value strategy that uses shareholder yield as its value measuring stick. Shareholder Yield is a metric that starts with dividend yield but adds buyback yield to it, i.e what percentage of shares is the company buying back every year. It does not use more traditional value metrics such as PE ratio, PB ratio, EV/EBITDA, etc It turns out that in different sectors the value metrics that yield the best performance vary. In one sector shareholder yield may outperform, while in a different sector other value metrics do better. As youll see in the Utilities strategy sometimes its a combination of value factors that does best. For this strategy dividend yield is the second best value factor. You can use it without losing too much in returns or risk. By using dividend yield you can implement it in the free finviz screener.

The second point I want to highlight is that the more uncommon the metric the harder it is to implement for the individual investor. There are a lot of screeners that let you sort by P/E ratio but try to find one that even has shareholder yield in it. The best full function low cost stock screener I have found is Stock Investor Pro from AAII. Its a PC based application and its $198 a year. Not too bad considering what you can do with its but not free by a long shot. Personally, I have found it well worth the money. The learning curve is not too bad either.

How is that in terms of effort to implement a strategy that has returned over 16% a year since 1965 with risk adjusted returns over 3 times the market? Once youve learned how to implement this strategy it takes less than 10 minutes to run and maybe an hour making sure none of the portfolio management rules have been violated and thats about it.

In the next post Ill cover the second half of the strategy, the Utilities portfolio.

Full Disclaimer — Nothing on this site should ever be considered advice, research or the invitation to buy or sell securities. These are my personal opinions only.