QBAMCO On Gold And Inflation Don t Fight The Fe Run It

Post on: 6 Май, 2015 No Comment

Excerpted from Lee Quaintance and Paul Brodsky of QBAMCO ,

Financial asset investors may continue to benefit in the short term while stocks and bonds remain well bid, but production and labor in over-levered economies should continue to wither .

When we take it to its logical conclusion, central banks cannot withdraw debt support (on a net basis) and so our baseless currencies seem highly likely to fail to provide sustainable purchasing power. (This happens as producers demand more currency units for their labor and resources, not when consumers drive prices higher by competing with each other for finite supplies of labor and resources.) Continued inflation of all global currency stocks is likely .

This implies to us that fundamental expectations of the inevitability of price inflation across borders and in all currencies must change, from unlikely to highly likely. When might this happen? We think it would have to be when politicians and monetary authorities believe it is in their best interest to let perceptions change. After all, there are no currencies not controlled by central banks, no competing currencies in which the global marketplace may find sanctuary. Neither are there global capital markets denominated in truly independent scarce currencies.

Our sense of sustainable value in today’s global markets is tied directly to the general perception of future inflation. The overwhelming majority of investment capital is positioned for low inflation today and tomorrow. This implies and explains the current dominance of levered revenue models sponsored by levered investors borrowing from levered creditors. Were expectations of rising inflation to come to the fore, we believe un-levered assets and businesses that do not rely on ever-more public leveraging would perform far, far better than currently levered assets owned by levered investors selling goods and services to businesses and consumers that fund their purchases through credit.

Since very few investors expect rising inflation anytime soon, the return skew is overwhelmingly positive in its favor. Both deep value and gamma are buried in the changing popular perception of future inflation, and the best part about this is that rising price inflation expectations are precisely what all central banks around the world will soon be forced to promote.

Don’t fight the Fed — front-run it.

. macroeconomics has been reduced by world-improving monetary authorities to the study of gibberish. The folly (I’m tapering, just kidding, I’m tapering, just kidding) would be funny if it were not so real and contemporary and meaningful.

The entire spectacle is manifest in the public capital markets where almost no new capital is being formed, or (and here’s the weird part), where little sustainable wealth is being created and transferred. Our time is defined by economic releases suggesting little and unreserved electronic credits hop-scotching back and forth in search of financial return. Bernanke or Draghi, Ackman or Icahn, place your bets. (Hey, I love this guy cause I make money betting against him!) Where’s the value proposition?

Today’s apparently a-cyclical economies make it crystal clear that the leverage cycle is the ultimate determinant of demand for goods, services and labor — not animal spirits. To be more specific, the fluctuating ratios of 1) credit-to-base money in the banking system, and its evil twin, 2) public debt-to-assets in the broader economy, literally determine secular economic and business cycles. (Debt to GDP ratios are fine but they compare the stock of debt to the flow of output. One cannot service or repay a dollar-denominated debt with an iPhone. Money is needed.) We argue that consistently easy credit conditions have led to ever-increasing consumption of goods, services and assets, which in turn have levitated output and prices to levels unsupportable by production.

If unreserved bank credit is not extinguished, only continually rolled over, it eventually pressures banks and their central banks to inflate nominal asset prices on which that credit was extended (and they can, through almost infinite credit extension and infinite money creation). Alternatively, bondholders (or, say, your uncle) do not have infinite balance sheets or printing presses with which to prop up asset prices collateralizing their credit. So, the only credit in a modern economy likely to be extinguished is non-bank credit, and at great pain to everyone else.

This process is harmful to the real economy. Excessive bank system leverage that further instigates excessive economy-wide leverage ultimately leads to debt destruction or re-arrangement — not in the banking system but in the real economy. The obvious example is today’s environment where asset prices continue to increase while output languishes.

As central banks freely proclaim, their primary objective is stable prices.

In advanced economies today, the economic elephant in the room is the almost complete takeover of commerce by the financial and political dimensions, which has been promulgated by central bank policies. Consistently easy credit conditions for a generation increased demand and the general price level higher than they would otherwise be. Meanwhile, wages in these domiciles have not been able to keep pace because the value of labor is more objectively priced by the commercial marketplace.

As a result, the scale and growth path of our economies remain reliant upon the continuation of easy credit policies – even when financing rates can go no lower, even while monetary authorities are directly subsidizing deficit funding, even when everyone in the marketplace and markets knows the frightening counter-cyclical impact were policy makers to stop, even when the efficacy of new debt on real economic output is diminishing. The graph below shows how pointless new debt issuance has become.

Policy makers in advanced economies seem to think they must do everything in their power to ensure prices do not fall, even if prices do not represent the sustainable real value of goods, services and assets, because falling prices would directly lower the value of debt (i.e. bank and pension assets), which in turn would greatly slow economic activity. Re-scaling (shrinking) economies to more sustainable price levels that would then naturally promote increased production is not a practical option. The political fallout from allowing this to occur makes it unfathomable in a monetary regime in which the money stock and price level is easily managed. Thus, it is wise to be bet against falling prices.

Bank on Inflation

While it may be wise to bet against falling prices, why should we bet on rising prices? The short answer is: because that’s the way we have always rolled and inflation is even more necessary now.

Inflation is entirely man made. created and administered by monetary authorities. Again, contrary to popular belief, aggregate demand cannot produce sustainably rising prices. Without bank system-manufactured inflation, population growth, innovation and economies of scale (i.e. productivity gains) would naturally drive lower the nominal prices of goods, services, labor and assets (though their values to society could remain the same, increase or decrease based on social preferences).

The current policy goal to inflate – in the US, Japan, and most advanced economies in Europe with the possible exception of Germany – should not be so startling. In economies where economic expansion is predicated on nominal asset price increases rather than production, generating inflation must be a policy objective.

Inflation, of course, is the loss of purchasing power of the currency in which we consume, save and invest.

Should equity investors be worried or excited about the need to inflate? We think the answer is yes!

Inflation will be the means to de-lever systemic balance sheets and it will affect different equities in different ways, at different times and in very different magnitudes. We believe the implied mandate, long precedence and demonstrated current willingness to inflate will ultimately sustain and increase the money stock, which in turn portends further nominal gains.

Inflating just enough not to produce the general fear of inflation is producing malaise, characterized by widening wealth and income gaps driven by the relative success of those closest to credit and levered assets in relation to those further away (or relative to those choosing not to leverage).

The former generally produce far less than the latter, and the trick for monetary authorities is to continue executing accommodative policies amid declining real production and the general perception that nothing exceptional is occurring (and to not be blamed for widening income and wealth gaps).

Nevertheless, the Fed cannot taper unless banks are willing to re-leverage rather than de-leverage. We expect any form of monetary or credit tightening to be summarily reversed once asset prices fall and balance sheets suffer, which they would quickly do. It is boxed. It will keep going and it will likely need to increase its purchases over time.

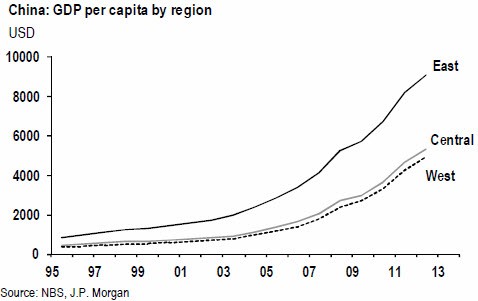

Our level of confidence is high. For better or worse (better generally for the investor class, worse for everyone else), the economic model for advanced economies over the last thirty years has been asset-centric rather than production-based (and levered-asset centric at that). Over the last twenty years, sustainable wealth from production has moved east. Production efficiencies have moved to emerging economies (precisely why they are emerging), while nominal balance sheets in advanced economies have expanded. Meanwhile, human and natural resources have continued to be consumed out of proportion in advanced economies. thanks to the great leveraging that has allowed advanced economies to exchange their unreserved digital credits for foreign labor, natural resources and production.

We believe the product of this reconciliation should be a shift in the perception of value among assets – from those that may offer nominal gains in line with indexes today (beta), to those that would benefit most from systemic de-levering in real terms. As inflation is the only practical means of necessary de-levering, and since real and financial assets are not currently pricing-in inflation, significant risk-adjusted Alpha today is buried in the process of de-levering through inflation.

Financial asset investors may continue to benefit in the short term while stocks and bonds remain well bid, but production and labor in over-levered economies should continue to wither .

When we take it to its logical conclusion, central banks cannot withdraw debt support (on a net basis) and so our baseless currencies seem highly likely to fail to provide sustainable purchasing power. (This happens as producers demand more currency units for their labor and resources, not when consumers drive prices higher by competing with each other for finite supplies of labor and resources.) Continued inflation of all global currency stocks is likely.

This implies to us that fundamental expectations of the inevitability of price inflation across borders and in all currencies must change, from unlikely to highly likely. When might this happen? We think it would have to be when politicians and monetary authorities believe it is in their best interest to let perceptions change. After all, there are no currencies not controlled by central banks, no competing currencies in which the global marketplace may find sanctuary. Neither are there global capital markets denominated in truly independent scarce currencies. Where is wealth supposed to go? Who will pay for natural and human resources? Micro-economies occurring around kitchen tables that collectively form true macro-economies (sans political incentives and policy mandates), will pressure authorities to act.

Full QBAMCO Letter below.