Put Call Ratio by

Post on: 17 Май, 2015 No Comment

Put Call Ratio — Definition

Put Call Ratio is the ratio of the amount of put options traded versus the amount of call options traded.

How to Calculate Put Call Ratio?

Types of Put Call Ratios

There are 2 main types of Put Call Ratios; Total Equity Put Call Ratio, Index Put Call Ratio.

Equity Put Call Ratios measure the put call ratio of equity based options such as stock options while Index Put Call Ratios measure the put call ratio of index based options such as the OEX.

Equity Put Call Ratio

The most authoritative total equities put call ratio in the United States is the Chicago Board Of Exchange Total Equities Put Call Ratio. The CBOE Total Equities Put Call Ratio divides the total volume of equity put options by the total volume of equity call options traded daily and serves as the broadest measure of market sentiment in the equity market. The CBOE total equities put call ratio is also what most options traders are referring to when talking about Put Call Ratios.

Index Put Call Ratio

Index Put Call Ratios, also known as Composite Put Call Ratios, are put call ratios calculated for component stocks in an index such as the OEX. Index put call ratios are meant to be contrarian indicators for the underlying index but due to the amount of hedging done by portfolio managers and Market Makers in the index options resulting in a skew towards more put option buying than call option buying, Index Put Call Options are not generally regarded by the options trading community as indicative of general investor sentiment.

Put Call Ratios also come in various time scales. In fact, the CBOE Total Equities Put Call Ratio comes with daily, weekly as well as monthly ratios.

How To Interpret The Put Call Ratio?

There are 2 main ways to interpret the Put Call Ratio. First, it is taken widely to be a Panic Meter where a higher reading suggests panic in the market as investors rush into put options. Second, it is taken to be a contrarian indicator which points to major reversals in the market.

The Put Call Ratio’s role as a Panic Meter is intuitive. The higher the ratio, the more investors are betting to downside, hence the higher the level of panic in the market. There is no single way to make use of this indication except for the fact that investors ought to be more cautious when panic is high.

A contrarian indicator is an indicator designed to tell a different tale than its basis of calculation is suggesting. All indicators are designed such that higher readings usually suggest bullishness and lower readings, bearishness. This makes the Put Call Ratio a contrarian indicator as the more put options are being traded versus call options, the higher the reading becomes and the more bullish it is supposed to be for the market. This is also why it is created as a Put Call Ratio and not a Call Put Ratio. Trading put options are supposed to be indicative of bearishness but too much bearishness only mean that the bottom is near and that a bullish rebound may occur soon. Similarly, investors tend to be overly optimistic near market tops and a sudden ditch in Put Call Ratio due to a rush into call options might suggest that the market might go down soon.

Another popular explanation why the Put Call Ratio is a contrarian indicator is in the relatively low winning rate of most option buyers. There was even a myth stating that 80% of all options bought expires worthless. With this in mind, wouldn’t it make a lot of sense betting against these options traders?

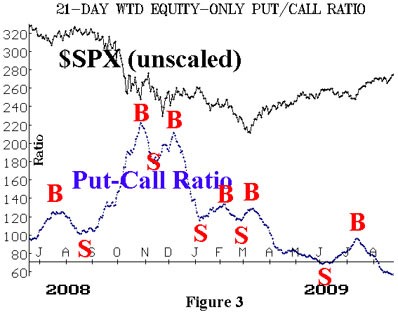

In fact, many market turn arounds have been preceded by sudden surges in Put Call Ratio, making the Put Call Ratio a reliable leading indicator for market reversals.

The contrarian accuracy of put call ratios seem to deteriorate as the basket of stocks involved in the calculation shrinks. The most useful put call ratio so far seems to be the Total Equities Put Call Ratio while the contrarian accuracy reduces for index put call ratios and the worst being individual equity put call ratios. In fact, there were many instances when a stock continues to make new highs for years even though its put call ratio is extremely low. An example would be GOOG. GOOG’s put call ratio went all the way down to 0.56 in June 2005, which is a multi-year low. GOOG was about $400 then, again, near all time highs. By the contrarian nature and method of interpretation of put call ratios, GOOG ought to be falling significantly from that point onwards, but it did not. It went on to making new highs over the next year, going as high as $741.

This is why many analysts prefer to take individual equity put call ratios more literally; Higher for bearish, lower for bullish. On top of that, the panic indication of put call options also seem more useful than its contrarian nature. When put call ratio is high, panic is in the market and usually suggest that the bottom is near. However, when put call ratio is low due to widespread optimism, it tends to go on for a while as most investors are more inclined to buy and hold than to sell.

Problems with the Put Call Ratio

There are 2 main problems associated with Put Call Ratios:

1. Does not differentiate between buying or writing volume

2. Does not take the purpose of the trade into consideration

Does Not Differentiate Between Buying And Writing Volume

The main drawback of the Put Call Ratio is that it does not take into consideration whether those options are being bought or written. In layman terms, options volume does not differentiate if a trade is a Buy To Open or Sell To Open trade. When put options are being written, investor sentiment is actually bullish instead of bearish and when call options are being written, investor sentiment is actually bearish but such information are not reflected in the volume of put and call options. This makes it hard to prove emphirically whether a higher put volume is bearish or bullish.

Does Not Take The Purpose Of The Trade Into Consideration

Both call options and put options are bought and sold not only for speculative directional trading but also as components in an overall stock or options strategy. Call options can be sold in Covered Call strategies in order to speculate a stagnant market and put options can be bought to protect a portfolio of stocks expected to move to upside in a Married Put. The strategy within which the options are bought or sold determines the real sentiment of investors and that is not taken into consideration in the Put Call Ratio as well.