Public Debt Inflation and the Stock Market CXO Advisory

Post on: 7 Май, 2015 No Comment

When the U.S. government runs substantial deficits, some experts proclaim the dollars inevitable inflationary debasement and bad times for stocks. Other experts say that deficits are no cause for alarm, because government spending stimulates the economy, and the country can bear more debt. Politicians argue about reducing spending and/or increasing taxes to reduce the deficit. Does a large federal deficit (increase in public debt) spur inflation and drive down stock prices? Using annual (end of fiscal year) level of the U.S. public debt , interest expense on the debt , U.S. Gross Domestic Product (GDP) , Dow Jones Industrial Average (DJIA) return and inflation rate data over the period June 1929 through September 2012 (about 83 years), we find that:

The following chart compares on log scales the evolutions of U.S. public debt and compounded inflation over the entire sample period. Overall, debt has grown faster than prices. Periods of stronger than average debt growth include the Great Depression, World War II (especially), the denouement of the Cold War (the 1980s) and perhaps the recent economic stimulus.

For a closer look at the relationship between public debt and inflation, we look at annual data.

The following scatter plot relates next-year inflation rate (calculated by fiscal year) to annual change in public debt over the entire sample period. While the slope is positive (Pearson correlation 0.07), the R-squared statistic is just 0.005, indicating that annual changes in public debt have little or no influence on next years inflation rate.

Might change in public debt lead inflation rate at some longer interval?

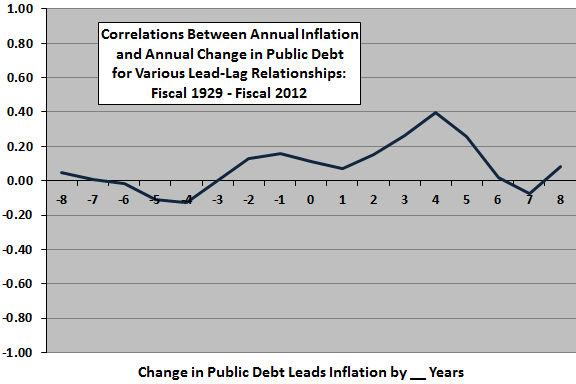

The next chart summarizes correlations between change in the public debt and annual inflation rate for various lead-lag relationships, ranging from inflation leads debt change by eight years (-8) to debt change leads inflation by eight years (8). The most prominent feature on this chart is the peak at 4, indicating that high (low) growth in public debt leads increases (decreases) in the annual inflation rate by three to five years. However, the sample is small for this kind of analysis.

Next we investigate connections between U.S. public debt and the U.S. stock market.

The next chart compares on log scales the evolutions of U.S. public debt and DJIA over the entire sample period. Stocks have appreciated at approximately the same rate as debt has grown since the end of World War II.

For a closer look at the relationship between public debt and inflation, we look at annual data.

The following scatter plot relates next-year (fiscal year) changes in DJIA to annual changes in public debt over the entire sample period. The Pearson correlation for the two series is 0.17 and the R-squared statistic is 0.03, indicating that change in the public debt explains 3% of stock market return the following year. In other words, more debt tends to be slightly positive for stocks.

Might the change in public debt lead stocks differently at other horizons?

The next chart summarizes correlations between changes in the public debt and annual (fiscal year) DJIA returns for various lead-lag relationships, ranging from stock returns lead debt changes by eight years (-8) to debt changes lead stock returns by eight years (8). Results suggest that:

A good (bad) stock market precedes low (high) growth in public debt by two to five years.

High (low) growth in public debt accompanies and precedes by one year a good (bad) stock market, which effect then disappears and perhaps reverses.

Variations in corporate and individual tax payments may underlie these relationships. However, indications are generally weak, and the sample is small for this kind of analysis.

Can the U.S. easily absorb a greater debt load?

The next chart compares the evolutions of U.S. public debt as a percentage of U.S. GDP and the interest paid on this debt as a percentage of GDP for fiscal year 1977 through fiscal year 2012 (September 2012). GDP estimates are averages of the four quarterly readings during the fiscal year. While the debt load has generally increased, the cost of carrying the debt load (depending on both debt load and interest rates) has mostly declined since the late 1980s.

An increase in interest rates (as suggested by the third chart above) and an increase in public debt (as indicated by deficit projections), without an offsetting increase in GDP, would make the cost of carrying the debt load bend upward.

How do future stock market returns relate to debt load?

The following scatter plot relates next-year (fiscal year) changes in DJIA to interest paid on U.S. public debt as a percentage of GDP for fiscal year 1977 through fiscal year 2012. The Pearson correlation for the two series is 0.38 and the R-squared statistic is 0.14, indicating that variation in the interest paid on the public debt explains 14% of stock market return the following year. In other words, counterintuitively, more a higher cost of carrying public debt tends to be positive for stocks.

Sample size is small. For example, removing 1987 from the data lowers the R-squared statistic to 0.09.

Interest rates may be a more useful line of investigation than public debt or interest on this debt.

In summary, evidence from simple tests on a modest sample suggest that U.S. government deficit spending may have a slight tendency to stimulate the U.S. stock market at a one-year horizon and a stronger tendency to increase the inflation rate three to five years out. A much smaller sample suggests that the current cost of carrying debt, because of low interest rates, is not onerous.

Cautions regarding findings include:

- As noted, sample sizes are generally small for the analyses performed, especially in terms of number of business/economic cycles, greatly limiting confidence in findings.

- Predictive analyses are in-sample and may not be exploitable in real time. The sample is too small for reasonable out-of-sample testing.

- GDP data includes revisions from many months (years) after ends of measured quarters, injecting look-ahead bias.

Why not subscribe to our premium content?

It costs less than a single trading commission. Learn more here.