Protecting Your Profits in Stock Investing (StopLoss)

Post on: 16 Март, 2015 No Comment

You Don’t Have a Profit Unless You Sell for More Than You Paid

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Unless you actually sell your profitable stocks, you not actually made any money. But, when do you sell and how do you protect a profit.

There are two basic ways to protect your unrealized profits. This article and the accompanying one (see below) describe the two strategies.

It is often harder to know when to sell than it is to know the correct price to buy. However, if you are going to make money in the stock market you must have a strategy to protect your profits.

The only way to profit from a stock investment is to sell it for more than you paid. Of course, you don’t want to sell too early and miss further profits.

The downside is that without a strategy it is easy to watch profits slip away while waiting for a down trending stock to rebound.

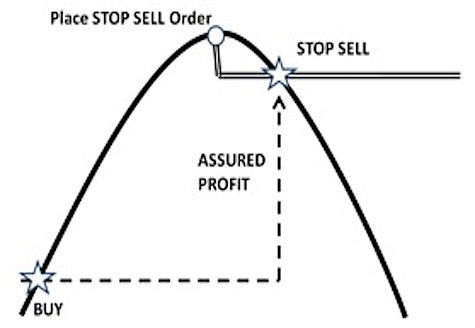

One of the best ways to protect your profits in a stock is to use stop-loss orders. A stop-loss order tells your broker that when the price falls to a specific price, you want to sell.

For example, you buy a stock for $20 per share. The company has a good run and the stock rises to $30 per share. Will it go higher or will profit takers swoop in and sell driving the price down?

You don’t know for sure what will happen, so you enter a stop-loss order for $25 per share. If the stock starts dropping in price, you can wait it out to see if the price will rebound.

However, your stop-loss order will be triggered when the price drops to $25 per share. At that point, your order becomes a market order and the stock is sold at whatever the market price is at that moment.

You have protected a profit of $5 per share, but left room for the price to fluctuate below $30 per share. In a normal market, you will get very close to the $25 per share stop-loss price. (All of these illustrations ignore commissions, fees, taxes and so on).

This is usually a conservative strategy the will protect some portion of your profits. Many brokers will let you enter a stop-loss order that follows the price up.

For example, suppose your $30 per share stock continues to rise in price. A sliding stop-loss order will follow it up. If you want to maintain a $5 per share margin, the sliding stop-loss will move up as the stock price moves up.

If the price rises to $35 per share, your stop-loss order will move up to $30 per share from the original $25 per share.

A note of caution: Stop-loss orders usually work fine in normal markets. However, if the market crashes or drops suddenly and dramatically, the price may fall through you stop-loss and keep going.

When a stop-loss order is triggered, it becomes a market order meaning the stock is sold for what the current price is. During an extraordinary market event, the price may drop so fast no buyer can be found at your stop-loss price.

Your broker will sell the shares for whatever it can get. In a crash, the stock price could fall to $10 a share before a buyer is found and that’s what you’ll get for your stock.