Protect Your Portfolio With Defense Funds

Post on: 26 Апрель, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

The Indianapolis Colts won last season’s Superbowl largely because the team unexpectedly fielded a defense that was almost as potent as its deadly passing game.

Until this Sunday when they were edged out by the New England Patriots, that defense helped the Colts maintain a perfect record through the first seven games of this year’s campaign.

With the stock market alternatively jumping on interest-rate cuts and running into air pockets on earnings disappointments, a few added defensive stocks for your portfolio wouldn’t be a bad idea.

Exposure to defense — the defense industry, that is — might be a good way to add some defensiveness to holdings.

After all, U.S. defense spending is hardly likely to fall, given the current tension with Iran and North Korea. And while some presidential candidates would like to wind down our military involvement in Iraq, none has been calling for drastic cuts in overall defense spending.

And since federal spending on defense isn’t really a function of corporate profits, you could argue that the defense industry represents, well, a defensive investment opportunity.

The performance of defense stocks in recent years has more closely resembled the explosive Colts offense than that of a grind-out-the-yards-but-don’t-surrender-any-turf squad.

Adding to the appeal of companies in the defense industry is that, to the consternation of pacifists, they tend to book relatively heavy overseas sales, thus capitalizing on elevated global military tensions as well as the rising value of foreign currencies relative to the U.S. dollar.

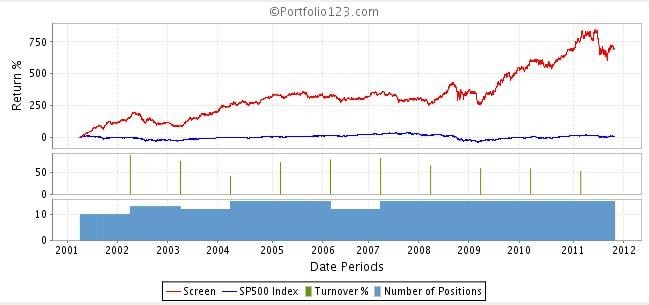

The SPADE Defense Index — an acronym for SPAce and DEfence — has climbed steadily from a value of 1000 at the end of 2002 to recent highs north of 2750. The benchmark has outperformed the S&P 500 in each of the past seven calendar years and enjoys a comfortable lead so far in 2007.

TheStreet.com Ratings tracks three funds that are pure plays on the sector. (FSDAX ) Fidelity Select Defense & Aerospace (FSDAX) is the lone open-end mutual fund defense sector pure play. The fund holds 14 of the 25 largest components of the SPADE index, making up 70.6% of its holdings. The fund’s largest holdings are Lockheed Martin (LMT — Get Report ) and General Dynamics (GD — Get Report ).

The PowerShares Aerospace & Defense Portfolio (PPA ). an exchange-traded fund, tracks the SPADE Defense Index. The 25 largest SPADE components account for 83.6% of its value. Its largest holdings are Lockheed Martin and Honeywell International (HON — Get Report ).

The iShares Dow Jones U.S. Aerospace & Defense Index ETF (ITA ) tracks the Dow Jones index embedded in its name. It holds 15 of the 25 largest SPADE components, which comprise 72.5% of its total net assets. Boeing (BA ) and United Technologies (UTX ) are the fund’s largest holdings.

All three sport the TheStreet.com Rating’s highest possible grade of A+, placing them in the buy category. Each member of the trio has a return of more than double the S&P 500’s 14.56% over the past 12 months. In addition, each has produced double-digit gains for the three-month period ended Oct. 31.

Major Defense Stocks are Widely Held

Funds investing in the 25 largest components of the SPADE index.