Protect Stock Profits in Pullback or Major Correction with Strategies

Post on: 16 Июль, 2015 No Comment

Stock Investors Watch for Ways to Guard Against Losses

Please refer to our privacy policy for contact information.

How do you know when stocks are headed for a modest pullback or major correction?

After the market has had a sustained bull run, it is natural for investors to expect a change in direction.

The question is will the change be a strong reversal or a modest bump in the road followed by more gains. The correct answer means the difference between more profits and getting out too soon.

In insider language, this is known as calling market turns and many claim great expertise at this alleged skill.

Stock Market Turns

I say alleged skill because most of the people who claim to possess it are like the doomsayer in California who predicts an earthquake every day – sooner or later, he’ll be right.

What you should be concerned about is protecting accumulated profits if you have ridden a bull market for some time.

A minor pull back may be an opportunity to add to your position rather than sell out – if you’re sure the market is coming back soon.

Since you may not know for certain, you can protect your profits in several ways.

One of the safest ways is to use trailing stops to protect profit in a position.

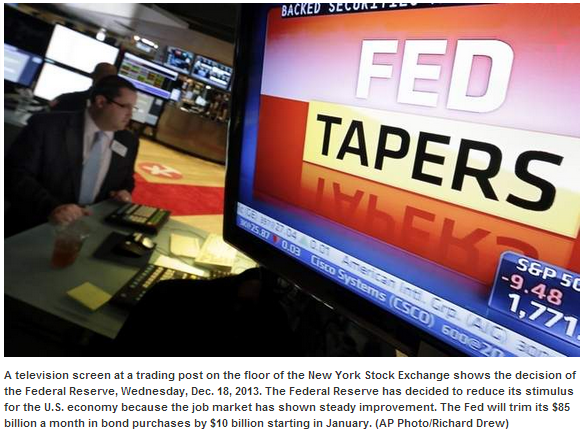

Stockbroker

A trailing stop is an order you place with your stockbroker that says if the price drops by a certain percentage or amount, your broker is to sell at that price.

This locks in a certain profit in the event the stock begins to tumble along with the market in a major pullback.

The trailing stops are set so that normal fluctuations in the stock’s price do not trigger the sell order.

You can learn more about using trailing stops in this article.

Stock Beaten Down

If you think the company is still solid, but the stock is going to take a beating in a market correction, you may want to sell a chunk (some percentage that will lock in a profit for you) and hold the proceeds in a money market account.

If the stock is beaten down in a market correction and the company still looks like a good, long-term investment, you may want to buy back in at a lower price.

This strategy only makes sense if you are absolutely convinced the company is still a solid investment. It is not any easier to call the bottom of a market than it is to call the top, so don’t try – buy back into the company when you can get a good price, but don’t be greedy.

Market go up and markets go down, but it isn’t a given that we’ll know when or by how much. Protect your profits while letting your winning stocks run and you’ll make the most of your investing dollars.