Prospectuses Annual Reports and Other Documents

Post on: 19 Май, 2015 No Comment

Every mutual fund is required to publish documents that help you evaluate its suitability as an investment. There are three such documents that are especially important, and which you should read and understand before making the decision to invest in any given mutual fund: the prospectus, the Statement of Additional Information (SAI ) and the annual report. Although these documents are usually rife with legal and financial jargon, they also contain important information about the fund and its overall financial health. Each is described below.

Prospectus

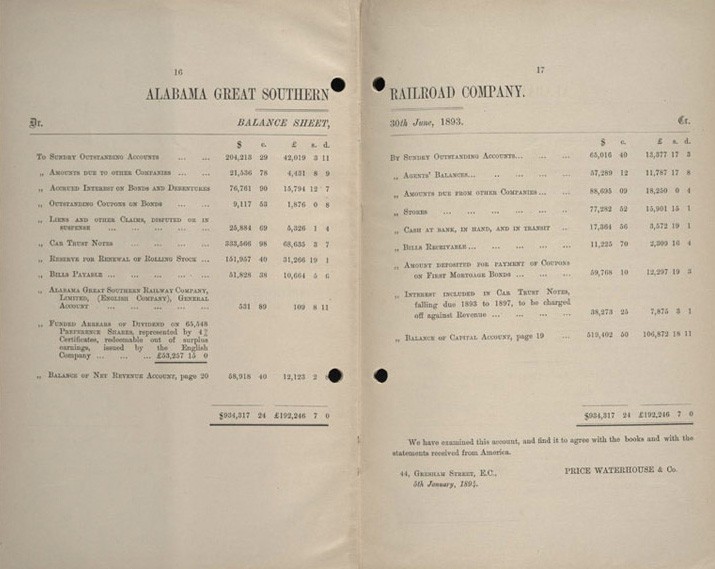

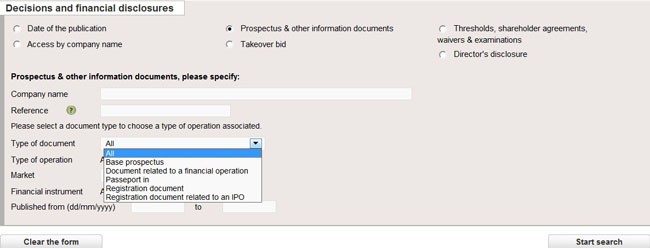

The first place you should look for information when considering investing in a mutual fund is the funds prospectus. The prospectus is a legal document required by the Securities Act of 1933 that explains the mutual fund offer. It includes information about the terms of the offer, the issuer, and its objectives. Before you invest in a mutual fund, you should always make sure that you understand what it said in the prospectus. Prospectuses can seem daunting at first as they are packed with information and tables, but you should keep in mind that the information presented there is for your benefit. When reading through a prospectus you should look for the following key sections:

Investment Objective

Investment Strategy

Fees and Expenses

Although mutual funds aim to make money for their investors, their ultimate goal, just like any other business, is to make money for themselves. In order to do so, funds charge their shareholders a variety of fees and expenses, all of which must be documented in the prospectus. A table at the front of every prospectus contains a breakdown of the different fees and expenses, along with a hypothetical projection of how the fees would impact a $10,000 investment over a 10 year period. This should make it easy for you to compare fees and expenses across mutual funds .

Account Information

This section contains very basic information about how to buy and sell shares and other account-related information. For most mutual funds the method of buying shares is the same. You can either go the traditional route and send a check to the fund each time you want to deposit more money, or you can set up automatic withdrawals from your bank account. Some mutual funds also allow wire transfers for quick deposits, but often times they charge a small fee for the transfer.

In addition to telling you how to get your money into the fund, the prospectus will also tell you how to remove it. Most mutual funds will require that you fill out a redemption form or write a letter to the fund in order to receive your investment. However, some funds will also let you redeem shares over the phone and others will even wire the money straight into your bank account for you (although usually they will charge a fee for this service). The prospectus will inform you which of these redemption methods are available to you.

Risks

One of the most important sections in the prospectus is the one describing the level of risk that the fund takes with its investments. Although all investments in stocks and bonds (with perhaps the exception of U.S. Treasuries) involve some measure of risk, this section will tell you what risks are associated with the specific investments made by the fund. So, for example, if the fund invests in emerging markets, this section would include information about the risks particular to investing in such markets (e.g. political, economic and/or social instability).