Private Equity and Hedge Funds

Post on: 14 Август, 2015 No Comment

August 7, 2007

Chicago

AFL-CIO Executive Council statement

In the past year, the global labor movement has mobilized to address the issue of what John Monks, president of the European Trade Union Confederation, has labeled the “financialization” of the global economy.

Financialization describes the growing dominance of finance over the real economy, and, in the United States at least, over politics as well. At the heart of financialization are the growing size and power of hedge funds and leveraged private equity funds—leveraged private pools of capital that benefit from extensive tax subsidies and are unregulated and shrouded in secrecy.

The AFL-CIO has long favored greater investor protections and regulatory oversight of hedge funds, as the Executive Council reaffirmed in its statement last March. However, the recent dramatic growth in both leveraged private equity and hedge funds has made it necessary to state the labor movement’s views on the challenges these funds pose to policymakers, to workers and their unions and to fiduciaries entrusted with workers’ capital.

Leveraged buyout funds and hedge funds have been around for years and are not going to disappear. Pension funds and other institutional investors have used them properly in modest amounts to help round out their portfolios and offset the volatility of other investments. But it is both dangerous and illusory to believe that pension funds in general can achieve sustained above-market rates of return for large portions of their portfolios by investing in leveraged asset pools. And there is no reason why these funds should be secretive or unaccountable. Finally, there is no reason why the individuals who manage private equity and hedge funds should receive tax subsidies that leave the burden of paying ordinary tax rates to working people.

It is easy to generate high returns to equity with a combination of cheap debt financing and tax subsidies. That is not a long-term strategy, nor does it require genius—and there is a real cost. There is a hidden cost to the investors who are paying for the leverage with risk, a real cost to workers and their companies that are managed for short-term return and a real cost to the rest of us who subsidize the massive redistribution of our wealth and tax dollars to billionaires.

While leveraged buyouts can provide needed capital to troubled companies, a mania for leveraged finance sets in motion a dynamic in which companies are acquired and hollowed out to make them appealing candidates for being flipped back into the public markets. Workers’ jobs, their health and retirement benefits and, in the end, their communities are nothing more than costs that can be converted into debt repayments. America’s workers experienced this dynamic in the late 1980s, and now we are experiencing it again.

In response, the AFL-CIO’s policy on private equity and hedge funds addresses government policymakers, pension fund fiduciaries and private equity and hedge fund managers themselves.

First, policymakers should enforce our existing laws, protect investors and, most of all, ensure that our tax system is fair. Private pools of capital should be required to play by the same set of rules as everyone else.

The Securities and Exchange Commission should enforce the Investment Company Act and require private equity and hedge funds that wish to sell interests in their underlying investment pools to register as investment companies.

The IRS should look into self-dealing tax avoidance schemes by private equity funds and hedge funds going public. The IRS and the SEC should investigate whether the positions taken by these funds going public with each agency are mutually consistent.

The AFL-CIO strongly endorses both the Grassley-Baucus bill, S. 1624, and the Levin-Rangel bill, H.R. 2834. The Grassley-Baucus bill requires private equity firms and hedge funds that go public to either provide investors with the protections they are entitled to under the Investment Company Act or pay corporate taxes on their earnings, while the Levin-Rangel bill requires hedge fund and private equity managers to pay ordinary income tax rates on their wages like other Americans. We commend the authors and co-sponsors of these bills for their leadership in this area, together with those in Congress who have asked the regulators to enforce the existing tax, investor protection and national security laws. Both bills are badly needed correctives to a tax system that has become grossly unfair.

The AFL-CIO calls upon politicians who think billionaires should have lower tax rates than firefighters and teachers to explain why they deserve the votes of working people.

The AFL-CIO recommends that fiduciaries exercise great care in investing workers’ capital in leveraged or opaque private investment vehicles. We urge fiduciaries to invest only in hedge funds that are registered with the SEC as investment advisors, and to ask hedge fund managers to agree to be bound by key protective provisions of ERISA. Some funds also have adopted policies that address the workplace practices of private equity and their impact on long-term value creation.

We particularly urge fiduciaries to work with their asset consultants to ensure the total exposure to either of these categories is modest and the expectations in relation to long-term risk-adjusted returns are realistic.

Finally, the AFL-CIO calls upon the hedge fund and private equity industries to act responsibly—to engage in dialogue both in the United States and globally around investor protection, taxation and workers’ rights in the companies they control and influence. There are models for responsible behavior—leveraged buyout firms with a significant history of working productively with workers and their unions, both in the United States and overseas, generating healthy returns while preserving jobs and treating workers with respect.

We particularly urge the industry to engage in a dialogue around investor protection, tax fairness and workers’ rights with the global labor movement. America’s workers and their unions stand in solidarity with our brothers and sisters around the world in facing the challenge of financialization.

FACT SHEET

MYTHS AND FACTS ABOUT PRIVATE EQUITY AND HEDGE FUNDS

As generally occurs when great wealth and power are concentrated in the hands of a few people, hedge funds and leveraged private equity funds promote a variety of myths about themselves. Fiduciaries and policy makers need to cut through the paid propaganda and focus on the truths behind financialization.

- Neither the term “private equity” nor the term “hedge fund” really describes an asset class. Private equity is a code word for leveraged buyout. There are leveraged buyout firms that borrow money to buy companies, and there are venture capital firms that invest equity in start-up businesses. Almost every “private equity” deal really is a leveraged buyout. As to hedge funds, any asset management strategy can be pursued in the hedge fund form. A hedge fund is a legal structure that avoids regulation in search of an asset class.

- Leveraged private equity and hedge funds do not create money from nothing. Leveraged trading strategies generate high returns by taking on risk through borrowing. That’s what the term “leverage” means. Recent studies from Harvard Business School suggest that after adjusting for the high fees and the risk from the leverage, private equity firms may not outperform public markets.

- The business strategy of leveraged buyouts puts them inherently at odds with workers’ interest in maintaining living standards, and at odds with our member’s interests in having employers and pension funds that focus on long-term value.

- Leveraged buyouts are cyclical—they thrive when risky debt is cheap and stocks are depressed. Recently, long-term debt has been very cheap as China and other countries that run trade surpluses with us look for places to put all the dollars they are accumulating. Tightening credit markets let the air out of leveraged buyouts and can lead to serious losses for leveraged buyout investors.

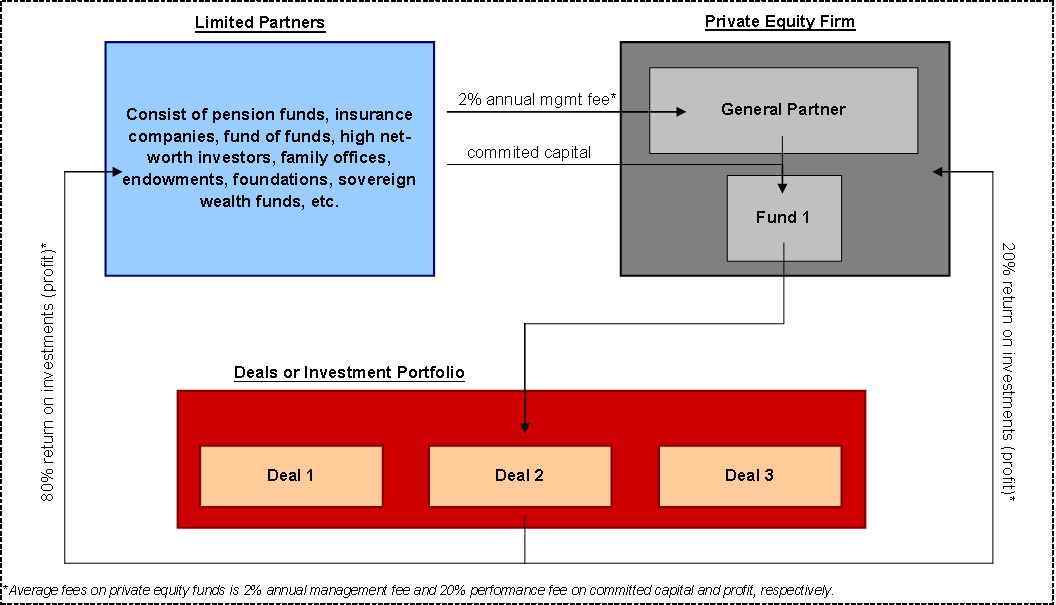

- Leveraged buyout firms, like their hedge fund relatives, charge their investors extraordinary fees—2 percent of assets managed and 20 percent of the total fund earnings over a benchmark—and pay their partners extraordinary amounts of money. The top 25 hedge fund managers last year earned $14 billion dollars, enough to pay New York City’s 80,000 public school teachers for nearly three years.

- Leveraged buyout firms and hedge funds are forms of pooled money management, just like mutual funds. When they try to sell interests in themselves to the investing public, no matter how complex the structure they use to disguise what they are doing, they must be subject to the investor protections of the Investment Company Act.

- Leveraged buyout firms and hedge funds and the people who run them get extraordinary tax breaks that are not justified and that may not in all cases be legal. Private equity and hedge fund managers pay 15 percent capital gains rates on their money management income (called the “carried interest”) even though they put no money at risk. Private equity firms and hedge funds that go public tell the SEC they are in the business of active management of companies—but then tell the IRS they are in the business of passive management of securities to get an exemption from paying corporate taxes.