PrincipalProtected Investments Risks Fees And Regulations

Post on: 14 Июль, 2015 No Comment

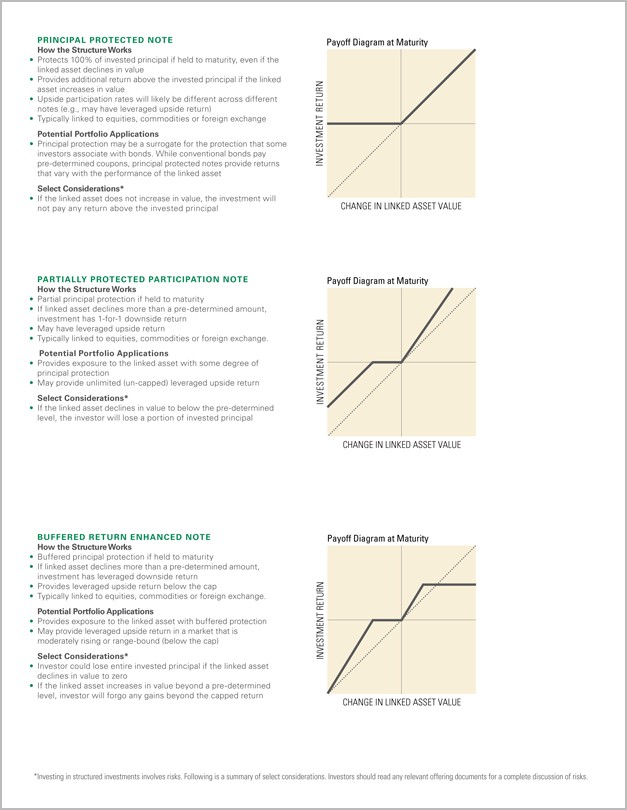

Principal-protected notes (PPNs) guarantee to return, at a minimum, all invested principal. The potential to obtain attractive returns, given favorable market conditions, also exists. The distinguishing feature of a PPN is its principal guarantee. The names used to describe PPNs, or notes, vary. In the U.S. market, the names include structured securities, structured products or non-conventional investments. In Canada, names like equity-linked notes and market-linked GICs are common. Be aware that structured products, which are similar to notes but without a principal guarantee, are available.

This article provides an overview of the risks and due diligence requirements associated with the purchase of a note. The sample calculations are for a note with an eight-year term, a sales commission of 4%, an annual inflation rate of 2% and an annual interest rate of 5%. Compounding is on an annual basis. (For an overview of these tools, see Principal-Protected Notes: Paying For A Guarantee .)

Regulation/Disclosure

Compared to stocks and bonds, notes are complex investments that contain embedded options and their performance depends on the linked investment. These features can make the performance of a note difficult to determine and complicates their valuation.

Because of this, regulators have expressed concerns that retail investors, especially the less sophisticated ones, may not appreciate therisks associated with the purchase of a note. Regulators have also emphasized the need for due diligence, both on the part of the seller, and the purchaser, of a note.

Numerous Fees

A note is a managed product and, as with all managed products, there are fees. It makes sense that the fees associated with a note will be greater than with a stock, bond or mutual fund investment because the principal guarantee is really the purchase of insurance. The insurance premium is the interest foregone by purchasing a note rather than an interest-bearing security.

Besides the insurance premium, there are numerous other explicit or implicit fees. These include selling commissions, management fees, performance fees, structuring fees, operating fees, trailer fees and early redemption fees. There is little need to focus on each fee, but knowing the total amount of money spent on fees is important because it will eat away at your potential return. Ironically, it is not always possible to know the total fee. For example, with a commodity-linked note, based on a constant proportion portfolio insurance (CPPI) strategy, trading fees depend on the volatility of the commodity. This is one of the added complexities to investing with notes.

All investments come with exposure to risk. Investors need to understand the risks associated with an investment to make prudent investment decisions. The risks associated with notes include interest-rate risk. the risk of a zero return, fee risk, suitability risk and liquidity risk. (To learn how risk tolerant you are, see Determining Risk And The Risk Pyramid and Personalizing Risk Tolerance .)

Interest Rate Risk