Price to Sales Ratio Backtest

Post on: 10 Июнь, 2015 No Comment

The Price-to-Sales (P/S) ratio is a commonly mentioned valuation ratio. It is similar to the P/E ratio but uses revenues instead of earnings. The advantages of using sales in this valuation ratio are two fold. First, it somewhat controls for earnings manipulation, since it is harder to manipulate sales numbers. Second, because the Price/Sales ratio does not rely on earnings, you can use this ratio to compare the valuation of companies that are not currently profitable. The price to sales ratio is calculated as follows:

Price-to-Sales Ratio = Market capitalization / Sales for past 12 months

Lets take a look at a backtest of this ratio to see how it works. I used the data and backtesting tool provided by Portfolio123. The Portfolio123 backtesting eliminates the problem of survivorship bias by using point-in-time and retaining data on stocks that have gone to zero. This backtest uses the same filtered universe of stocks as my recent P/FCF Ratio Backtest. I’ve designed the filtering criteria for this backtest specifically for individual investors and with a focus on enhancing data quality. The filters include the following criteria:

- No OTC stocks. Stocks not traded on the New York Stock Exchange, NASDAQ, or American Stock Exchange markets are excluded. The quality of fundamental stock data for OTC can be somewhat lower and less timely that that for stocks traded on major exchanges.

- No ADRs. Fundamental data for foreign American Depositary Receipt can include errors due to currency exchange, different accounting standards, and share count.

- Exclude the Financial Sector. The concept of sales revenue does not really work well for banks and other similar financial sector companies.

- Liquidity test. The average daily total amount traded over the past 60 trading days must be larger than $100,000. This amount was selected so that a $1 million dollar portfolio could hold 100 positions and that each new $10,000 position would not exceed 10 percent of a day’s trading volume. The liquidity test also ensures that the backtest has reliable market price information for any of the stocks that are being tested.

- Market Cap > $50 million. Nano cap stocks are excluded to help improve data quality. This filter also ensures that positions in a modest sized portfolio never exceed one percent of shares outstanding or the available float for a company.

- Price > $1. True penny stocks are excluded due to various information issues and manipulation of these stocks.

- P/S ratio > 0. This filter insures we are looking at stocks that actually have valid data on the Price/Sales ratio.

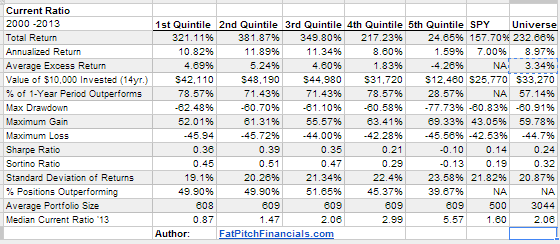

After these filters are applied, we are left with approximately 2,600 to 3,600 stocks. These stocks are then ranked by the criteria being tested; in this case, we are testing the Price/Sales ratio. The lowest 20 percent of stocks ranked by the P/S ratio are placed in the first quintile and the next 20 percent in the second quintile and so forth until we have five portfolios of stocks. The portfolios are rebalanced every 12-months and compounded annually to more realistically replicate what an individual investor might be expected to do to avoid higher short-term capital gains tax and trading costs. The following 5 charts display the quintile returns for the Price/Sales ratio in red and the S&P 500 Equal Weight Index in blue. The first quintile includes the companies that had the lowest P/S ratios and the 5th quintile includes the companies that had the highest P/S ratios.

Price/Sales Ratio Quintile Returns 2000 2013

Price to Sales Ratio Backtest 1st Quintile