Price To Free Cash Flow_1

Post on: 13 Апрель, 2015 No Comment

Price-to-Free-Cash-Flow Screen AAII: The American – The Price-to-Free-Cash-Flow Screen represents AAIIs interpretation of the investment approach and is not determined by the original strategist. The list of passing companies represents a hypothetical portfolio, which is used to track the

Price-to-Free Cash Flow Ratio (P/FCF) Definition & Example – Investors often hunt for companies that have high or improving free cash flow but low share prices. Low P/FCF ratios typically mean the shares are undervalued and prices will soon increase.

Free Financial Market Education: Price to Cash Flow Ratio vs – Free Cash Flow Formula vs. Price to Cash Flow Ratio. Both of these methods present a useful way to find out the valuation the market assigns to the stocks of a particular company.

Free cash flow Wikipedia, the free encyclopedia – In corporate finance, free cash flow (FCF) is a way of looking at a businesss cash flow to see what is available for distribution among all the securities holders of

Using Cash Flow Analysis to Value Stocks About – Free Cash Flow Free cash flow is a You divide the current price by the free cash flow per share and the result describes the value the market places on the company s ability to generate cash. What they Mean Like the P/E,

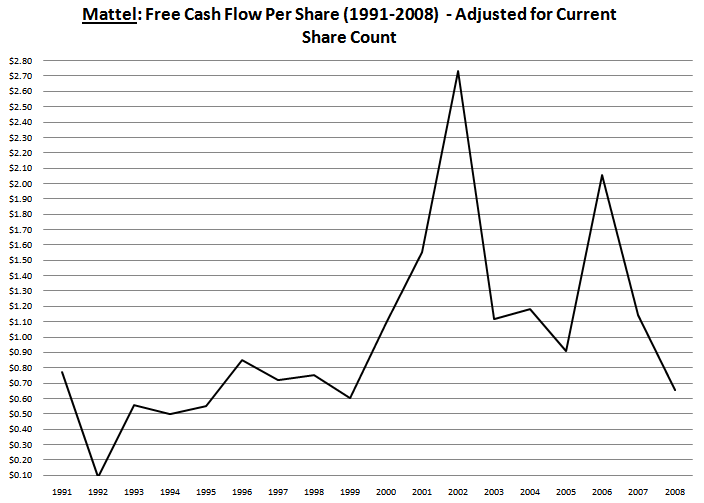

Many investors prefer using free cash flow instead of net income to measure a companys financial performance because free cash flow is more difficult to manipulate. Free cash flow is the operating cash flow minus capital expenditure. I have searched for very profitable companies that pay rich

In finance, discounted cash flow (DCF) analysis is a method of valuing a project, company, or asset using the concepts of the time value of money. All future cash

Price to Cash Flow Ratio Why You Should Focus On It Rather Than the Price to Earnings Ratio

This backtest of the P/FCF ratio reveals that the first quintile outperforms the S&P 500 Equal Weight Index benchmark. The second through fifth quintiles have lower average annual excess returns than each of the previous quintiles and the overall trend in excess returns is a linear decrease as

In theory, the lower a stocks price/cash flow ratio is, the better value that stock is. For example, if the stock price for two companies is $25 per share and one company has a cash flow of $5 per share (25/5=5)

Trial & free software & templates for business plan, financial projection plans, cashflow forecasting plus business planning tools, models, samples, guides & papers

The price-to-cash-flow ratio is an indicator of a stocks valuation. The Price-to-Free Cash Flow ratio, which takes into account free cash flow or cash flow minus capital expenditures is a more rigorous measure than the price-to-cash-flow ratio.

Free Cash Flow. When valuing the operations of a firm using a discounted cash flow model, the operating cash flow is needed. This operating cash flow also is called

The ratio of a stocks price to its cash flow per share. The

What is the free cash flow calculation? There are three ways to calculate free cash flow.