Price to earnings (P

Post on: 12 Сентябрь, 2016 No Comment

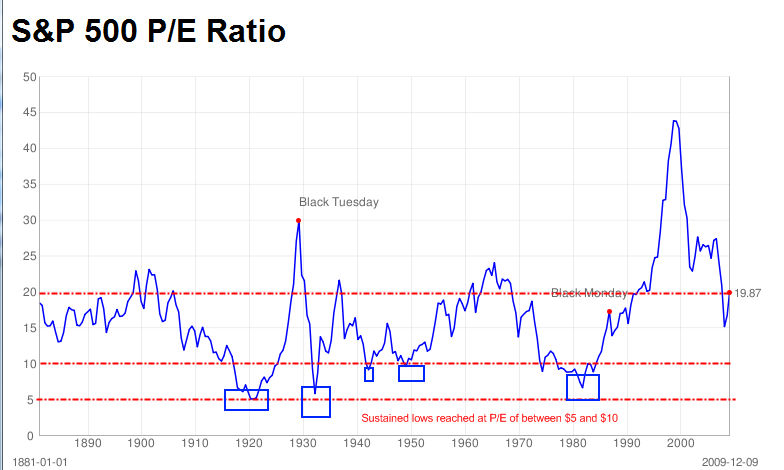

Price per earning ratio is the most talked about factor for selection of stocks. In fact the P/E ratio is considered by some traders as the final statement about the potential of the stock. Though it is not right to say that P/E ratio is the last word in the stock market it is true that it is one of the most indicative factors that needs to be considered while selecting the stocks. Price per earning ratio or P/E ratio is calculated by dividing the current price of a single share of the stock by the earning per share of the company (EPS). The price per earning is calculated by dividing the total earning of the company in the last 12 months by the number of outstanding stocks of the company. For example if the current trading price of a certain stock is 50 and the EPS of the stock is 10, then the P/E ratio of the stock will be 50/10=5.

The P/E ratio in other words is the amount that the market is willing to pay for the earning of the company. So a stock with high P/E ratio generally means that the market is willing to pay more for the earning of the company. Reversely, if the P/E ratio is low then it proves that the market is not interested to invest in that stock. As the price of the stock is determined by the demand of the stock in the market, the P/E ratio is an important indicator for the demand of the stock in the market. So, when you see the P/E ratio of a certain stock or more rightly the average P/E ratio of the stock, you know about the demand for the stock in the market. Generally the stocks that are high on demand has the maximum potential to appreciate in the market. So if you are looking for the stocks for investing P/E ratio is a vital indicator that you should consider.

Generally the average P/E ratio of the company is compared with the P/E ratio by the investors to determine which one is the better stock to invest. It is a one point reference for most of the traders. Traders also compare the P/E ratio of a certain stock with the average P/E ratio to determine whether the stock is worth investing. The P/E ratio is higher than the average then the feel that the stock is worthy of investment. But while doing the comparison, you have to keep in mind that the every industry and market consider different ranges of average to be normal. If you make any mistake in judging P/E ratio your investment strategy can go wrong. So you should be careful while comparing the average P/E ratio and P/E ratio of the certain stock.

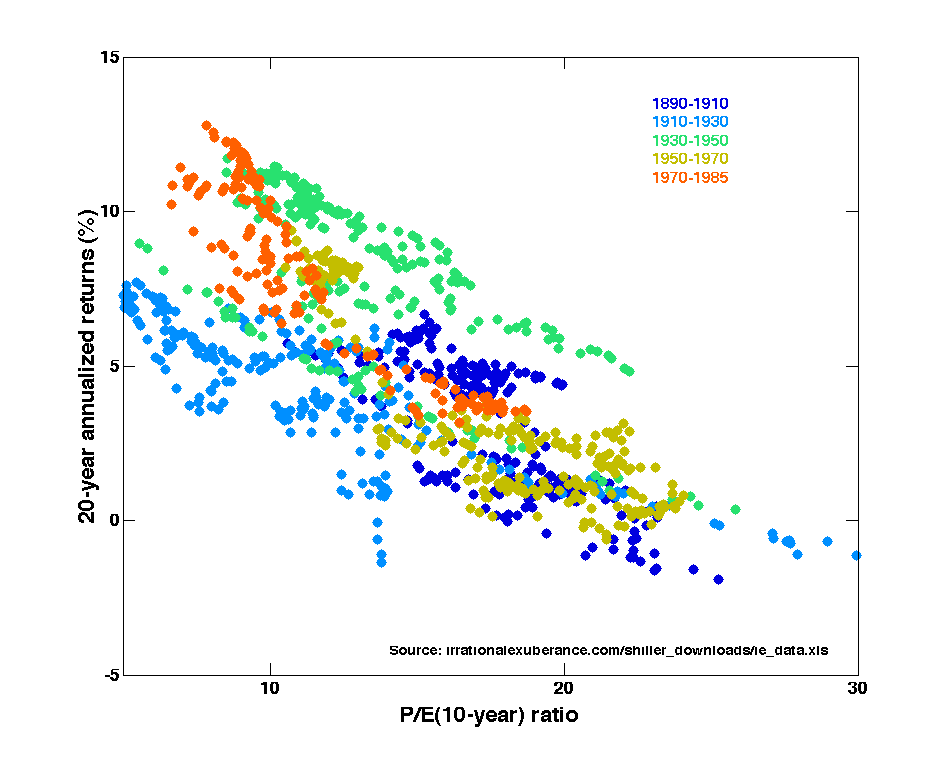

It is normally believed by the traders that a higher P/E ratio is good for indicator for investing in a stock and a lower P/E ratio means it is a bad investment to make. This is true in a general way and you can not take it as a final statement for selecting the stocks for investment. The stock with a high P/E ratio can actually be an over priced stock. That means the stock some reason is being traded at a price that is over the potential price of that stock or in other words, market is ready to pay a price for the stock that is way above the potential price of the stock. A bull market, some news about the company or some opportunity in the sector of the stock might be the reason behind this. Whatever is the reason, there is no doubt about the fact that when the market is corrected or gets stable the price of this stock is bound to fall. That means if you invest in the stock seeing only the high P/E ratio, you can also suffer loss.

On the other hand a low P/E ratio does not necessarily mean that the stock has got no potential in the future. It may be case of low priced stock. That means that the stock is being traded at a lower price than what should be the actual price of the stock. If you do not invest in that stock seeing only the low P/E ratio you will actually miss the opportunity of making a good investment .

To Know About our Packages Click here

Click here for Indian stock market tips