Price Launches More Conservative Target Date Fund Series

Post on: 17 Апрель, 2015 No Comment

In a sign of the shareholder jitters that still linger in the wake of the 2008-09 market meltdown, T. Rowe Price plans to launch a new suite of 11 target date funds with smaller allocations to stocks at retirement .

The Baltimore-based fund complex will continue its existing lineup of target date funds.

T. Rowe will label its new series Target Retirement Funds. The existing suite is called Retirement Funds.

The new suite is scheduled to debut on Aug. 22. Its introduction does not imply anything negative about the existing set of funds, said Wyatt Lee, co-manager of the new group and associate manager of the existing group.

Instead, it addresses demand from some 401(k) plan sponsors for a more conservative option.

It points out that the period around the target date (for retirement ) is slightly more important in the new product because it should moderate volatility, Lee said. It places more emphasis on results around the retirement date.

The new funds will also be open to shareholders outside of 401(k) plans. The current rally has erased the broad market’s losses since the low of March 2009.

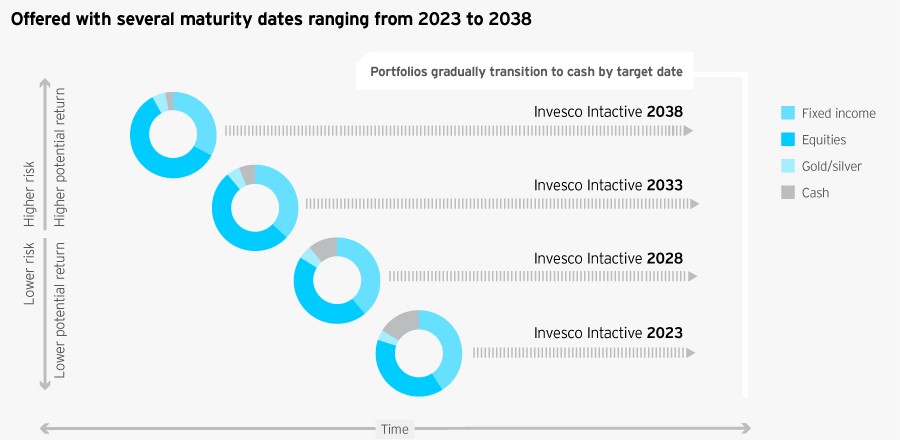

T. Rowe Price’s new target date funds will aim for 42.5% of fund assets to be invested in stocks at each fund’s named retirement date. The target allocation to stocks in the existing suite at that point is 55%.

Both allocations are more aggressive than the industrywide average, which is a little more than 30% equity, according to Morningstar Inc. The average allocation to bonds is about 64%, 3.48% to cash and 2.05% to other assets.

Ten years prior to each T. Rowe Price fund’s named target date, the planned allocation to stocks in Target Retirement Funds will be 57.5%. Industrywide it is about 52.9%, with another 44.4% in bonds.

When Divergence Happens

At some points along their lifecycles, or glide paths, the two suites stock-bond allocations will be the same. At 40 years prior to their target date, both groups will have 90% stock weightings.

But as they get closer to their named target dates, their equities weightings will diverge, Lee said. After their retirement dates, they will start to converge again. By 20 years past retirement. the glide paths will be the same.

The change is not a direct response to the market downturn, Lee says. The new series does reflect how a number of plan sponsors think about the target date space, as well as their fiduciary concern and the growth of target date funds, he adds. It led those sponsors to look for which strategy would be most appropriate within their plans, Lee said.

The lower volatility format is better suited for shareholders who plan to make smaller withdrawals at or shortly after their target dates, Wyatt says. They may have larger balances or other sources of income, Lee said.

Many investors are increasingly concerned about vulnerability of bond prices to interest rate hikes, which the Federal Reserve has said are still about two years away.

Lee says the new fund series’ bond risk is not excessive. They’ll still have a big allocation to equities, he said. Outperformance by stocks should more than offset price declines by bonds, he says.