Price Dividend Growth Fund (PRDGX)

Post on: 16 Март, 2015 No Comment

# 73 Large Blend

U.S. News evaluated 470 Large Blend Funds. Our list highlights the top-rated funds for long-term investors based on the ratings of leading fund industry researchers.

Summary

T. Rowe Price Dividend Growth looks to offer investors one of the things they want most in the today’s economy: current income.

As of February 04, 2015, the fund has assets totaling almost $4.62 billion invested in 117 different holdings. Its portfolio consists primarily of shares of dividend-paying companies.

In the current market climate, dividends, which provide shareholders with current income at regular intervals, are taking on newfound importance. In other words, jittery investors are looking to use dividends to supplement returns elsewhere in their stock portfolios. That’s good news for this fund, which looks for companies that are capable of increasing their dividends over time.

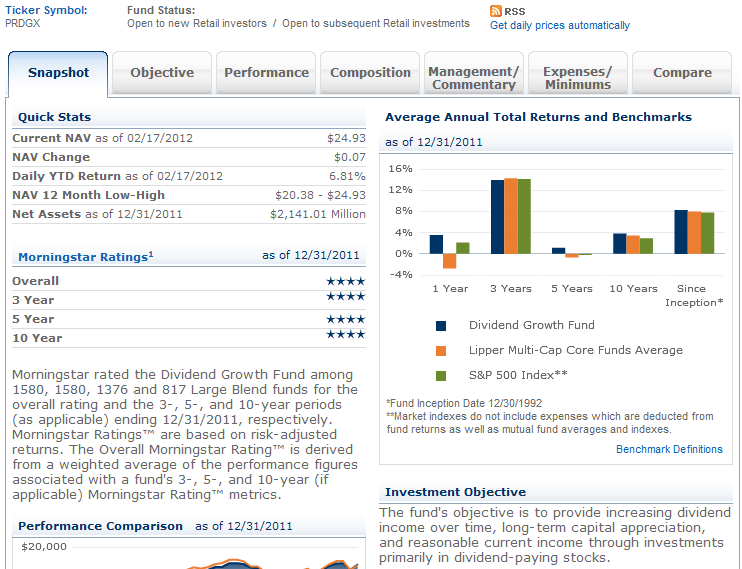

Recently, this fund increased its exposure to a number of its top holdings, including ExxonMobil, Pfizer, and Wells Fargo. The fund had a relatively tame start to 2011, sticking close to the S&P 500 in the first quarter. So far in 2011, the fund’s exposure to PepsiCo and U.S. Bancorp has held it back. The fund has returned 13.00 percent over the past year and 16.27 percent over the past three years.

Historically, the fund has developed a solid track record. As of the end of the first quarter, its returns for the trailing five- and 10-year periods both landed it in the top quarter of Morningstar’s large-blend category. The fund has rarely had blockbuster years, but over time its steady returns have rewarded investors. The fund has returned 14.58 percent over the past five years and 7.82 percent over the past decade.

Investment Strategy

According to the fund’s prospectus: The fund will normally invest at least 65% of its total assets in the common stocks of dividend-paying companies that we expect to increase their dividends over time and also provide long-term appreciation. T. Rowe Price believes that a track record of dividend increases is an excellent indicator of financial health and growth prospects, and that over the long term, income can contribute significantly to total return. Dividends can also help reduce the fund`s volatility during periods of market turbulence and help offset losses when stock prices are falling.

Role in Portfolio

Morningstar calls this fund a core holding.