Prepare Your Retirement For The Coming Inflation

Post on: 16 Июль, 2015 No Comment

The Federal Reserve has embarked on several rounds of Quantitative Easing hoping that increasing the bank reserves will help to stimulate the economy and lower unemployment. The critics of the program see this as money printing and fear it will backfire creating inflation or even hyperinflation within the economy. No matter the outcome of the Fed’s actions, inflation is a risk that must be addressed in all retirement portfolios.

Know thy Enemy — A Short Course on Inflation

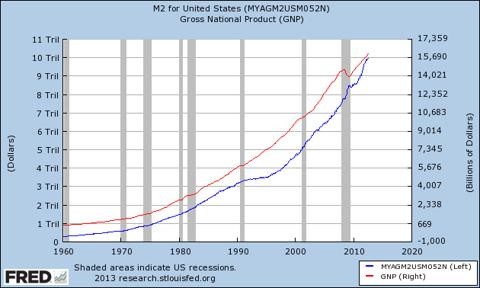

There is some truth to the money printing theory; our money supply is increasing as shown on the below graph of the M2 money stock.

However, this growth alone shouldn’t be a concern because the money supply is always increasing. To prevent deflation, the money supply must grow in lock step with the growth of the economy. Below is a graph of the M2 money supply from 1960, showing the steady growth of the money supply in blue and the Gross National Product in red. Note the correlation.

When making investment choices it is important for the investor to realize contrary to what they may have been told that in reality the money supply increase doesn’t drive the amount of goods inflation in our economy. The graph below charts the change in money supply (red) against the change in CPI (blue). See the lack of correlation?

We can conclude from this graph there is no direct link between inflation and money supply. So we can dismiss the cries that money printing will cause general inflation. The simple truth is money printing will cause inflation, unless it doesn’t. But, regardless, we must still protect against inflation in our portfolios.

There Are Many Types of Inflation

The reason money supply doesn’t always cause general goods and services inflation is because there are many types of inflations that investors don’t always think of being inflation. For instance, if the PE ratio of the stock market increases, that is inflation of stock prices. If the GDP increases, that is the inflation of output. A rising money supply will cause some type of inflation, it is just difficult to know specifically what will inflate.

There are five broad types of inflations resulting from an increase in currency.

- Economic Output Inflation or Growth of GDP

- Inflation of the Rate of Savings and Debt Repayment.

- Inflation of Financial Asset Prices like stocks and real estate.

- Inflation of the Trade Deficit caused by an increase in imports

- And last, inflation of Goods and Service Prices.

Money supply growth will generally cause a small amount of inflation in all of the above. In rare occasions, it can manifest itself in only one. Here are the dominant inflations through the years:

- In the 1960s we had inflation of output.

- The late 1970s and early 1980s say an increase in the inflation of goods and services

- Through the late 1980s and the 1990s we had inflation of financial assets, stocks and real estate.

- Starting in the 1990s until the financial crisis, we have had inflation of the Trade Deficit.

Much of the Trade Deficit inflation has been with China — shown below.

China’s economic relationship is a little odd. China sells us lots of goods but it doesn’t buy many goods from us. China essentially saves the money in US Treasuries. They then engage in their own QE program by converting the dollars imported into their economy into US Treasuries.

Just as the Fed buys US Bonds with dollars, the Chinese effectively buy US Bonds with Yuan. It is the same monetary mechanics using a different currency. The effect of the monetary mechanism is to export our inflation to China. China accepts our inflation in order to keep their factories running. The result is we can print money than we would normally be able to do and it won’t be inflationary in our country.

For the investor the take-away is that money printing doesn’t have to cause monetary inflation, it can cause other types of inflation instead.

Inflation and Your Retirement

Investors will want a portfolio that can react to these different types of inflations. An optimized retirement portfolio will capture two economic forces and protect against two economic forces. It will capture a rising stock market caused by asset price inflation and benefit from the effects of economic growth or output inflation The portfolio will protect against the effects of goods and service or general inflation. And last, the allocation will protect against negative economic growth or output deflation like we saw in 2008.

Investment Choices

Put your investments into four buckets that protect against these forces.

- Goods and Service Inflation

- Financial Asset Inflation or Stock Market and Real Estate Inflation

- Inflation of the Savings Rate or Deflation

- Inflation of Output or Economic Growth.

Get a Factory Warranty

To protect against Goods and Service Inflation get the factory warranty. US currency is manufactured by the US Government and the US Government is willing to offer a factory warranty on the value of their currency via Treasury Inflation Protected Securities or TIPS. These bonds are biannually indexed to the US CPI rate. If the CPI increases the value of the bond is increased. Unlike other purported inflation hedges, it is a direct correlation.

There are many aftermarket inflation warranties available in the form of gold or commodities but like many aftermarket warranties they don’t always pay off. For example the often touted correlation between gold and US inflation is a miserable 0.22 or almost no correlation at all. See the below graph of gold prices (blue) and CPI (red). There is no strong correlation. If an investor had bought gold in 1980 to hedge inflation, look where they would be in the year 2000.

Find a Ride on The Growth Engine

Next, allocate part of your portfolio to investments that benefit from a growing economy. One commonly proposed solution to this is to invest in stocks but they are an unreliable pick. Below is a graph of the change in the Dow Jones Industrials (blue) against the change in Gross National Product (red).

As can be seen, there is no correlation between stocks and economic growth. Stocks have a mind of their own. The best way to get exposure to economic output inflation is to buy corporate bonds and preferred stocks.

When there is strong economic growth, companies can pay the interest and pay off their debts. When times are deflationary bonds have more trouble.

Catch the Winds of the Stock Market

As seen from the above graph the stock market might have a mind of its own but it has a mind. When the stock market is well-behaved and there is financial asset inflation within the economy stocks can be an excellent investment. The way to participate is to own individual stocks or an ETF like SPY. or VTI .

Beware of Deflation

Last, a major cause of disinflation and deflation is an increase in savings and debt repayment or default. This is a sort of inflation of savings. It is usually accompanied with a decrease in the velocity of money.

Money Velocity is how fast currency is spent within the economy or how fast it changes hands in a given time frame. When the velocity drops rapidly there is usually an increase in Treasury Bond prices.

The graph below shows the 10 year treasury (blue) against the velocity of money (red). Notice the indirect correlation? An allocation within the portfolio to US Bonds will help to protect the investor against deflation.

Summary

Money printing doesn’t always cause goods and service inflation. Money printing can cause different types of inflation — general, output, asset, savings, and import.

- Protect your portfolio against all forms of inflation.

- Buy a factory warranty on US currency with TIPs to protect against goods and services inflation.

- Own private fixed income to gain from output inflation.

- Have a portion in the stock market to benefit from asset inflation.

- Use Treasury Bonds to protect against disinflation and deflation.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational and educational purposes only. The views expressed in this article are the opinions of the author and should not be interpreted as individualized investment advice. Investment objectives, risk tolerances and the financial situation of individual investors may vary. Please consult your financial and tax advisors before investing.