Preferred Stocks v A Primer on Preferred Stocks II

Post on: 13 Июль, 2015 No Comment

T his is a column from regular contributor Clark.

Part 1 of this series looked at the advantages and disadvantages of preferred stocks over common stocks. This entry will deal with their differences in relation to bonds.

How are preferred shares different from bonds?

Term Bonds are issued for a specific number of years such as 1, 3, 5, 10, etc. Both preferred and common shares do not have a time-frame as such. A company could repurchase some shares and retire them but there would still be outstanding stock left for trade on the market.

Ownership Preferred (and common) share owners are part owners of a business. Bond owners are strictly creditors and have no ownership stakes in the corporation. During takeovers, the debt of the existing company is taken on by the buying company and the existing shareholders may be offered comparable stock of the buying company.

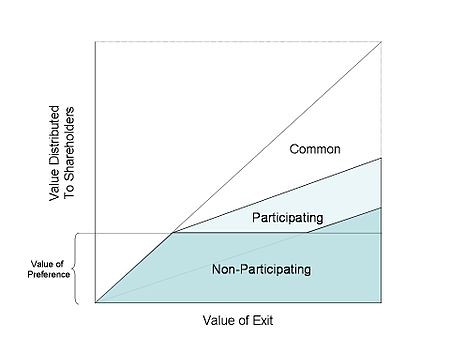

Right to Property — If a company goes bankrupt, then bondholders are second in line to be paid; secured creditors with collateral get first preference followed by bondholders. Preferred stockholders are ahead of common stock owners who bring up the rear (assuming enough money is available for all!). If it is a Chapter 7 (bankruptcy) filing, then bondholders should receive a portion of their investment. If it is a Chapter 11 filing, then the bonds may trade, but the investor will not receive any interest or principal. However, preferred (and common) share owners may be wiped out completely under most bankruptcy proceedings, if there are not enough assets to cover all.

Ratings As is the case with corporate bonds. rating agencies issue credit ratings for preferred stocks to help investors gain some knowledge about their investment grades. Preferred share ratings may be differ from the company’s bond ratings. A bond of ZYX Corporation may have a bond rating of AA but a preferred stock rating of B. This disparity is due to the guaranteed nature of bond interest payments, whereas preferred dividends, though senior to common stock, are not certain and can be suspended in case of cash flow problems for the company.

Nature of Distribution (dividend vs. interest ) Although preferred shareholders receive dividends at fixed rates, they are not guaranteed. They have to be declared by the company unlike bond interest, which is assured. If the company misses its bond payments, it is said to have defaulted, whereas preferred shares do not hold the company to that same stringent standard. Bonds are accorded this higher degree of certainty because they are secured by an indenture. Also, bond interest is paid with pre-tax dollars of the company, while dividends preferred and common are funded with the company’s net income, i.e. profit after tax. So, apart from the legal obligation, bond interest is cheaper to pay from a financial standpoint of the company.

Volatility Preferred (and common) shares incorporate the credit risk in their pricing. The higher the credit risk, the lower is the price of the stock. On the other hand, bond investors utilize this credit risk by seeking a higher rate of interest for the greater risk of default the company poses. So, preferred shares are likely to show higher price variations than bonds, while bonds are more susceptible to interest rate risk.

Liquidity Individual preferred shares are relatively more liquid than individual bonds. Usually, bonds have a minimum investment amount of $5000 or more, while preferred shares do not have the requirement as long as an investor is willing to pay the trading commission for a smaller amount, even if it is a high percentage of the trading amount.

Have I missed other points that one should consider when comparing preferred shares to bonds?

About the Author. Clark is a twenty-something Saskatchewan resident employed in the manufacturing sector. He repaid around $20,000 in student loans and has been working to build his investment portfolio as a DIY investor (not trader) while nurturing plans to retire early. He loves reading (and using the lessons learned) about personal finance, technology and minimalism.