Preferred Stocks preferred stock preferred dividends

Post on: 13 Июль, 2015 No Comment

Too many stocks, too little time? Click here to subscribe to Dividend Detective

About

Corporations issue preferred stocks to raise cash. Although you buy or sell them the same way you trade regular stocks, preferreds are more like bonds than common stocks. Investors buy them for the steady dividends, which typically equate to 4% to 8% yields. Most preferreds pay dividends quarterly.

Unlike common stocks, you’re won’t enjoy much share price appreciation if your company comes up with a hot product. Further, in most cases, the dividend never goes up either.

The term “preferred” means that a firm must pay the dividends due on its preferred shares before it pays any common stock dividends. Also, in theory, if a company goes bankrupt, preferred holders have priority over common stock shareholders. However, when a company fails, both common and preferred shareholders usually get nothing.

Finally, another meaningless distinction: unlike common stock holders, preferred shareholders don’t get to vote on company proposals. But, in fact, individual common shareholders have almost no influence on any corporation’s policies.

Nuts & Bolts

When a company issues a preferred stock, it sets the annual dividend and sells the shares at a preset price, typically $25, but some are issued at $50 or $100.

The initial yield, called the “coupon rate,” is the annual dividend divided by the issue price. For instance, the yield on shares paying $1/year on shares issued at $25 is 4%.

However, since preferreds trade on the open market just like regular stocks, the actual trading price depends on supply and demand. Thus, if the shares mentioned above slip to $24, the yield to new investors (market yield) rises to 4.2% ($1 divided by $24).

Ticker Symbols

Companies that issue preferred stocks typically sell more than one series, for instance, Series A, Series B, etc. Ticker symbols are usually the issuing firm’s ticker followed by a “-“ and then the series identifier. For example, the ticker for Bank of America’s “I” series preferreds is “BAC-I”. MSN Money’s (moneycentral,msn.com ) Company Report is a good place to see current prices and trading volumes.

Calling Preferreds

Preferreds have minimum 30-year maturities and some are perpetual, meaning that the firm is not obligated to redeem them. However, most preferred stocks are “callable,” meaning that the issuer has the right to call (redeem) them at the “call price” after a specified date (call date), typically five-years after issue. The call price is usually the original issue price, but under certain conditions it may be slightly higher.

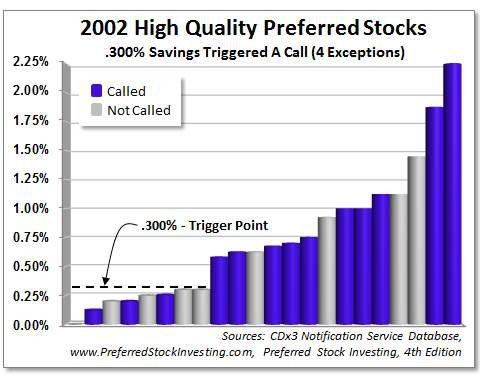

The issuer is not obligated to redeem the shares at the call date. Issuers are likely to call their preferreds if interest rates have dropped and they can save money by calling existing preferreds and selling a new batch paying lower rates. Thus, depending on prevailing interest rates, preferreds might continue to trade for years after the call date.

Nominal Yield

A preferred stock’s coupon rate defines its annual dividend, but not the yield that you would receive if you bought the preferreds after the issue date. For instance, A 7.0% bond issued at $25 pays $1.75/share annually (7% of $25). If the price drops and you only pay $23.00 per share, your nominal yield would be 7.6% ($1.75 divided by $23). On the other hand, your yield would drop to 6.7% if you pay $26 for the shares, which still might be acceptable, depending on what banks are paying at the time.

Yield to Call

For preferreds near or already past their call dates, it’s important to know your potential return should they be called. For instance, say that you pay $26 per share for 7.0% (coupon rate) preferreds originally issued at $25 per share that can be called in 12-months. Even though you’re collecting a nominal 6.7% yield, you would lose $1/share in 12-months if the shares were called at that time. Factoring that in, your actual return, called the yield to call, would drop to 2.9%. Rather than doing the math yourself, use this handy calculator to determine your preferred’s yield to call.

Potential Price Appreciation

Ideally, you would like to buy preferreds below their issue price. Assuming that the issuing corporation is a solid player and won’t renege on its dividend obligations, the preferreds will eventually move back up to their issue price. If that happens, you would enjoy capital appreciation in addition to the dividends. For instance, suppose that you buy shares originally issued at $25, but currently trading at $23. Your capital appreciation potential is 8.7%. and your nominal dividend yield is 7.6%.

Obviously, thanks to the capital appreciation potential, the call date isn’t an issue when you buy preferreds trading below their call price. For example, for the 7.0% coupon preferreds trading at $23, your yield to maturity would be 16.3% if they were called 12-months after you purchased.

Preferred stock investors face three major risk factors: 1) dividend suspension or company failure, 2) rising interest rates, and 3) low trading volumes.

Dividend Suspension/Company Failure

Firms that are facing cash flow problems will be tempted to suspend paying preferred stock dividends, and in the worst case, might file for bankruptcy. Either of those events would sink preferred share prices.

Consequently, preferred investors must understand the issuing corporation’s fundamental outlook. Preferreds issued by marginal corporations will look tempting because they will be trading at big discounts to their issue price. Thus, be sure to do your homework before buying preferreds in that category.

Many preferred stocks are rated by bond rating agencies such as Moody’s and Standard & Poor’s. They use a combination of letters, numbers, and plus or minus signs such as AAA, BA1 or B- to rate the preferreds. The details vary between agencies, but all ratings starting with A, and three letter ratings starting with B, indicate investment quality.

S&P: Investment quality ratings are AAA, AA, A, and BBB. Below investment quality ( best to worst) are BB, B, CCC, CC, C and D. S&P may add a “+” or “-“ to indicate that a rating falls near the top or bottom of a rating category.

Moody’s investment quality ratings, are Aaa, Aa, A, and Baa. Below investment quality (best to worst) are Ba, B, Caa, Ca, and C. Moody’s may add a “1,” “2,” or “3” to a rating to indicate that it falls near the top or bottom of a rating category (1 is best).

Since issuers must pay Moody’s or S&P to be rated, not all preferreds are rated. Unrated preferreds aren’t necessarily risky, but they require more work since you’ll have to do the financial strength analysis on your own.

Beware; bond-analysts sometimes overlook the obvious. For instance, in 2007, many didn’t realize that falling home prices would reduce the value of mortgages secured by those homes. Thus, it’s up to you to keep up with the news and avoid industries with obvious problems.

Interest Rate Risk

After the issuing company’s financial outlook, prevailing interest rates are the most important factor controlling preferred share prices. If market rates rise, preferred stock prices will probably drop, and vice versa. Here’s why.

Suppose that you own preferreds paying an initial 6% dividend yield; for instance, a preferred issued at $25 that pays dividends totaling $1.50 annually. Now, say that prevailing corporate rates rise to 7%. There would be no market for preferreds paying 6% at $25 per share. Instead, buyers would only be willing pay $21.43 per share. At that price, the $1.50 annual dividend would equate to a 7% return ($1.50 divided by $21.43 is 7%).

Conversely, if interest rates drop, investors would be willing to pay more for you shares because they are yielding better than market returns. Thus, the best time to own preferreds is when the outlook for corporate interest rates is steady or headed down.

Trading Volumes

Some preferred stocks are not widely followed and are lightly traded. Those are risky business because the lack of trading volume makes it difficult to move in or out of a position at a reasonable price. Avoid preferred stocks trading less than 4,000 shares daily, on average.

For reasons too involved to detail here, the dividends from some preferreds are subject to the maximum 15% dividend tax rate, while others are taxed as ordinary income. That can make a big difference. For instance, $1.00 of dividends taxed at 15% nets out to roughly the same amount as $1.30 taxed at the maximum 35% ordinary tax rate. For each preferred, Quantum Online (www.quantumonline.com ) specifies whether the 15% maximum rate applies.

Corporations that have invested in other firm’s preferred shares, in most instances, enjoy a dividend received deduction that allows them to exclude 70% of dividends received from their taxable income. Quantum Online also specifies whether each preferred qualifies for the corporate dividend received deduction.

Evaluate preferreds by analyzing the issuing company’s financial strength. What’s important is that the firm has the cash to pay its dividends. It doesn’t matter if the issuer’s earnings came in below analysts’ estimates or it said next quarter sales would be lower than previously forecast.

Here are some selection criteria to keep in mind.

• Current Price vs. Call Price: ideally, the current price would be no higher than call price, and preferably lower.

• Credit Rating: should be investment grade (any rating starting with A and three-letter B ratings) unless you’re up to analyzing the issuing firm’s balance sheet on your own.

• Trading Volume: minimum 4,000 shares, traded daily, on average.

• Issuing Company Analyst Consensus Buy/Sell Rating: hold or better.

• Issuing Company Return on Assets: 6% or higher.

• Issuing Company trailing 12-months (TTM) Operating Cash Flow: positive.

Adjustable Rate. annual dividend varies depending on predefined factors.

Callable. issuer has the right to redeem shares at issue price after a specified date.

Call Date. earliest date that shares can be called. Usually five years after issue date.

Call Price. price issuer will pay for redeemed shares. Usually the same as the issue price.

Convertible. holders have the right to convert preferred shares to common stock at predetermined ratio after specified date. This gives preferred holders a chance to benefit from the common stock’s share price appreciation.

Coupon Rate. yield based on initial issue price

Cumulative. skipped dividends must still be paid before common stock dividends are paid and before the shares are redeemed.

Current Yield. yield based on current share price.

CUSIP. unique identifier for each security.

Exchange-Traded Debt Securities: a.k.a. Preferred Equity Traded (PET) Bonds or Junior Subordinated Debentures. Debt securities such as debentures, notes and bonds that trade like stocks. These unsecured debt instruments rank below secured debt, but senior to preferred and common stocks.

Ex-Dividend Date. you must purchase shares prior to the ex-dividend date to receive the corresponding payout.

Issue Price: original share price.

Liquidation Value. same as issue price.

Market Yield. same as current yield.

Maturity Date. the date the preferred shares must be redeemed by the issuing firm, typically 30 to 100 years after issue.

Par Value. same as issue price

Participating. annual dividend varies depending on firm’s net income or dividends paid to common shareholders.

PINES (Public Income Notes): a.k.a. QUIBS (Quarterly Interest Bonds) or QUIDS (Quarterly Income Debt Securities). Debt securities such as debentures, notes and bonds that trade like stocks. These senior unsecured debt instruments rank below secured debt, but senior to preferred and common stocks.

Redeemable. same as “callable.”

Redemption Date. same as call date.

Third Party Trust Preferred. a Trust Preferred issued by a third party such as an underwriter.

Trust Preferred Securities. a cumulative preferred variation that provides certain income tax and accounting advantages over traditional preferreds to the issuer, but not for the shareholder. Instead of selling preferreds directly, a corporation sets up a special trust that buys debt securities from the corporation and, in turn, issues preferred shares. If the issuer suspends dividends, shareholders may still be liable for income taxes on the unpaid dividends. TruPS — Trust Preferred Securities are Smith Barney’s brand name for Trust Preferreds. TOPrS — Trust Originated Preferred Securities are Merrill Lynch’s brand name for Trust Preferreds.

Yield to Call. return you would receive assuming the preferred is redeemed on the call date.

Yield to Maturity. return you would receive assuming the preferred is redeemed on its maturity date.

Click here to see our preferred stock picks (Premium subscription required, click here to subscribe)