Preferred stock valuation International Economics

Post on: 16 Март, 2015 No Comment

Assignment Help >> International Economics

1) Authorized and available shares Aspin Company charter authorizes issuance of 2,000,000 shares of common stock. Currently, 1,400,000 shares are outstanding and 100,000 shares are being held as treasury stock. The firm wishes to raise $ 48,000,000 for a plant expansion. Discussions with its investment bankers indicate that the sale of new common stock will net the firm $ 60 per share. a. What is the maximum number of new shares of common stock that the firm can sell without receiving further authorization from shareholders? b. Judging on the basis of the data given and your finding in part a, will the firm be able to raise the needed funds without receiving further authorization? c. What must the firm do to obtain authorization to issue more than the number of shares found in part a?

2) Common stock value Zero growth Kelsey Drums, Inc. is a well- established supplier of fine percussion instruments to orchestras all over the United States. The company’s class A common stock has paid a dividend of $ 5.00 per share per year for the last 15 years. Management expects to continue to pay at that amount for the foresee-able future. Sally Talbot purchased 100 shares of Kelsey class A common 10 years ago at a time when the required rate of return for the stock was 16%. She wants to sell her shares today. The current required rate of return for the stock is 12%. How much capital gain or loss will Sally have on her shares?

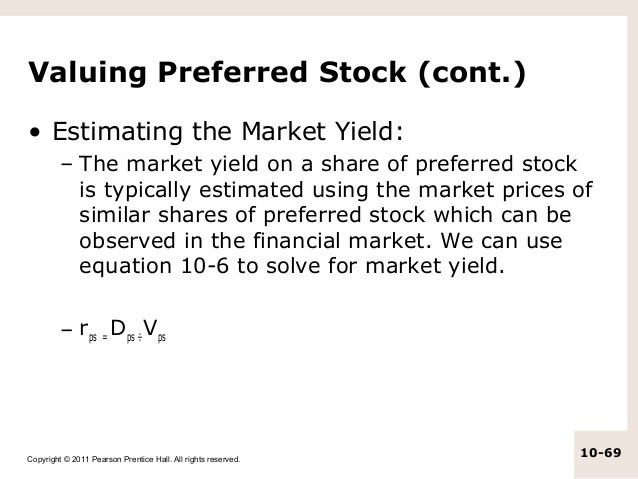

3) Preferred stock valuation Jones Design wishes to estimate the value of its out-standing preferred stock. The preferred issue has an $ 80 par value and pays an annual dividend of $ 6.40 per share. Similar- risk preferred stocks are currently earning a 9.3% annual rate of return. a. What is the market value of the outstanding preferred stock? b. If an investor purchases the preferred stock at the value calculated in part a, how much does she gain or lose per share if she sells the stock when the required return on similar- risk preferred has risen to 10.5%? Explain.

5) Common stock value Constant growth McCracken Roofing, Inc. common stock paid a dividend of $ 1.20 per share last year. The company expects earnings and dividends to grow at a rate of 5% per year for the foreseeable future. a. What required rate of return for this stock would result in a price per share of $ 28? b. If McCracken expects both earnings and dividends to grow at an annual rate of 10%, what required rate of return would result in a price per share of $ 28?

6) The firms dividend per share next year is expected to be $ 3.02. a. If you can earn 13% on similar- risk investments, what is the most you would be willing to pay per share? b. If you can earn only 10% on similar- risk investments, what is the most you would be willing to pay per share? c. Compare and contrast your findings in parts a and b, and discuss the impact of changing risk on share value.