Preferred Stock Investors How Afraid Should You Be Of Increasing Interest Rates

Post on: 13 Июль, 2015 No Comment

Preferred stock investors are rightly concerned that when interest rates start going up (2015?), the market prices of their preferred stock shares will go down. Interest rates and the market prices of fixed-income securities (bonds, preferred stocks) tend to move in opposite directions.

But on the upside, high quality[1] preferred stocks are currently offering one of the best returns available. Today’s fixed-income alternatives look something like this:

- Bank Certificates of Deposit (national average, 24 month APY): 1.1%

- Corporate Bonds: 4%

- High Quality Exchange Traded Debt Securities: 6.5%

- High Quality Preferred Stocks: 6.8%

Taxes and inflation wipe out the first two.

If you avoid investing in high quality preferred stocks at today’s 6.8%, are you making the right call? How much would future prices have to drop anyway, and how likely is that?

Rate Increase in 2015 (?)

The Federal Reserve has announced several times that it is not going to be raising interest rates until at least late-2014. That’s at least ten quarters from now. By investing at today’s average dividend rate of 6.8% for the next ten quarters you will earn $4.25 per share in dividend income[2].

Should preferred stock investors walk away from today’s 6.8% for fear that a future interest rate increase will lower prices enough to wipe out their gains?

Let’s take a look at what happened to high quality preferred stock market prices the last time the Federal Reserve started increasing interest rates (namely, the federal funds rate).

Before jumping into this analysis, it is important to note that the relationship between the federal funds rate and preferred stock market prices is not a perfect one. There are a multitude of costs of money at various levels within the U.S. economy that are each affected by a variety of circumstances, events, policies and other cross-currents (domestic and foreign).

We have to look no further than the recent Global Credit Crisis (2007 — 2009) for an exception to the usual inverse relationship between interest rates and preferred stock market prices (rates down, prices up and vice versa). During the crisis, the Fed lowered the federal funds rate to zero but, for much of this same period, preferred stock market prices dropped as well.

But for this analysis, the federal funds rate suits our purposes fairly well since this is the rate that investors are watching and will react to in the event of a change (or even the announcement of a pending change) probably more so than any other single rate.

Study Period: July 2004 through June 2006

The idea here is to find a recent period that is arguably comparable to today’s circumstances where the Fed increased the federal funds rate, and then see what happened to the market prices of high quality preferred stocks during that period.

July 2004 through June 2006 provides an excellent study period[3]. Going into this period, the average dividend rate being offered by high quality preferred stocks was 6.8% (same as today); the federal funds rate was at a historically low level and had been there for a long time (also similar to today); the Fed started increasing rates with the policy objective of holding off inflation as the post-9/11 economy recovered (which is likely to be the same policy reasoning come 2015); and they did so in very minor 0.25% increments that were announced in advance as to not introduce an unwanted shock (which is also likely to be the case come 2015).

Beginning in July 2004, under Chairman Alan Greenspan, the Fed gradually and very steadily increased the target federal funds rate for twenty-four straight months.

Beginning at 1%, the federal funds rate was increased to 5.25% twenty-four months later with no breaks in between. Because of this consistent, steady and prolonged rate increase, preferred stock market price data from this period is nearly pristine.

Preferred Stock Market Prices

So what happened to preferred stock market prices the last time the Fed started increasing rates?

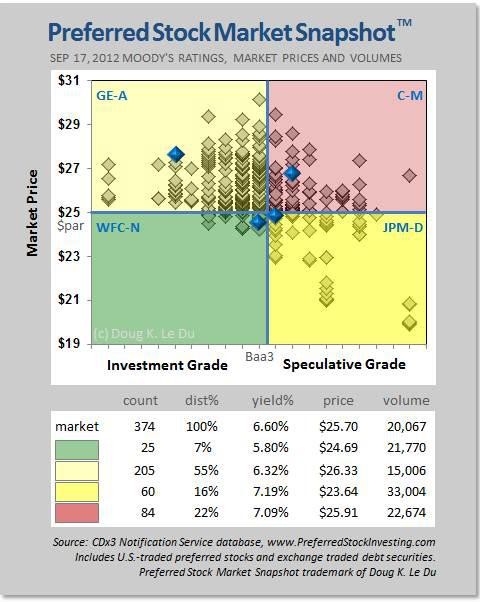

The following chart shows the monthly average market price of high quality preferred stocks during the same period, July 2004 through June 2006[4].

Interestingly, preferred stock market prices actually increased for several months when the Fed started raising rates in July 2004 (perhaps because the rate increase was not as significant as investors had feared).

Also note that, while prices definitely dropped over this period of increasing rates[5], they did not fall below their $24.81 starting point until October 2005, fifteen months after the Fed started increasing rates.

The result of this significant increase in the federal funds rate was an $0.82 per share drop in the average market price of high quality preferred stocks (from $24.81 to $23.99).

Preferred stock investors who chose to purchase high quality preferred stock shares going into this study period had earned an average of $2.55 in dividend income twenty-four months later. These investors gave up $0.82 in value to gain $2.55 in dividend income over the study period.

Back To Our Original Question

So back to our original question: If you avoid investing in high quality preferred stocks at today’s 6.8%, are you making the right call? How much would future prices have to drop anyway, and how likely is that?

Because we are talking about the future here, the short answer is that there is no way to know for sure. It is hard to say how meaningfully past events will apply to the future.

But remember that just as the direction of interest rates and preferred stock prices are related, the same is true of magnitude . Minor and gradual rate changes tend to have a minor and gradual impact on prices.

Once the Fed starts raising interest rates, do you think it is more likely the any such increase will be (NYSE:A ) huge, sudden and unannounced or (NYSE:B ) minor, gradual and announced in advance as to avoid shocking what is sure to be a fragile economy coming out of recession?

Assuming that future rate increases are more likely to be minor and gradual, it is doubtful that a resulting price drop would be major and sudden.

To the extent that we can apply our study period to a 2015 rate increase, it seems unlikely that a 2015 rate increase would erode market prices enough to offset the $4.25 per share in dividend income that preferred stock investors will collect between now and then.

Footnotes:

[1] High quality preferred stocks are those that meet the ten risk-lowering selection criteria from chapter 7 of my book, Preferred Stock Investing. For example, high quality preferred stocks have investment grade ratings and the cumulative dividend requirement.

[2] A 6.8% preferred stock with a standard par value of $25 pays a dividend of $0.425 per quarter (($25 x 6.8%) /4). $0.425 per quarter for ten quarters is $4.25 per share in dividend income. All such values used throughout this article are per share.

[3] While this is the best and most recent period to compare, keep in mind that there are significant differences between the preferred stock market as it existed then versus today. For instance, Big Bank trust preferred stocks (TRUPS) dominated the offerings then. But due to the January 1, 2013 implementation of Section 171 of the Wall Street Reform Act, that will not be the case come 2015. See the related Seeking Alpha article titled REIT Preferreds: An Attractive Alternative To Big Bank TRUPS In 2012 .

[4] Source for all preferred stock data in this article: CDx3 Notification Service database, TDAmeritrade, Preferred Stock Investing, Fourth Edition, see PreferredStockInvesting.com. Disclaimer: The CDx3 Notification Service is my preferred stock email alert and research newsletter service including data for all preferred stocks and Exchange Traded Debt Securities traded on U.S. stock exchanges.

[5] Chapter 15 of Preferred Stock Investing, Fourth Edition itemizes every high quality preferred stock that has been issued since January 2001. High quality preferred stocks used for this price analysis were taken from the chapter 15 tables. Issues were from a variety of industries including banks (JP Morgan (NYSE:JPM )), insurance (W.R. Berkley (NYSE:WRB )) and a diversified group of REITs (Vornado Realty (NYSE:VNO ), Weingarten (NYSE:WRI ), PS Business Parks (NYSE:PSB ), ProLogis (NYSE:PLD ) and BRE Properties (NYSE:BRE )).

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.