Preferred CEF Showdown Part 3 John Hancock Advisors My Top Pick

Post on: 26 Июнь, 2015 No Comment

Before I begin my analysis of the John Hancock Advisors preferred closed end funds, I would like to restate what my objective is with this series of analyses (as, unfortunately, it has been a while since my last article in the showdown series — the earlier of which can be found here and here).

At one point in my career, I worked for an investment consulting firm, where I was the Director of Fixed Income Research. Essentially, what I was responsible for was analyzing markets and managers and recommending managers for our clients’ (pensions, endowments, foundations. ) fixed income mandates. The analysis and recommendations were based on:

Manager style,

Manager returns, and

Fund/portfolio client fit

This is what I planned for the series: I am going to review three managers’ preferred closed end fund complexes (one manager per article) and recommend one fund per manager. All data used in this report is from company reports and filings, CEFA and morningstar.

Let’s get this showdown started.

Management team :

John Hancock Financial is a unit of Manulife Financial Corporation, a leading Canadian-based financial services group serving millions of customers in 22 countries and territories worldwide. The Boston-based mutual fund business unit of John Hancock Financial, John Hancock Funds, manages more than $66.4 billion in open-end funds, closed-end funds, private accounts, retirement plans and related party assets for individual and institutional investors at December 31, 2011.

Gregory K. Phelps is a senior managing director and senior portfolio manager at John Hancock Asset Management. Prior to joining the firm, Mr. Phelps was a vice president and portfolio manager at Spectrum Asset Management. Previously, he was a supervisor of stock transfer at U.S. Surgical Corp. and director of corporate relations at the American Stock Exchange. Mr. Phelps Joined the team in 2003, joined the subadviser in 2005 and joined the adviser in 1995.

Mark T. Maloney is a managing director and portfolio manager at John Hancock Asset Management. Mark has held several positions in investment operations and financial reporting before joining the investment staff in 1997. Prior to joining the firm, Mark spent seven years at John Hancock Mutual Life Insurance Company. Mr. Maloney joined the team in 2003, joined the subadviser in 2005 and joined adviser in 1982.

The funds managed by John Hancock that will be analyzed are:

John Hancock Preferred Income Fund (NYSE:HPI )

John Hancock Preferred Income Fund II (NYSE:HPF )

John Hancock Preferred Income Fund III (NYSE:HPS )

The funds objectives are stated as (from funds annual report (N-CSR) preferred I. preferred II and preferred III):

The Fund’s primary investment objective is to provide a high level of current income, consistent with preservation of capital. The Fund’s secondary investment objective is to provide growth of capital to the extent consistent with its primary investment objective. The Fund seeks to achieve its objectives by investing in

securities that, in the opinion of the Adviser, may be undervalued relative to similar securities in the marketplace. Under normal market conditions, the Fund invests at least 80% of its assets (net assets plus borrowings for investment purposes) in preferred stocks and other preferred securities, including convertible preferred securities.

An overview of the funds is as follows:

Manager style in a preferred CEF context can be somewhat determined by portfolio concentration, sector allocation and portfolio turnover.

Portfolio concentration — Ideally, if an investor wants a stable return (payout) portfolio, the manager should not have overly concentrated positions (or sectors to be addressed next). A review of the top ten holdings should give us a feel for the concentration of the portfolio. What we are going to look for is positions greater than 5-10% and significant sector concentration within the top ten holdings. Let’s take a look:

The three Hancock funds are well diversified, with the top ten holdings (as percent of the portfolio) falling in between Spectrum and Flaherty. The maximum concentration is 4.61%, which does not raise any warning flags. Notice also the top ten holdings account for a larger percentage from the earlier inception date to the larger. As well, notice that there is significant overlap, but the overlap lessens between the first and the third fund as HPI and HPF ramped up around the same time. While HPS has the largest top ten concentration, I do not think it is significant enough to create a notable difference in risk profile across the funds.

Sector allocation — Part of a manager’s style can be determined by their sector/industry distribution. If a fund/portfolio is too focused in any one sector, the manager is making a bet on the sector and returns can be volatile. For our purpose, we desire a portfolio that is diversified among sectors and has stable constituents as well as higher beta constituents. Let’s have a look:

As you can see, the managers have not radically changed their allocations, the primary shift across the funds is the reduction in consumer discretionary into the utilities and telecom sectors — which would seem, on the surface, to be a reduction of economic risk. Due to the similarity between funds and the similarity of changes to industry allocation from 2010 to 2011, I do not see that any fund is either advantaged or disadvantaged due to their industry allocation.

Portfolio turnover — A manager’s style can often be viewed as a closet benchmarker or an active manager. A benchmarker will often set it and forget it and have very low portfolio turnover, whereas an active manager will have a greater turnover as they attempt to optimize their portfolio. Let’s see where Hancock falls:

Of the three fund managers, Hancock has the lowest portfolio turnover rate. I would actually like to see the turnover rate a little higher as you are paying the manager to manage the portfolio and to take advantage of opportunities and situations as they arise. Lower portfolio turnover rates can often imply a closet index strategy. I do not believe this is the case with Hancock, but their turnover rate is too low in my opinion.

Ratings — Often a manager’s style can be reflected in the portfolios’ ratings distribution. For a current yield based portfolio, a large concentration in high yield can reflect higher risk based yield and hint to future volatility and difficulty maintaining current distribution rates. A review of Hancock’s portfolios does not raise this concern:

The funds are consistent with their ratings profile and do not have an outsized weighting to non-investment grade securities. Of the three managers, Hancock has the lowest exposure to non-rated securities.

Manager returns:

Returns are the easiest aspect of our analysis as they are the result of all the factors analyzed.

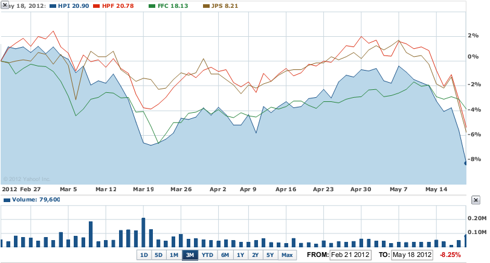

As we saw in the two previous installments of this series, the 2008 and 2009 volatility were significant. Of the three funds, HPI has the best and most consistent returns while having the best down year (although not by much).

Conclusion:

When I review all the information presented above, I arrive at the following conclusion: The funds are somewhat homogeneous and have similar attributes, the manager’s style from a sector basis is consistent among funds although the top holdings of the various funds have some smaller differences (apparently with the passage of inception date). Liquidity is available across funds due to their relative size and the expense ratios are pretty close (8bps from high to low) although leverage is 5% lower in HPF (although its current yield is similar to the other two).

As a result of the above analysis, my top pick from the Hancock Advisors CEF complex is John Hancock Preferred Income Fund II. While the fund does not have the highest three and five year returns, it has the lowest expense ratio and lowest leverage, which gives the fund room to grow and reduces the leverage risk currently.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.