Precious metals life cycle nearing an endGDXJStockhouse news

Post on: 13 Июль, 2015 No Comment

3 Comments | June 27, 2013

Final stage of denial

The life cycle of most things no matter what it is (living, product, service, ideas etc) goes through four stages and the stock market is no different. Those who recently gave in and bought gold, silver, mining stocks, coins will be entering this stage of the market in complete denial. They still think this is a pullback and a recovery should be just around the corner.

Well the good news is a recovery bounce should be nearing, but if technical analysis, market sentiment and the stages theory are correct then a bounce is all it will be followed by years of lower prices and dormancy.

I really do hate to be a mega bear or mega bull on anything long term but the charts have painted a clear picture this year for precious metals and I want to share what I see. Take a look at the chart below, which shows a typical investment life cycle using the four stage theory.

Four Stages Theory

Classic economic theory dissects the economic cycle into four distinct stages: Accumulation, Markup, Distribution, and Decline. A stock or index is no different, and proceeds through the following cycle:

- Stage 1 — Accumulation: After a period of decline a stock consolidates at a contracted price range as buyers step into the market and fight for control over the exhausted sellers. Price action is neutral as sellers exit their positions and buyers begin to accumulate.

- Stage 2 — Markup: Upon gaining control of price movement buyers overwhelm sellers and a stock enters a period of higher highs and higher lows. A bull market begins and the path of least resistance is higher. Traders should aggressively trade the long side, taking advantage of any pullback or dips in stock price.

- Stage 3 — Distribution: After a prolonged increase in share price the buyers now become exhausted and the sellers again move in. This period of consolidation and distribution produces neutral price action and precedes a decline in stock price.

- Stage 4 — Decline: When the lows of Stage 3 are breached a stock enters a decline as sellers overwhelm buyers. A pattern of lower highs and lower lows emerges as a stock enters a bear market. A well-positioned trader would be aggressively trading the short side, taking advantage of the often quick decline in share price.

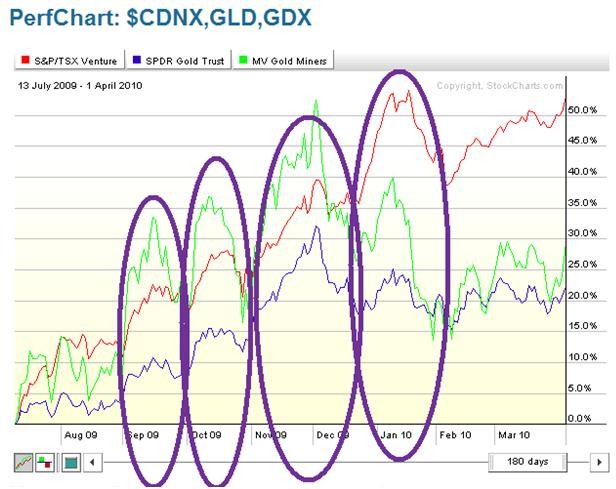

Gold Price Weekly Chart Stages Overlaid

Silver Price Weekly Chart Stages Overlaid

Gold Mining Stocks Monthly Chart

This chart is a longer term picture using the monthly chart. I wanted to show you the 2008 panic selling washout bottom in miners, which I think is about to happen again. While physical gold and silver are in a bear market and should be some a long time, gold mining stocks will likely find support and possibly have a strong rally in the coming months.

Many gold stocks pay high dividends and are wanted by large institutions and funds. The lower prices go the higher the yield is making them more attractive. So I figure gold miners will bottom before physical metals do. A bounce is nearing but at this point selling pressure and momentum continue to plague the entire PM sector.

Precious Metals Investing Conclusion:

In short, I feel with Quantitative Easing (QE) likely to be trimmed back later this year, and with economic numbers slowly improving along with solid corporate earnings the need or panic to buy gold or silver is diminishing around the globe.

While there are still major issues and concerns internationally they do not seem to have any affect on precious metals this year. Long terms trends like the weekly and monthly charts shown in this report tends to lead news/growth/lack of growth by several months. So lower precious metals prices may be telling us something very positive.

The precious metals sector is likely to put in a strong bounce this summer but after sellers will likely regain control to pull prices much lower yet.

Get My Daily Analysis and Trade Alerts: www.TheGoldAndOilGuy.com