Precious Metal a Golden Opportunity for Investment Scams

Post on: 13 Июль, 2015 No Comment

FINRA issues Investor Alert

Thu, 08/25/2011

20off%20Gold%20for%20Affluent%20Investors,%208-24-11_1.jpg /%

What’s good for the economy may not be the best for gold. The price of gold dropped this week in the wake of some encouraging data. The government announced yesterday that orders for durable goods in the U.S. rebounded to 4 percent in July after declining 1.3 percent last month. That boosted stocks (Dow Jones industrials rose 144 points to 11,321), but sent gold sliding $104 an ounce.

Even after yesterday’s price drop, the precious metal has had a very good year. Gold is up more than 23 percent this year, USA Today reported, and gold-struck investors could be prey for scams, prompting the Financial Industry Regulatory Authority (FINRA) to issue a new Investor Alert.

Demand for gold is strongest as concerns about the global economy and the value of paper money intensifies. Investors are more risk averse in the face of extreme market volatility that has been seen in recent weeks. Other concerns over inflation, European debt, and the explosive rebellion currently playing out in Libya can only make wary investors more gun-shy.

Analysts and bullion-boosters suggest that gold’s price drop this week may just be a normal price correction. Still, gold has lost some of its luster, according to a Millionaire corner survey of investors last month. Nearly a third (31.7 percent) of respondents were ambivalent about whether gold was a better investment than most other market sectors. Almost twice as many investors believe that it is not than those who do.

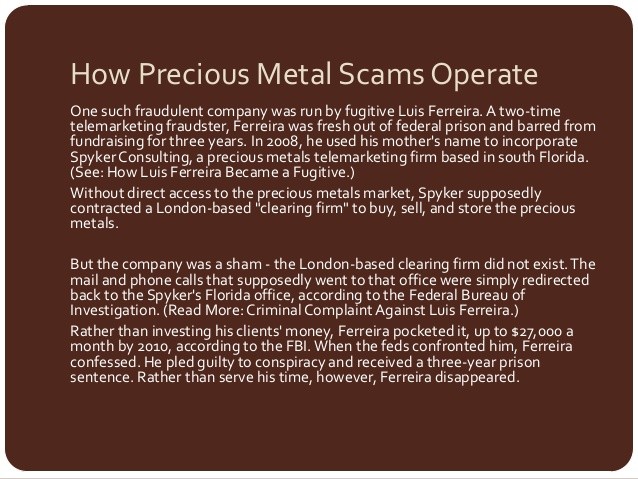

For many, though, gold’s allure is irresistible, and FINRA cautions against scams that center on inflated claims regarding the stocks of gold mining companies whose value is often based on gold reserves that are difficult to estimate or verify. The Securities and Exchange Commission (SEC) recently took legal action against a Florida-based mining company for issuing false claims that a mining project in Ecuador contained gold reserves worth more than $1 billion.

FINRA’s Investor Alert, Gold Stocks—Some Investments Mine Your Pocketbook advises investors be on guard for any gold investment pitch that uses scare tactics such as the threat of an economic meltdown or centers on a company that has changed its name or trading symbol to align it more closely with gold. One such company, FINRA noted, “currently purports to engage in gold mining and exploration (but) was originally incorporated with a business strategy to provide golfing opportunities on private courses to non-members.”

Remember, too, there is no such thing as a “free-lunch.” FINRA cautions to be wary of these programs that promise to provide educational information about gold investing. In June 2010, the SEC charged six people with running a Ponzi scheme that bilked more than 3,000 investors out of $300 million.

FINRA recommends investors to do their research, read a company’s SEC filings, and to always, when a stranger tells you about a golden opportunity, ask, “Why me?”