Potential Benefits Of Bond Funds Mutual Funds Learning Center State Farm

Post on: 24 Август, 2015 No Comment

learningcenter.statefarm.com/finances-1/mutual-funds/potential-benefits-of-bond-funds/ bb3 Aug 28, 2014

By Staff writer State Farm Employee

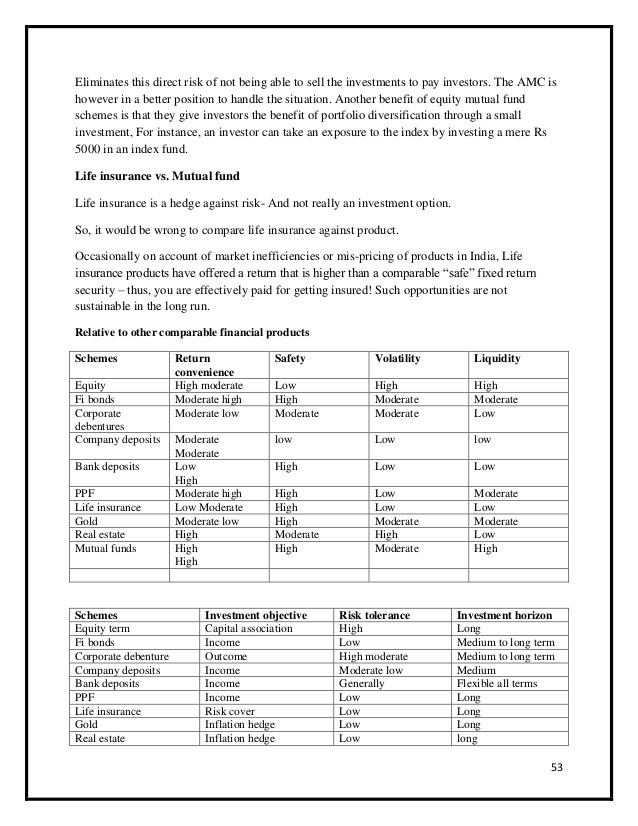

Bond mutual funds offer opportunities for many investors to add a source of current income to their portfolio. They also tend to have less risk than a stock fund. This makes them a popular choice for conservative investors, people looking for immediate income, or people who are looking to add some diversification to a stock portfolio.

A bond is a type of loan. The borrower, usually the federal government, a state or municipal government, or a major corporation, sells the bond in exchange for cash. It agrees to pay interest on a regular basis, usually twice a year, and then repay the amount borrowed (also called the principal or the face value) when the bond matures. The amount of interest is typically set as a percentage of the face value and usually does not change. This is why bonds are often called fixed-income securities.

Regular income is the key advantage of owning bonds. Many retired people use those payments to help fund their lifestyle; people who don’t want to spend the income now can reinvest the money in their accounts.

Bond Funds And Risk

As long as the bond issuer is in the financial position to repay the loan, the bond holder will receive the principal back when the loan matures. If an issuer can’t pay back the loan, the bond owner will lose the principal. If the issuer goes bankrupt, though, the bonds will have to be repaid before the stockholders receive anything. That’s the main reason that bonds have less risk than stocks.

It is also important to understand that the market value of the bond may fluctuate up or down until maturity because of changes in interest rates. An investor buying the bond in the open market cares about the going rates now, not what you received when you bought the bond. If rates go up, the bond’s price will go down; if rates go down, the bond’s price will go up.

Types Of Bond Funds

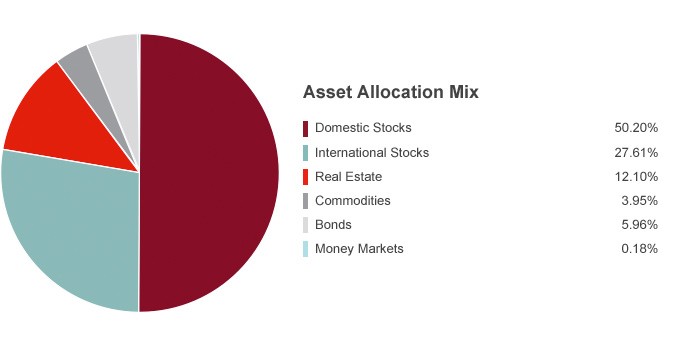

Bond mutual funds usually invest in one sector of the market, such as U.S. government bonds or high-credit corporate bonds. Some are managed to pay a high income, others to maintain the principal value. Still others are managed to get the best possible combination of income and principal, known as total return. Someone looking for a regular income check might care more about the bond’s ratio of income to principal, known as its yield. An investor looking for diversification benefits would probably care more about total return than about income.

Investors who are willing to take more risk than they would with a money market 1 fund or a bank account, and who are interested in generating income, may want to consider bond funds. Although they fluctuate with interest rates and may lose value, they tend to serve as a more stable piece of a diversified portfolio.

1 An investment in the Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Securities are not FDIC insured, are not bank guaranteed and are subject to investment risk, including possible loss of principal.

Securities issued by State Farm VP Management Corp. For more information, call 1-800-447-4930.

Diversification and asset allocation do not assure a profit or protect against loss.

Bonds are subject to interest rate risk and may decline in value due to an increase in interest rates.

Neither State Farm nor its agents provide investment, tax, or legal advice.

AP2014/08/1489

Was this article helpful? Yes ( ) | No ( )