Portfolio123 View Thread Using ETFs to Protect Your P123 Stock Portfolios

Post on: 2 Май, 2015 No Comment

Using ETFs to Protect Your P123 Stock Portfolios

Hello to all,

In another thread, Steve from StockMarketStudent spoke to his worry about feeling like a bit of sitting duck in stocks, and was wondering how he could diversify risk with ETFs, thinking about.

an asset allocation model based firstly on indices, followed by ETF substitutes for the indices, then replacing individual ETFs with stock portfolios where possible.

And he put it another way.

Im interested in using stocks to spice up the returns of a well diversified ETF-based portfolio.

Two sides of a similar coin.

1) Those of us who are 100% invested in optimal ETF strategies could probably do better by replacing their U.S. equity ETF allocations by using P123. Individuals can outperform the funds by going where the managers cant.

2) And those who focus 100% on stocks would probably do better, in the LONG run, by building in some ETF-diversified protection against the next 2008. If you are not diversified beyond equity, into other completely different Asset Classes, you have a high degree of exposure.

Given the amount of systemic risk that is built into todays environment, its a topic that is probably more relevant now than ever. Some serious pros even say that its wise to diversify beyond the world of finance — to actually own real-world apartment buildings or egg-laying farms, for example, or even gold overseas.

Maybe extreme, maybe not. Well see. The point is the need to diversify to the well-informed level that you feel is best for you, given a full understanding of the cost/benefit of doing so.

On the subject of asset allocation and true diversification in that same thread, Marc Gerstein said.

Id love to see us get into that in a serious way. Frankly, though, the stuff Ive seen is great for textbooks and classrooms, but pretty poor for real-world use. If anyone knows of approaches that really work under real-world conditions, please, please, please let us know.

I know of one that has worked in real-time for 40 years. And there are proponents of others. Before getting to that, though.

I italicized true (above) to call out the fact that many people think of diversification as being, say, American value equity, European midcap stocks (i.e. varying equity geography, style, size), along with some U.S. investment-grade corporate bonds and, to spice it up, high yield (junk) bonds.

In fact, theres very little true diversification in a portfolio like that. Almost all of it rises and falls on the basis of the same economic drivers.

As a new user to P123, I arrived here primarily interested in building optimal customized strategies for ETFs, using findings from academic papers. While Im way out of my depth here in discussing P123, I have studied the subject of Asset Allocation and diversification.

I hope that I can give back a little to the community (for your help and for not laughing sometimes ![]() ) by helping out on this topic raised by Steve and supported by Marc, splitting the subject into this new thread. As a brief bit of personal background.

) by helping out on this topic raised by Steve and supported by Marc, splitting the subject into this new thread. As a brief bit of personal background.

I have had 3 successful businesses, while letting others invest for me with so-so results. My best results have actually come from the buying of non-financial assets, opportunities discovered by serendipity that worked out well.

Now, as I have more time, I decided to finally learn about the wonderful world of investing, not all of it, of course. I was just hoping to find a niche to focus upon that would enable long-term, low-risk, steady-growth of my familys net worth.

Its only been 3 months that I have been exploring, which I add as a caveat to you. Although I believe I have a good grasp of what Ive learned about this topic, its not based on lifelong professional experience. (And, contrary to my original vision, Im getting deeper than planned, which is why I find myself here. -) )

Once I discovered ETFs, I settled pretty quickly on the concept of building an optimal, buy-and-hold diversification of various Asset Classes that would take me through just about any major macro upheaval.

Studying diversification and asset allocation is the necessary first step for that. As Steve noted, ETFs fit my original goal well because many of the well-managed, passive ones serve as tight-tracking proxies for so many classes.

They also make it easy to test ETF strategies even if you do not ultimately decide to fill a class with an ETF. For example, you may decide to buy Long Treasuries directly or on the market, instead of in the TLT or EDV wrapper.

Ill cover some basics and then hope that Scott drops by — Ive learned quite a lot from his work. He mentioned P123 on his blog, and now Im trying to get up to speed with it. -)

While most folks here seem to be equity-focused and use P123 to build an ideal equity portfolio, theres a lot more that you can do with P123 and ETFs to do even better than passive diversification of an optimal mix of Asset Classes.

Passive (buy-and-hold) alone will be a big help, which is where Ill start. The bottom line reason for diversification is simple.

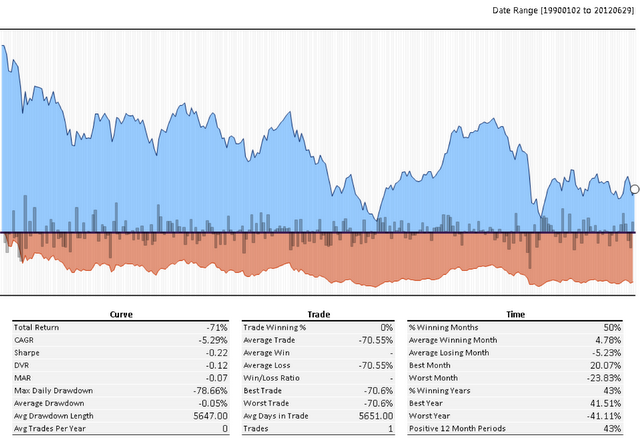

Even the best stock-pickers will take a hit when the next 2008 slams again (and it will happen, perhaps quite a bit harder). Good PASSIVE diversification blunts that. Good ACTIVE diversification (dynamic rules-based strategies) does even better.

Actually, skilled active investing in ETFs can do so well that they outperform the best equity ETFs while significantly reducing risk. Scott can demonstrate that if he happens by.

Getting familiar with these concepts should increase your overall returns while reducing risk. Theyll also bring a stronger, more well-rounded perspective. Finally, when well diversified, youll be much less likely to panic during the next big market crash since your overall portfolio will, in the worst case (barring total financial Armageddon), be losing much less.

To diversify well, you need to blend non- and negatively-correlated Asset Classes (where the correlation of two classes is 0 if price movements relative to each other are random, -1 if they always act inversely, +1 if they follow each other in the same direction lockstep). One problem to be aware of.

As Marc also mentioned earlier in a different thread, we have seen correlations between some sub-classes converge in recent years. Nowadays, you need to go to the Frontier Market ETFs (like FM or FRN or or some specific country ETFs) before you see Correlation matrix numbers drop below 0.8.

While convergence within a major class has been happening, the macro-basics have not changed. To test that, try the Asset Correlation tool at this nice little free site (I have no relationship to any URL that I may post) to see what I mean.

Enter SPY (S&P500), VEA (Developed markets, ex-US), VWO (Emerging) and FRN (Frontier) to see what I mean. Just copy and past SPY VEA VWO FRN into Symbols for Tickers and click on View Correlation. Youll get.

1) Correlation Matrix — so much for Emerging Markets, let alone the developed rest of world, adding a lot of diversification.

2) Rolling Correlations — the fluctuations are interesting, as are longer-term trends. The number you see in the matrix fluctuates, but does ballpark number does separate groups when the differences are large enough.

But even diversifying into FRN wont keep you from PAIN during the next big crash. You can eyeball what Im talking about at this Total Returns chart of the 4 ETFs.

Staying in the general Asset Class of Stocks, there is no way to reduce MaxDD significantly. Even moving to so-called defensive sectors has minor effect compared to moving into totally different Asset Classes. To see that.

Now try the same thing with VTI TLT IAU SHV (stocks, long treasuries, gold, cash). Youll see an enormous difference.

So if you really want to maximally diversify, you do have to go out of class. Some people seem to feel that theyre diversifying just because a hedge fund ETF, say, doesnt correlate with anything else. I feel, though, that not only should assets not (or negatively) correlate, adding them to the mix should address the prime economic DRIVERS of risk and reward.

You have two basic choices, passive or active.

I) Passive — buy-and-hold-and-rebalance-annually across non- and negatively-correlated Asset Classes. This was my original intent that developed as I got a little deeper.

I did an extensive review and I sort of agree with Marc when he says that asset allocation/diversification is pretty poor for real-world use. That assertion holds best in his context of this group, people who are very stocks-oriented and generally more risk-tolerant than those who focus on asset allocation.

My guess is that few here would be willing to accept much of a reduction in CAGR in return for decreased MaxDD and Volatility. Thats our special challenge here. -)

But, for those primarily interested in optimal diversification, first, and then building a strong equities portfolio, there are indeed approaches that really work under real-world conditions, meaning significant drops in Max DD and Volatility, but with only mild decrease in CAGR.

And I think that Ive got one, even for those who dont want to give up too much.

A classic diversification plan, my favorite, comes from Harry Brown, the libertarian author. I can remember reading, 40 years ago(!), Harry Browne proposing that a 25% allocations to each of U.S. stocks, gold, long-term treasuries and cash would deliver optimal risk-adjusted returns.

I read his newsletter for his libertarian thinking and was still a student then, had no money, so wasnt much interested in investing advice. But I do remember how it made good macro-economic sense back then, and it was so Occams razor-simple.

It addressed all of the major drivers of risk/reward with as few classes as possible.

I had forgotten all about it when I started out. But I soon rediscovered Harry Browne and his Permanent Portfolio, that same 25-25-25-25 allocation. He had published a short book about it a little later.

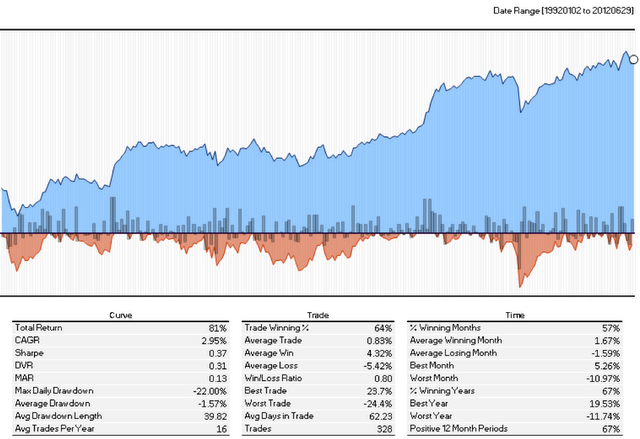

Meanwhile, something interesting had happened since I first read that article. It has had 40 years of real-time forward-testing, delivering near-equity level returns but at a fraction of the Volatility and MaxDD. This page keeps an up-to-date set of charts on it.

And explains how 4 very different Asset Classes combine so well.

Another excellent source.

The annual rebalancing part is important. In my own back-testing (with ETFreplay, which I also use), it added an amazing 2% CAGR while ALSO reducing the risk parameters.

That free lunch come from how uncorrelated they are. The more correlated x classes, the less youll get out of simple rebalancing back to your starting weights. If forces you to take some winnings and buy more of whats on sale, which are often counter-intuitive actions.

So, if you wanted to keep it as simple as possible, a passive P123 Portfolio would have.

- 25% in your P123 stocks portfolio (instead of a strong, all-round U.S. stocks ETF, such as VTI)*

- 25% in long-term treasury bonds (EDV, TLT or actual long-term treasuries)**

- 25% in gold (little-known PHYS is probably the best bet ETF since it actually allocates gold and trades at a slight discount now, but goes to a premium when gold is hot; IAU or GLD are the most popular with the nod to IAU due to its lower Expense Ratio of 0.25% — or of course, physical gold stored and allocated according to your world worry level)

- 25% in cash (SHV or SHY if you want to chase a minimal amount of yield, or rolling actual 1-year t-bills).

* Those looking to build a 100%-passive ETF portfolio would be willing to accept more risk and diversify among strong concepts like VBR (value, small) and RSP (equal-weight the S&P).

** Again, ETFers-only may choose the more extreme EDV. The Permanent Portfolio Concept is so well balanced that it doesnt seem bothered by more extreme volatility in its components.

Just how well-balanced is it? Below are the results of PP2x vs PPclassic from Jan 2010 (the date of inception of one of the 2x ETFs) to today. The PP can even deal with 2x-leveraged ETFs of each class, delivering CAGRs that arent far off from double, with Sharpe staying close to the same.

CAGR Sharpe MaxDD Volatility

+ 7.7% 1.08 -8.00% 6.5% (Classic)

+14.2% 1.04 -14.81% 12.3% (2x)

Or for 2010 alone..

CAGR Sharpe MaxDD Volatility

+13.7% 1.72 -3.12 % 6.9%

+25.3% 1.61 -6.44 % 13%.0%

For such volatile ETFs (the 2xs rebalance daily, with notorious instability that are NOT supposed to be held for weeks, let alone years), thats pretty decent diversification of risk.

Problems with PP

Id bet that many here would be strongly against having 25% in cash. Cash was Harrys ultimate safety net — a severe tight-money recession/depression hedge and one that also delivered high-interest rates when inflation raged (albeit not keeping up with inflation).

Nowadays, especially, it seems like holding 25% in cash woulds be a real waste. And long-term bonds certainly seems like a losing bet. And gold is scary.

But the fact is that regardless of where you are in the business cycle, there are almost always 1 or 2 classes that seem to be bad plays, and gold has always been speculative in the short-medium run.

Ive read many old threads about the PP, where people were afraid to enter because 1 or more classes seemed like such sure losers.

So why not cheat a little, theyd ask, wanting to do what everyone else thinks. The herd instinct is one of the behavioral traits that define the sub-optimal investor. Its part of the same intuitive human judgment that leads even doctors to diagnose appendicitis less accurately than a rules-based protocol.

Human instincts are what lead typical investors into selling stock low and buying high. Another of those trait is overconfidence, so were all sure that I have none of those traits. ![]()

Rules-based algorithms beat human judgment (when the rules have been well-researched and designed). As much as experts rebel against evidence-based systems of all kind (feeling un-needed), countless studies show that we underperform best practice rules-based decision-making. Even if we have access to such systems as guidance (with discretion to over-ride), humans do less well.

Yes, sometimes 2 or even 3 classes may do poorly, yielding rare bad years. Usually, though, year in and year out, one sick class turns out to lose while the other surprises. And more often than on the downside, the stars align to give some very happy results.

Overall, the buy-hold-rebalance approach of the PP flattens all the huge ups and downs. Over the past 40 years, its had years with 20%+ returns but never any large losses. It flattened both 2008 and 2013 while turning in near-equity returns with very low risk numbers over the long run.

Other Passive Diversification Schemes

There are many other passive approaches, as outlined here.

The PP does well against the many others that have come along (this study may not be quite as unbiased as it claims, structured in way that would seem to favor the system that is being promoted, but its still a good quick overview of other diversification systems).

Risk Parity is a model that also makes sense, but not the same kind of sense. It ties allocations to level of volatility, which is conceptually neat, but volatility varies over time. Its a drivee and not a driver.

No other model has the simple macro coverage of having one or more assets to cover the major drivers of prosperity/recession, inflation/deflation, liquidity and crisis. Here is one final article that touches upon the same theme, with an interesting heat map.

To summarize, PP has.

1) simple macro-economic good sense

2) highly non- and negatively-correlated Asset Classes

3) the 40 years of forward-testing.

Earlier, I said there were 2 ways to diversify. The first was passive and now.

II) Going Active

Theres only one problem with passive diversification. Inevitably, you get drawn into going active! It has sucked me in, thats for sure.

In the SeekingAlpha link above, youll note reference to the 2 systems that, as presented, are not strictly passive.

1) IVY portfolio (conceived to passively simulate the low-equity portfolios of the major endowments), here using a 10-month moving average (making it active).

2) Youll also note reference to a momentum strategy.

The latter, AKA Relative Strength, has been called an anomaly that is above suspicion by Fama and French. Momentum investing has a great deal of supporting academic literature, including why this area of inefficiency has not been arbitraged away. Its real.

At its simplest, it is nothing more than recent Total Return, higher being better.

If you head in this direction, you will head into a whole new use of P123, working out.

1) optimal look-back periods — generally 3-12 months or some weighted blend

2) optimal formula — inclusion/exclusion/quantification of volatility, most recent month and others.

And ultimately, youll find an approach that INCREASES Total Return while keeping risk low.

I try to maintain the PP theme by building mini-portfolios around each Asset Class, choosing the Top 2 out of each. Each PP goes to cash when nothing in the mini-portfolio is stronger than SHY — this cuts out much of the downside of major regime changes.

And recently, an exciting new development, changing a binary decision into a probabilistic one.

I still have NO idea how to turn this into rules in P123 for back-testing (have to walk before I run), but this seems to be a big and recent step forward.

Anyway, the bottom line is beware of what you wish for. ![]()

You may end up doing way more than you thought as you attempt to get more than what you wanted.

Steve, you wanted to tweak the stocks ETFs and/or use non-stock ETFs to diversify the raw risk of being in one Asset Class. Passive ETFs will do that. Active ETF-investing should go you one better and give you the best of both worlds.

Marc, I hope this is what you were looking for.

And I do hope that this helps someone.

Hopefully, too, Scott will pop by. He knows 100x more about this than I do and can show you what a smart Active Allocator can do!

All the best,

Ken

P.S. Gad, didnt mean to go so long. Sorry about that.

P.P.S. I put this in General instead of ETFs forum since the topic is more about diversification. ETFs were just the vehicle. I hope its the right spot.