Portfolio Theory LifeCycle Investing and Retirement Income

Post on: 21 Июнь, 2015 No Comment

Recent Life-Cycle

Fund Performance

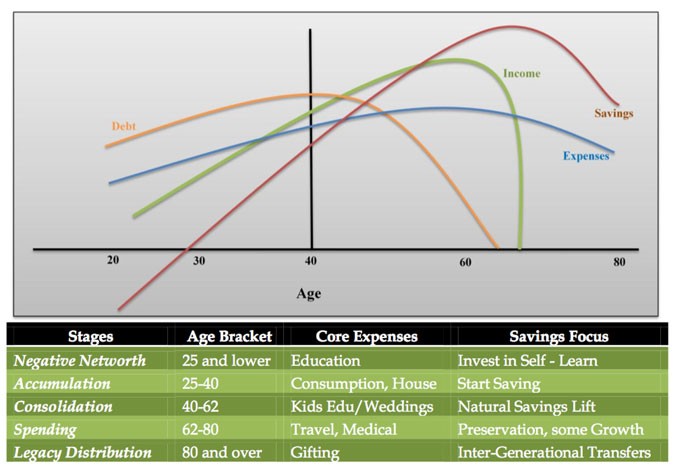

There has been much discussion recently about life-cycle funds and their role in providing a secure retirement income for older Americans. These funds, which gradually shift account assets from broad-based stock funds to bond funds as a participant ages, are becoming an important vehicle for retirement savings. This policy brief explores the economic rationale behind the life-cycle approach and the advantages and limitations of life-cycle funds.

Questions about the analysis should be directed to the author at 202-358-6218 .

The findings and conclusions presented in this brief are those of the author and do not necessarily represent the views of the Social Security Administration.

Introduction

Life-cycle funds are a relatively new approach to retirement investing and have gained popularity in recent years. Although the characteristics of these funds vary, the general life-cycle proposition calls for investment portfolios that hold a decreasing proportion of assets in equities (associated with higher risk) and a greater proportion in fixed-return investments (associated with lower risk) as an individual ages. Those types of plans seek to limit potential losses from market fluctuations as an individual approaches retirement. The building blocks of life-cycle funds are typically broad-based index funds, such as a stock fund tied to the S&P 500 or to a corporate bond fund that tracks the Lehman Brothers Corporate Bond Index. Broad-based index funds lower risk to retirement income that would arise from undiversified investments in individual companies.

Life-cycle funds are an increasingly important topic in discussions about retirement income. Vanguard (2004) reports rapid growth in the number of private-sector retirement plans that offer life-cycle funds. In addition, the defined contribution plan offered to federal employees (the Thrift Savings Plan) now includes life-cycle funds. Some Social Security reform proposals call for the creation of personal retirement accounts. Such accounts would allow individuals to invest in equities, corporate bonds, and government securities and could incorporate life-cycle funds.

This brief explores some of the theoretical and empirical foundations for life-cycle funds by reviewing the finance literature on optimal portfolio theory. It also discusses actual life-cycle plans and the advantages and disadvantages of these types of funds.

Portfolio Theory

Modern portfolio theory originated with the work of Markowitz (1952), who recognized that by combining assets that are not perfectly correlated (for example, assets whose returns do not move in complete unison with each other) an investor could reduce his or her investment risk without reducing expected returns. It is theoretically possible to derive a portfolio of risky assets that returns the smallest amount of risk for a given return.

Repeating this procedure many times for different levels of expected return produces the Mean-variance or Markowitz efficient frontier (Chart 1). Intended solely for illustrative purposes, the chart shows individual stocks with their respective ex-ante expected mean returns and standard deviations. The standard deviation, which measures how much a stock’s annual return deviates from its long-term historical average, is used as an estimate of risk or variability of investment outcomes (the standard deviation is the square root of the variance). The curved line denotes the efficient frontier, which is derived by combining the individual stocks and taking into account the degree of covariation between them. In reality, thousands of triangles and a very large number of computations would be needed to determine the efficient frontier.

Chart 1.

SOURCE: Author’s derivation.

The implications of the efficient frontier are quite significant. All portfolios falling on this frontier will provide the highest return for a given level * of risk (vertical line) and, conversely, the lowest risk for a given level r* of return (horizontal line). The efficient frontier does not eliminate risk but reduces it to the lowest level possible for a given expected rate of return. Investors wanting a portfolio of stocks with low risk could choose one from the bottom left portion of the efficient frontier; those wishing to seek higher returns by taking on more risk could choose a portfolio from the upper right portion of the frontier. All points below the efficient frontier are suboptimal in the sense that investors could increase their expected rate of return without assuming any additional risk.

Although the discussion up to this point has focused on stock portfolios, the concept of an efficient frontier can be generalized to incorporate other asset types, including bonds. Bonds typically have both lower returns and lower standard deviations than stocks. Thus, in Chart 1, a bond-heavy portfolio would be located on the lower left portion and a stock-heavy portfolio on the upper right portion of the frontier. Life-cycle funds can be thought of as moving along the frontier (from the upper right to the lower left) as one ages.

Life-Cycle Funds

The life-cycle funds described here create portfolios that are heavily concentrated in stocks at the beginning of the work life and gradually shift holdings to bonds as retirement nears. While this brief primarily focuses on the decision of how to invest accumulated savings, it is important to note that investors, in reality, face a set of complex and interrelated decisions over the life-cycle. The discussion here abstracts from many of those decisions (such as how much schooling to acquire, when to begin working, how much to save each period).

Several demographic and economic factors provide some rationale for life-cycle funds. The first deals with how the value of human capital varies over time as a fraction of total wealth. Human capital is composed of elements that are fixed (innate ability), that are largely fixed after a certain point (formal schooling), and that vary with time (experience). A good proxy for measuring the value of human capital is the present value of wages over an individual’s remaining working life. This is generally considered much less variable or stochastic than equity returns because its determinants are, to some extent, fixed. Therefore, to maintain a constant level of variability (risk exposure) over the life-cycle, relatively more of one’s total financial assets should be held in stocks when young and less as one gets older (Bodie, Merton, and Samuelson 1992).

To illustrate the constant risk of exposure approach, consider someone who wishes to hold 60 percent of total wealth at any given age in riskless assets (for example, inflation-protected bonds) and 40 percent in risky assets (for example, stocks). Suppose, further, the person’s human capital at a young age is equivalent to a riskless asset valued at $300,000. If the person has $200,000 in financial assets, they should all be held in risky assets (such as stocks) so that the 60/40 balance is achieved. As the person ages, the value of human capital falls (because only a few working years remain) but the financial assets grow. To maintain the 60/40 balance, financial assets must increasingly be shifted out of risky assets.

Although human capital is a determinant of the present value of lifetime earnings, it is not the only factor. Individuals have discretion over whether to work and how much to work. This issuelabor supply flexibilityis also important in discussions of life-cycle funds. Intuitively, because younger workers have greater labor supply flexibility and have just begun their working lives, their age can act as a buffer against market downturns since additional work can make up for lost wealth. Jagannathan and Kocherlakota (1996) argue that labor supply flexibility makes life-cycle funds desirable, but only if equity returns are relatively uncorrelated with labor income. Avenues for future research (Poterba and others 2006) focus on creating life-cycle portfolios that differ for singles as opposed to married couplesan approach that takes into account the added labor supply flexibility married couples have because of the potential of having two earners. Hence, married couples might be more inclined to invest a relatively larger fraction of their wealth in stocks later in life.

The work of Jagannathan and Kocherlakota (1996) and Poterba and others (2006) examines labor supply flexibility in the specific context of life-cycle funds, while other research on the same general topic offers insight into the foundations of life-cycle funds. Bodie (2001) examines labor supply flexibility and portfolio choice in terms of retirement age. He assumes a fixed saving rate and predictable earnings, from which he determines a baseline retirement income assuming retirement at age 65 and investments in riskless Treasury securities. He then considers whether the baseline retirement income could be achieved at an earlier retirement age with alternative portfolios: one invested 50 percent in stocks and 50 percent in riskless Treasury securities and the other invested completely in stocks. If the future risk premium (the expected return on stocks minus the return on riskless Treasury bonds) is assumed to be 4 percent and the standard deviation of stock returns is 20 percent, then the portfolio with half of its assets invested in stocks and the other half invested in Treasury bonds has an expected retirement age of 61, but this comes with a small probability of having to postpone retirement to age 67 to achieve the desired level of retirement income. The all-stock portfolio has an expected retirement age of 57, but again carries a small probability of having to postpone retirement until age 68. Although Bodie’s focus is on retirement age, his general point is that labor supply flexibility can offset market losses. With life-cycle funds, market losses will tend to be concentrated at relatively younger agesages at which health and labor market opportunities may be more favorable.

Booth (2004) finds support for life-cycle investing using a model that examines replacement rates. He argues that as the investment horizon increases, the distribution of ending wealth becomes more skewed, with the mean ending wealth being significantly greater than the median. Thus, while a younger person may need to hold only 50 percent in stocks to achieve an expected ending wealth (the mean distribution) that matches the replacement rate target, such a portfolio would not have a high probability of generating the appropriate ending wealth. In general, Booth argues that if individuals desire a high probability of achieving the target replacement rate, they may need to hold a greater share of their portfolio in stocks when they are younger.

Specific Approaches

This section discusses specific approaches to life-cycle investing as opposed to the general concept of holding a smaller percentage of assets in equities as one ages. Four examples of life-cycle investment approaches are considered:

- a popular rule of thumb known as the 100-minus age rule;

- the Malkiel approach (1990);

- the Shiller plan (2005); and

- the new L Fund plan offered to federal employees through the Thrift Savings Plan, a defined contribution retirement plan similar to a 401(k) plan.

Clearly this is not an exhaustive list of possible life-cycle investment plans or approaches, but specific examples will help sort out ideas and illustrate important concepts.

Table 1 presents the percentage held in stocks at specific ages under the four approaches. The simplest of these approaches is the 100-minus age rule, which dictates that the percentage invested in the stock market equal 100 minus one’s age. For example, at age 55, 45 percent of investments should be in a broad-based stock index fund and 55 percent in bonds. A somewhat more involved approach was suggested in Malkiel (1990). Malkiel’s approach suggests stock allocations that are roughly similar to those derived from the 100-minus age rule. The Shiller plan (2005) has a baseline life-cycle portfolio that is somewhat more aggressive at young ages and less so at later ages than is the 100-minus age rule or Malkiel’s plan.

Table 1. Illustrations of life-cycle fund allocations in equities, by age (in percent)