Portfolio Margin FAQs The Margin Investor

Post on: 5 Апрель, 2015 No Comment

Portfolio Margin FAQs

Q: What is Portfolio Margin?

A: Portfolio Margin is an upgraded alternative to traditional Reg-T Margin and is only available to qualified US investors. It’s popularity has grown rapidly since FINRA finalised broad implementation of the rules in 2008. Trading accounts usually obtain significantly lower margin requirements under Portfolio Margin compared to traditional Reg-T Margin. Portfolio Margin utilizes a risk-based methodology which calculates margin requirements based on the overall risk of the portfolio. While almost all investors benefit, Portfolio Margin is especially attractive to investors that employ advanced trading strategies such as option trading, spread trading, long/short trading, and portfolio hedging.

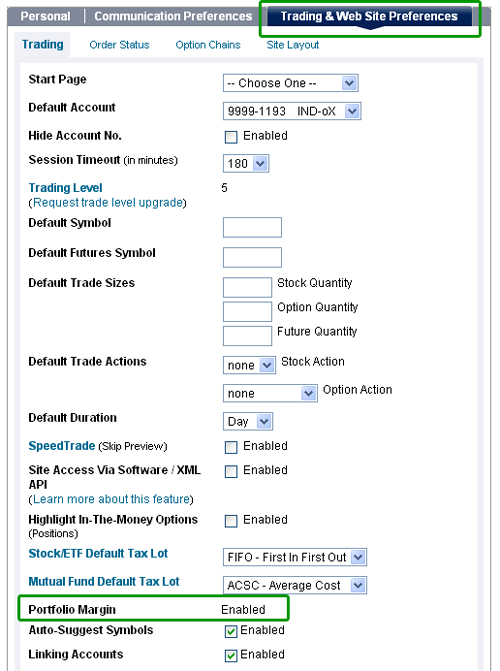

Q: Do I qualify for a Portfolio Margin account?

A: Yes, provided you are a US based investor and your brokerage account value has at least $100,000 in net asset value. A few brokerage companies impose higher minimums on net asset value, but most don’t.

Q: Which brokers offer portfolio margin?

A: There is a growing list of online brokers that offer portfolio margin accounts.

See our monthly updated comprehensive list of brokers for more information on individual firms.

Q: What is the margin requirement for equities?

A: Equity securities such as AAPL, GE, WMT and other individual equity securities obtain a flat margin of 15% under the Portfolio Margin rules. Some brokers apply an additional margin requirement if the stock in question is illiquid (i.e. low volume), trades below a certain threshold (such as $5.00) or if the account has a large concentration in one particular stock.

Q: What is the margin requirement for a portfolio of long and short equities?

A: While diversified index and ETF positions benefit by way of a reduced margin requirement when there is a long/short portfolio, the Portfolio Margin methodology does not provide the same benefit to long/short portfolios of individual equity securities (such as AAPL, GE, WMT, etc.). Basically, the OCC’s methodology does not allow for P&L offsets across different equity securities. So, the margin requirement is simply 15%.

Keep in mind that each broker may customize their house rules to deviate slightly from the OCC’s methodology. For example, in our experience running a diversified long/short portfolio through Interactive Brokers, we were able to obtain leverage of 6 to 1 without any issues.

Q: Do inverse and leveraged ETFs (such as the Proshares SSO and SDS) qualify for portfolio margin treatment?

A: Yes, inverse and leveraged ETFs qualify for portfolio margin treatment. According to the FINRA regulatory notice. the market moves applied to these positions are simply the corresponding stress test market moves for the benchmark index multiplied by the ETF’s stated leverage. So, for example, the market moves applied to SSO is simply the market moves for the S&P 500 index (-8% to 6%) multiplied by 2 (i.e. the ETFs stated leverage). This results in a stress test market moves across the range from of -16% to 12% for an SSO position.

Q: Do buy-write ETFs qualify for portfolio margin treatment?

A: It depends on the index underlying the ETF. If the index is a broad-based index such as the S&P 500, then the buy-write ETF does indeed qualify for Portfolio Margin treatment. Specifically, it falls within the High-Capitalization Broad Based Indexes Group. This means that the stress test range applied is: -8% to 6%. Buy-write indexes such as the BXM are an attractive proposition for investors seeking superior risk adjusted returns .

Q: Is Value-at-Risk used to determine the margin requirement in a Portfolio Margin account?

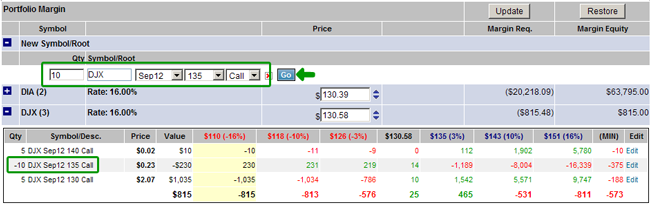

A: No. Brokers must calculate portfolio margin according the Option Clearing Corporation’s TIMS methodology. While this methodology is risk-based, it is not nearly as elaborate as a VaR calculation. With VaR, asset correlations and volatilities are used to determine the expected future loss at a percentile of the P&L distribution over a given time horizon (e.g. one day, one week, one month, etc.).

In contrast, the Portfolio Margin methodology should be thought of as an enhanced stress test. The stress tests used on different assets depends on the type of asset (broad-based indexes get stressed from -8% to 6%, narrow-based indexes get stress from -10% to 10%, individual stocks get stressed from -15% to 15%, etc.). A key point to note is that stress-test market moves are set in stone and do not change with market conditions.

Once the assets in the portfolio are stressed and the associated P&Ls are determined for each group of securities, a P&L netting procedure is applied to determine the final P&L for the portfolio. This netting procedure allows for the gains on one group of securities to offset the losses on other groups of securities. Similar to the stress test market moves, these P&L offsets are set in stone and do not change with market conditions.

Q: Where can I find an online calculator to compute the margin requirement for different option strategy positions?

A: There are two key calculators you should know about. One is for computing Portfolio Margin and the other is for traditional Reg-T margin. See our page on margin calculators .