Portfolio Hedging using VIX Calls Explained

Post on: 25 Май, 2015 No Comment

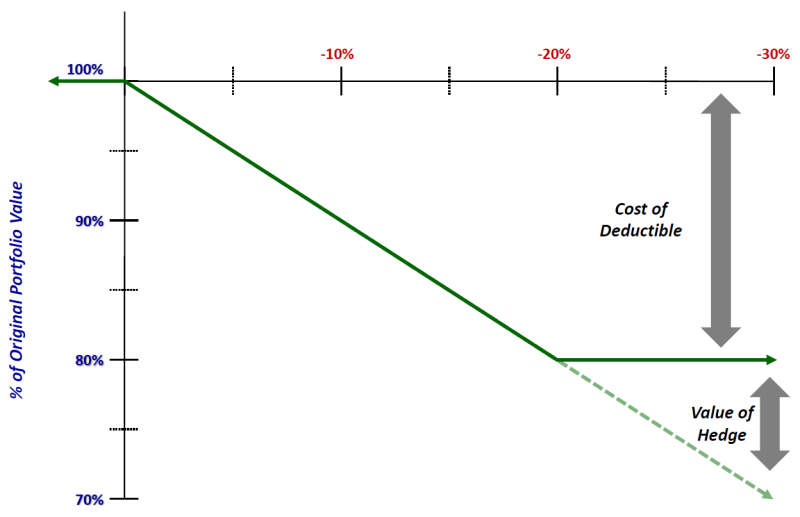

When the VIX is low, the negative correlation of the highly volatile VIX to the S&P 500 index makes it possible to use VIX options as a hedge to protect a portfolio against a market crash.

To implement such a hedge, the investor buys near-term slightly out-of-the-money VIX calls while simultaneously, to reduce the total cost of the hedge, sells slightly out-of-the-money VIX puts of the same expiration month. This strategy is also known as the reverse collar.

The idea behind this strategy is that, in the event of a stock market decline, it is very likely that the VIX will spike high enough so that the VIX call options gain sufficient value to offset the losses in the portfolio.

Implementation

To hedge a portfolio with VIX options, the portfolio must be highly correlated to the S&P 500 index with a beta close to 1.0.

The tricky part is in determining how many VIX calls we need to purchase to protect the portfolio. A simplified example is provided below to show how it is done.

Example

A fund manager oversees a well diversified portfolio consisting of thirty large cap U.S. stocks. For the past two months, the market has been climbing steadily with the S&P 500 index climbing from 1273 in mid-March to 1426 in mid-May. At the same time, the VIX has been drifting downwards gradually, hitting a five month low of 16.30 on 17th May. The fund manager thinks that the market is getting too complacent and a correction is imminent. He decides to hedge his holdings by purchasing slightly out-of-the-money VIX calls expiring in one month’s time. Simultaneously, he sells an equal number of out-of-the-money puts to reduce the cost of implementing the hedge.

As of 17th May,

- For simplicity’s sake, let’s assume the value of his holdings is $1,000,000.

- The S&P 500 Index stood at 1423.

- The VIX is at 16.30.

- June VIX calls, with a strike price of $19, are priced at $0.40 each.

- June VIX puts, with a strike price of $12.50, are priced at $0.25 each.

So, how many VIX calls does the fund manager need to buy to provide the necessary protection?

According to the CBOE Website, on average, the VIX rise 16.8% on days when the S&P 500 index drops 3% or more. This means that if the SPX move down by 10%, the VIX can potentially shoot up by 56%. To play it safe, the fund manager assumes that the VIX will rise by only 40% when the SPX drops by 10%. This means that, in theory, the VIX should rise from 16.3 to 22.8 if the S&P 500 drops 10% from the current level of 1423 to 1280.

- When the VIX is at 22.8, each June $19 VIX call will be worth $380 ($3.80 x $100 contract multiplier).

- 10% of the fund manager’s portfolio is worth $100,000.

- Number of VIX calls required to protect 10% of the portfolio is therefore: $100,000/$380 = 264

- Total cost of purchasing the 264 VIX June $19 calls at $0.40 each = 264 x $0.40 x $100 = $10,560

- Premium received for selling 264 June $12.50 VIX puts at $0.25 each = 264 x $0.25 x $100 = $6,600

- Total investment required to construct the hedge = $10,560 — $6,600 = $3,960