Portfolio Diversification Definition and Purpose

Post on: 3 Май, 2015 No Comment

What is Portfolio Diversification?

Definition of Diversification

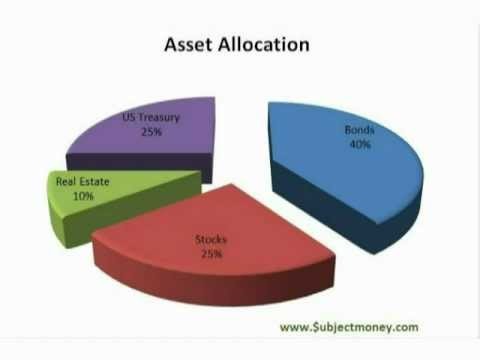

The definition of diversification is the act of, or the result of, achieving variety. In finance and investment planning, diversification is a portfolio management strategy combining a variety of assets to reduce the overall risk of an investment portfolio.

Purpose of Portfolio Diversification

The purpose of portfolio diversification is portfolio risk management and optimization. A risk management plan should include diversification rules that are strictly followed. Optimization occurs because risk is minimized, allowing the portfolio manager to seek out higher returns.

Your risk management plan should lower the volatility (risk) of a portfolio because not all asset categories, industries, or stocks move together. Holding a variety of non-correlated assets can nearly eliminate unsystematic risk. In other words, by owning a large number of investments in different industries and companies, industry and company specific risk is minimized. This decreases the volatility of the portfolio because different assets should be rising and falling at different times; smoothing out the returns of the portfolio as a whole. In addition, diversification of non-correlated assets can reduce losses in bear markets; preserving capital for investment in bull markets.

Portfolio optimization can be achieved through proper diversification because the portfolio manager can invest in more aggressive assets without increasing the risk of the overall portfolio. In other words, a portfolio manager with a target amount of total risk is able to invest in higher risk, higher reward assets because holding a variety of non-correlated assets has lowered the total risk of the portfolio. This is why some say diversification is the only free ride.

Can Over Diversification Hurt Investment Returns?

Some lessons can be over learned. There are disadvantages of diversification that has become almost as large a problem today as under diversification. It is common for investors to believe that if a given amount of diversification is good; then more is better. This concept is false.

If adding an individual investment to a portfolio does not reduce the risk of the total portfolio more than it costs in potential returns; then further diversification would be over diversification. Most experts believe 15-25 individual investments are sufficient to reduce unsystematic risk. Therefore owning mutual funds, or many mutual funds, with literally hundreds of individual investments guarantees a average return.

With a better understanding of what diversification is ; now you can put together your risk management plan and increase returns through portfolio optimization.