Portfolio Diversification

Post on: 5 Май, 2015 No Comment

Donald Marano

The asset-allocation decision is one of the most important factors in determining both the return and the risk of an investment portfolio.

Asset allocation is the process of developing a diversified investment portfolio by combining different assets in varying proportions.

An asset is anything that produces income or can be purchased and sold, such as stocks, bonds, or certificates of deposit (CDs). Asset classes are groupings of assets with similar characteristics and properties. Examples of asset classes are large-company stocks, long-term government bonds, and Treasury bills.

Every asset class has distinct characteristics and may perform differently in response to market changes. Therefore, careful consideration must be given to determine which assets you should hold and the amount you should allocate to each asset.

Factors that greatly influence the asset-allocation decision are your financial needs and goals, the length of your investment horizon, and your attitude toward risk. Reduction of Portfolio Risk

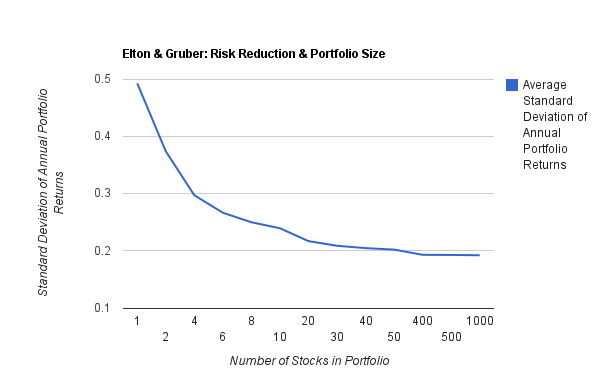

Diversification is the strategy of holding more than one asset class in a portfolio in order to reduce risk. This image depicts the relationship between portfolio volatility, measured by standard deviation, and the number of asset classes in a portfolio. Standard deviation measures the fluctuation of returns around the arithmetic average return of the investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns.

You can limit the effect that any individual security or asset class may have on the performance of a portfolio by investing in a combination of asset classes. As a result, declines in the total returns of one or two assets may be offset by increases in others. Notice that as the number of randomly selected assets in the portfolio increases, the risk level decreases. While it is impossible to completely eliminate risk, diversifying your investments can reduce the overall volatility experienced by your portfolio.

Diversification does not eliminate the risk of investment losses. Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than the other asset classes. Furthermore, small-company stocks are more volatile than large-company stocks, are subject to significant price fluctuations and business risks, and are thinly traded. International securities involve special risks that investors should consider such as fluctuations in currency, foreign taxation, political instability, and differing securities regulations and accounting methods.

About the data

The portfolios used in this image are created from equally-weighted combinations of the following randomly selected asset classes from 1989–2008: Small-company stocks, large-company stocks, international stocks, long-term government bonds, real estate investment trusts (REITs), long-term corporate bonds, Treasury bills, and international bonds.

Small-company stocks in this example are represented by the performance of the Dimensional Fund Advisors, Inc. (DFA) U.S. Micro Cap Portfolio, large-company stocks by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general, international stocks by the Morgan Stanley Capital International Europe, Australasia, and Far East (EAFE®) Index, long-term government bonds by the 20-year U.S. government bond, REITs by the FTSE NAREIT Equity REIT Index®, long-term corporate bonds by the Citigroup long-term high-grade corporate bond index, Treasury bills by the 30-day U.S. Treasury bill, and international bonds by the Citigroup Non-U.S. World Government Bond Index. An investment cannot be made directly in an index. Potential to Reduce Risk or Increase Return 1970–2008

Historically, adding stocks to a portfolio of less volatile assets reduced risk without sacrificing return or increased return without assuming additional risk.

This image illustrates the risk-and-return profiles of three hypothetical investment portfolios. The lower risk portfolio, which included stocks, had the same return as the portfolio comprised entirely of fixed-income investments, but assumed less risk. The higher return portfolio had the same risk level as the fixed income portfolio, but produced an increased return.

Although it may appear counterintuitive, diversifying a portfolio of fixed-income investments to include stocks reduced the overall volatility of a portfolio during the period 1970–2008. Likewise, it is possible to increase your overall portfolio return without having to take on additional risk.

Because stocks, bonds, and cash generally do not react identically to the same economic or market stimuli, combining these assets can often produce a more appealing risk-and-return tradeoff.

Diversification does not eliminate the risk of experiencing investment losses. Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than the other asset classes.

About the data

Stocks in this example are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general. Long-term government bonds are represented by the 20-year U.S. government bond, intermediate-term government bonds by the five-year U.S. government bond, and cash by the 30-day U.S. Treasury bill. Bonds represent an equally weighted portfolio of long-term government bonds and intermediate-term government bonds. All portfolios are rebalanced annually. Risk is measured by standard deviation. Standard deviation measures the fluctuation of returns around the arithmetic average return of the investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns. An investment cannot be made directly in an index. The data assumes reinvestment of all income and does not account for taxes or transaction costs. The Case for Diversifying

Diversifying your portfolio makes you less dependent on the performance of any single asset class.

Effective diversification requires combining assets that behave differently when held during changing economic or market conditions. Moreover, investing in assets that have dissimilar return behavior may insulate your portfolio from major downswings.

This image illustrates the annual returns of three different portfolios over a seven-year time period. Stocks represent a 100% investment in large-company stocks. Bonds represent a 100% investment in long-term government bonds.

When the stock and bond asset classes were combined into an equally weighted portfolio, the portfolio experienced less volatility than stocks alone and still maintained an attractive return. Notice that stock returns were up at times when bond returns were down, and vice versa. These offsetting movements assisted in reducing portfolio volatility (risk).

Diversification does not eliminate the risk of experiencing investment losses. Government bonds are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than bonds.

About the data

Stocks in this example are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general and bonds by the 20-year U.S. government bond. Annual rebalancing is assumed in the 50% stocks/50% bonds portfolio. An investment cannot be made directly in an index. The data assumes reinvestment of all income and does not account for taxes or transaction costs. Stocks and Bonds: Risk Versus Return 1970–2008

An efficient frontier represents every possible combination of assets that maximizes return at each level of portfolio risk and minimizes risk at each level of portfolio return.

An efficient frontier is the line that connects all optimal portfolios across all levels of risk. An optimal portfolio is simply the mix of assets that maximizes portfolio return at a given risk level. This image illustrates an efficient frontier for all combinations of two asset classes: stocks and bonds.

Although bonds are considered less risky than stocks, the minimum risk portfolio does not consist entirely of bonds. The reason is that stocks and bonds are not highly correlated; that is, they tend to move independently of each other. Sometimes stock returns may be up while bond returns are down, and vice versa. These offsetting movements help to reduce overall portfolio volatility (risk).

As a result, adding just a small amount of stocks to an all-bond portfolio actually reduced the overall risk of the portfolio. However, including more stocks beyond this minimum point caused both the risk and return of the portfolio to increase.

Diversification does not eliminate the risk of experiencing investment losses. Government bonds are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than bonds.

About the data

Stocks in this example are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general and bonds by the 20-year U.S. government bond. Risk and return are based on annual data over the period 1970–2008 and are measured by standard deviation and arithmetic mean, respectively. Standard deviation measures the fluctuation of returns around the arithmetic average return of the investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns. An investment cannot be made directly in an index. The data assumes reinvestment of all income and does not account for taxes or transaction costs. More Funds Does Not Always Mean Greater Diversification

Holdings-based style analysis can be used to determine security overlap.

The image illustrates two different equity portfolios that individually comprise five mutual funds. Each oval within the style box represents an ownership zone of a mutual fund, which accounts for 75% of the fund’s holdings. The level of diversification provided by each portfolio is quite different.

The funds in Portfolio A significantly overlap with one another, which indicates that each fund may hold stocks sharing similar style characteristics. While some overlap is acceptable in a portfolio, too much of it defeats the purpose of using multiple funds to create a diversified portfolio. In contrast, Portfolio B contains funds that span across many different styles. While the holdings in Portfolio A are more concentrated in the giant and large-cap value and blend segments, the holdings in Portfolio B are widely distributed among different investment styles.

While not all investment styles are appropriate for all investors, it is important to be aware of the range of investment options and the possibility of security overlap when constructing a diversified portfolio.

Source: Morningstar, Inc. Asset-Class Winners and Losers

It is impossible to predict which asset class will be the best or worst performing in any given year. The performance of any given asset class can have drastic periodic changes. This image illustrates the annual performance of various asset classes in relation to one another over the past 15 years. In times when one asset class dominates all others, as was the case for large stocks in the late 1990s, it is easy to ignore the fact that historical data shows it is impossible to predict the winners for any given year.

Investors betting on another stellar performance for large stocks in 1999 were certainly disappointed as small stocks rose from the worst performing asset class in 1998 to the best performing in 1999. Similarly, international stocks were the top performers from 2004 to 2007, but disastrously sank to the worst performing position in 2008. These types of performance reversals are evident throughout this example.

A well-diversified portfolio may allow investors to mitigate some of the risks associated with investing. By investing a portion of a portfolio in a number of different asset classes, portfolio volatility may be reduced.

Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than the other asset classes. Furthermore, small stocks are more volatile than large stocks and are subject to significant price fluctuations, business risks, and are thinly traded. International investments involve special risks such as fluctuations in currency, foreign taxation, economic and political risks, liquidity risks, and differences in accounting and financial standards.

About the data

Small stocks are represented by the fifth capitalization quintile of stocks on the NYSE for 1926–1981 and the Dimensional Fund Advisors, Inc. (DFA) U.S. Micro Cap Portfolio thereafter. Large stocks are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general, government bonds by the 20-year U.S. government bond, Treasury bills by the 30-day U.S. Treasury bill, and international stocks by the Morgan Stanley Capital International Europe, Australasia, and Far East (EAFE®) Index. An investment cannot be made directly in an index. The data assumes reinvestment of all income and does not account for taxes or transaction costs. Correlation Can Help Evaluate Potential Diversification BenefitsA well-diversified portfolio should consist of individual investments that behave differently.

It is possible to determine how closely two asset classes move together by evaluating their correlation. Correlation ranges from –1 to 1, with –1 indicating that the returns move perfectly opposite to one another, 0 indicating no relationship, and 1 indicating that the asset classes react exactly the same. For example, small stocks and large stocks have risen and fallen to the same market conditions. Their high correlation suggests combining them may do little to lower the risk of a portfolio. In contrast, the negative correlation of small stocks and intermediate-term government bonds illustrates the potential for better diversification. Investments still need to be evaluated for investor suitability, but understanding asset class behavior may help enhance the diversification benefits of investor portfolios.

Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than bonds. Furthermore, small stocks are more volatile than large stocks and are subject to significant price fluctuations, business risks, and are thinly traded. Diversification does not eliminate the risk of experiencing investment losses.

About the data

Small stocks are represented by the fifth capitalization quintile of stocks on the NYSE for 1926–1981 and the performance of the Dimensional Fund Advisors, Inc. (DFA) U.S. Micro Cap Portfolio thereafter. Large stocks are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general. Corporate bonds are represented by the Ibbotson Associates U.S. long-term high-grade corporate bond index, long-term government bonds by the 20-year U.S. government bond, intermediate-term government bonds by the five-year U.S. government bond, and Treasury bills by the 30-day U.S. Treasury bill. An investment cannot be made directly in an index. Diversification in Bull and Bear Markets

Diversification is the strategy of combining distinct asset classes in a portfolio in order to reduce overall portfolio risk.

The graph on the left illustrates the hypothetical growth of $1,000 in stocks, bonds, and a 50% stock/50% bond diversified portfolio, from 2002 to 2007. Stocks provide increased growth in bull markets. It is important to understand, however, that this greater wealth was achieved with considerable volatility in stocks compared to the diversified portfolio.

The significance of holding a diversified portfolio is most apparent when one or more asset classes are out of favor. The graph on the right illustrates the hypothetical growth of $1,000 in stocks, bonds, and in a diversified portfolio, between 2007 and 2008.

Notice that by diversifying among the two asset classes, the diversified portfolio experienced less severe monthly fluctuations than stocks or bonds alone. While bond prices tend to fluctuate less than stock prices, they are still subject to price movement. By investing in a mix of asset classes such as stocks, bonds, and Treasury bills, you may insulate your portfolio from major downswings in a single asset class.

One of the main advantages of diversification is that it makes you less dependent on the performance of any single asset class.

Diversification does not eliminate the risk of experiencing investment losses. Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than bonds.

About the data

Stocks in this example are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general, and bonds by the 20-year U.S. government bond. An investment cannot be made directly in an index. The data assumes reinvestment of income and does not account for taxes or transaction costs. The bull market analyzed is defined by the time period October 2002—October 2007, and the bear market by the time period November 2007—December 2008. Diversified Portfolios and Bear Markets

Diversification can limit your losses during a severe market decline.

The benefits of diversification are most evident during bear markets. This image illustrates the growth of stocks versus a diversified portfolio during two of the worst performance periods in recent history.

The blue line illustrates the hypothetical growth of $1,000 invested in stocks during the mid-1970s recession and the 2007–2008 bear market. The gray line illustrates the hypothetical growth of $1,000 invested in a diversified portfolio of 35% stocks, 40% bonds, and 25% Treasury bills during these same two periods.

Over the course of both time periods, the diversified portfolio lost less than the pure stock portfolio. Over longer periods of time, the more volatile single asset-class portfolio is likely to outperform the less volatile diversified portfolio. However, you should keep in mind that one of the main advantages of diversification is reducing risk, not necessarily increasing return, over the long run.

Diversification does not eliminate the risk of experiencing investment losses. Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than the other asset classes.

About the data

Stocks in this example are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general. Bonds are represented by the 20-year U.S. government bond, and Treasury bills by the 30-day U.S. Treasury bill. The mid-1970s recession occurred from January 1973 through June 1976. The 2007–2008 bear market began in November 2007 and is still occurring as of December 2008 (an end date is yet to be determined). An investment cannot be made directly in an index. The data assumes reinvestment of income and does not account for taxes or transaction costs.