Point Figure Patterns Testing PointAndFigure Patterns FREE PATTERNS

Post on: 20 Август, 2015 No Comment

Categories: Photo

Viewing: All Point and Figure patterns

All Point and Figure patterns

Point and Figure pattern is special Xs and Os columns formation, which give us more clear and filtered view of a chart, which we trade on.

Decision when to buy/sell or wait is everyones individual thing. There are a lot of factors which may influence trader to make his own trading decisions when trading with Point and Figure charts. One of such factors are Point and Figure patterns(meaning described above). These patterns give us opportunity to detect common buy/sell or wait signals. All Point and Figure patterns are categorized by:

* bullish

* reversal

* wait and see (trend continuation)

Remember that patterns are only one of few things we look at when making trading decisions. For example when the market indicators are suggesting that demand is

in control of the overall market, then the bullish patterns work out better than bearish and vise versa when the main market indicators are suggesting supply is in control of the overall market, then the bearish patterns work out better than bullish.

Patterns are especially useful in determining entry points and logical stop loss points.

Bullish Point and Figure Patterns

Point and Figure Patterns. Point and Figure patterns. PnF patterns. Point and Figure Buy/sell signals.

Viewing: Point and Figure patterns added

Point and Figure patterns added

Published: 15 October 2011 Written by in section: Uncategorized

Hello, nice to see you again!

Point and Figure pattern is special Xs and Os columns formation, which give us more clear and filtered view of a chart, which we trade on.

Decision when to buy/sell or wait is everyones individual thing. There are a lot of factors which may influence trader to make his own trading decisions when trading with Point and Figure charts. One of such factors are Point and Figure patterns(meaning described above). These patterns give us opportunity to detect common buy/sell or wait signals.

So, I wish to inform you about new blog section point and figure patterns (search in upper menu under Point and Figure button. This blog section will include almost all of the Point and Figure charting patterns.

For more details of pnf charting patterns follow these links:

Point and Figure patterns. Formations. Buy/sell signals.

Testing Point-And-Figure Patterns

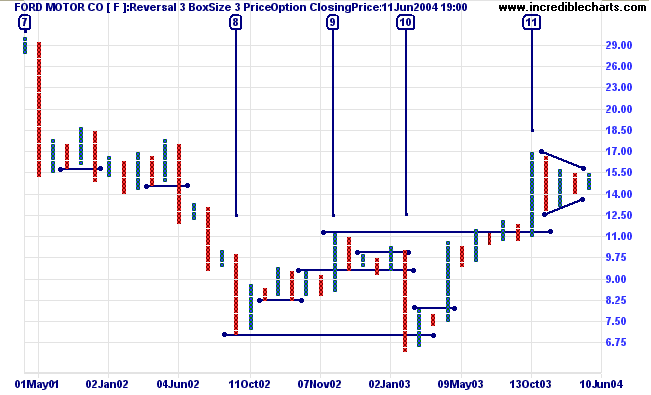

Point-and-figure (P&F) charts have been a part of the technicians toolbox for more than a century. They were used by Charles Dow in the late 1800s and Victor deVilliers published the first detailed explanation of this technique in 1933 in his book, The Point & Figure Method of Anticipating Stock Price Movements. P&F charts track only price changes and ignore time. Proponents of this technique believe that focusing solely on price changes eliminates day-to-day market noise. By ignoring smaller movements, traders believe that it should be easier to identify significant support and resistance levels. In this article well introduce you to several popular P&F patterns that may be useful in identifying potential breakouts.

Using a Traditional Tool

Figure 1

Only three columns are required to identify a double top or double bottom. These signals show only that the stock price has reached a higher high or lower low and that the momentum is likely to continue in the direction of the breakout. They are very useful for spotting the short-term trend and identifying stocks that have just broken out of a consolidation pattern.

Another nice feature of P&F charts is that stop-loss points are easily identified. In the case of the simple patterns we are talking about, a trader could place a stop order just below the price where the breakout occurred. If it is a false breakout. the stock will quickly return to the congestion zone, below the new high indicated by the double top or above the new low indicated by the double bottom. In either case, the loss is limited to only a few points.

A more complex buy signal is the triple top. in which a column of Xs rises above two previous X columns. This means that the bulls were unable to push the price above a certain price level on two separate occasions in the past and signals the momentum is strong.

On the other hand, the triple bottom sell signal results from a column of Os falling below two previous columns of Os (as seen in Figure 2). These patterns require at least five columns to form, and more columns in P&F patterns indicate larger price targets because the breakouts tends to be more dramatic.

Testing Point-And-Figure Patterns

#21 zwols

zwols

Advanced Member

Members 130 posts

Posted 18 March 2013 10:17 AM

We call it the scaling time for Point and Figure charts but i have no idea what is the ideal scaling time.

Point and Figure community Page 2

Point and Figure chart patterns

Point & Figure charting dates back to the turn of the century. Its acts like a filter, showing only significant price movements, allowing the yst to see patterns more readily. The basis for plotting revolves around selecting a box size (the value of a + or o). This is one of the most critical decisions for the yst. A box that is too small will make the chart too sensitive while one that is too large has the opposite effect. Current price, recent volatility and accepted standards provide the yst with guidelines for determining the optimum box value.

Plotting is based on well defined rules. Horizontal movement reflects trend changes rather than time. In other words, each column can encompass a different amount of days, weeks or even months.

Preference is given to price movements that continue in the direction of the current column. If the last column of the chart is a down column (os) then the low of the day is tested first. Price movements are considered significant if they exceed previous movements in the trend direction by one box.

The price must reverse direction by an amount equal to three boxes for it to be considered significant. Traditional charts use x to mark up trends and o to mark down trends. Our examples use a + instead of an x but otherwise follows the traditional format.

Daily Point and Figure chart of American Express with Reversal of 3 points and Box Size of $1.

Point and Figure chart created using Personal yst from Trendsetter Software.

Many of the same techniques for interpreting bar charts apply to Point & Figure. Trendlines are more easily identified as are many of the chart patterns. In the example above, we can see a Head & Shoulders pattern forming. The most common point and figure formations are shown in following example with corresponding buy and sell signals identified.