Point and Figure community

Post on: 20 Август, 2015 No Comment

Javascript Disabled Detected

You currently have javascript disabled. Several functions may not work. Please re-enable javascript to access full functionality.

Point and Figure Charts and Alerts

Point and Figure Charts Save Traders Time, Reveal Better Trading Opportunities.Point and Figure charting is an established method used by most investment firms as a primary or secondary charting method. Originally drawn by hand, most traders now use software to create charts.

How to Create Point and Figure Charts

1. Draw by hand

Point and Figure charts have been around for a long time. Early traders used to buy graph paper and mark an X or O as stock values changed.

One way to is to use software you install on your computer. The advantage of professional Point and Figure software is you can arrange portfolios of stocks, receive instant updates, and work with multiple data feeds.The downside is it doesn’t automatically send you notifications, and there is a learning curve. Learn more about Point and Figure software.

3. Online Point and Figure Charts

The fastest way to create charts is by using Point and Figure Alerts. Many traders prefer using this to charting software because of the proactive notifications and features not available in an installable program.

Finding new trading opportunities

Most traders examine many stocks to verify trends and patterns before finding a good pick. Point and Figure Alerts takes a different approach: let traders search for stocks that fit Point and Figure criteria. This saves you time because you can quickly pull up a list of dozens or hundreds of stocks that fit your ideal criteria. No more scanning through dozens (or hundreds) of stocks before you find your ideal pattern and criteria. You can then take a closer look at each stock and pick the best opportunities to focus on.

Protecting against losses with automated notifications

If desired, you can get emails sent to you when your investments meet a criteria you set. For example, a bearish pattern like the Point and Figure double or triple bottom. This helps you save time and energy, because you don’t have to check in on your investments as often. More importantly, it helps you avoid closing out trades too early due to emotions like fear.

Getting new stock picks automatically via email

Similar to the potentially bearish notifications on your portfolio, you can set notifications for stocks that are about to go bullish. You can receive notifications on your portfolio, a sector, or the entire market.

Using Relative Strength charts to catch multiple waves

The Relative Strength features help you compare how your investments stack up against other stocks, sectors, and the market in general. It’s a valuable tool for top-down investment strategies because it shows you which macro trends to align your strategies with.

Join the Point and Figure Secrets Course, Free

Learn more about how advanced Point and Figure charting strategies can help you make better trades. Test Point and Figure Alerts, free.

Point and Figure Charting basics

Background: Point and Figure charts are popular because they help you predict market outcomes. Their effectiveness has been proven by independent researchers. A study on Point and Figure Patterns performed at Purdue University showed that using Point and Figure patterns would result in a potential trade success rate of 71-93%.

Most institutional traders refer to Point and Figure charts to get an alternate view of their portfolio.

History: Point and Figure Charts were first mentioned in 1898, but were used by traders before then. Victor Devilliers, Richard D. Wyckoff and other prominent traders made Point and Figure Charts popular through books, articles, and great trading success using the method.

Drawing Point and Figure Charts:

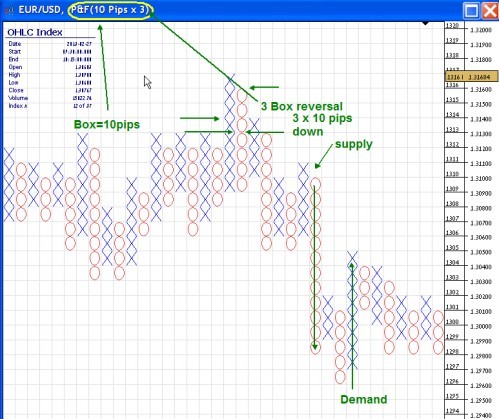

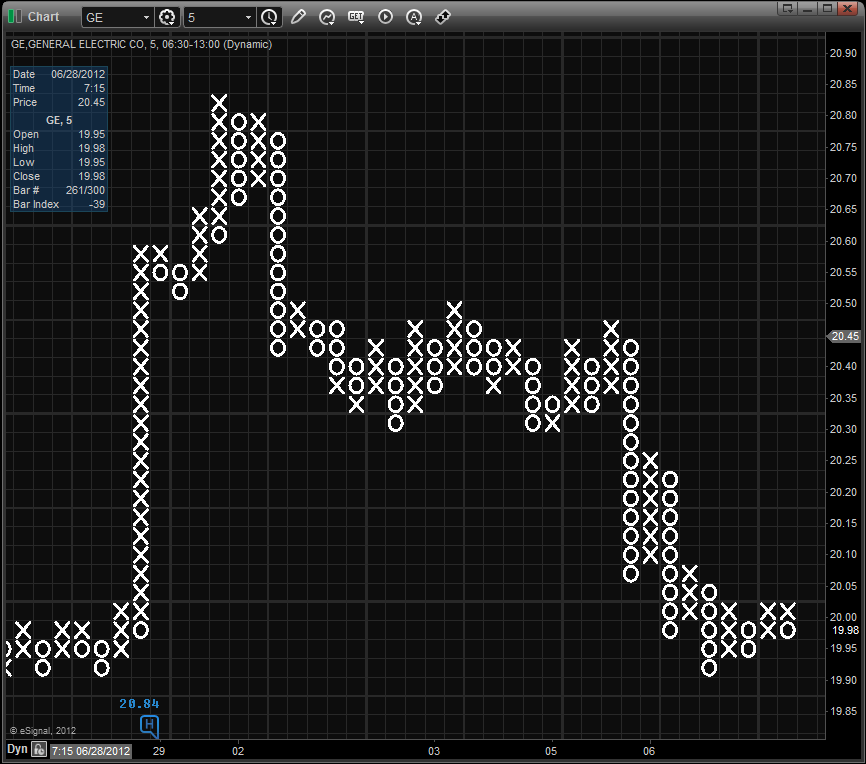

Point and Figure charts were originally drawn by hand, and are very simple. Rising prices are represented by an X. Falling prices are represented by an O.

The method filters out unnecessary detail and noise. Every price movement above or below a set increment results in a X or O in a box. 45 Degree angles are used to represent up or down trends. An X mark shows that the price went up by the fixed amount, O marks that the price went down by the same amount. When the stock changes direction from an up trend to a down trend, a new line is started.

Point and Figure Advantages and Characteristics:

-Gives you a different view of market action.

-Helps you focus your attention on the most important price movements.

-Is action or price-based, not time-based.

-Generates useful trendlines and patterns that are clear to see.

Point and Figure Patterns:

The simplicity of Point & Figure charts makes spotting important price action and patterns easier than other chart types. Independent research has proven the effectiveness of Point and Figure signals as predictors of the market.

Point and Figure charts have very simple Buy and Sell signals that you can find in trading. These patterns indicate the exact moment of change in the underlying relationship of supply and demand in a stock. These patterns are crucial to effective trading because supply and demand determine the price of any investment. Filtering out other noise and focusing on this supply and demand relationship is what makes Point and Figure charts so useful. Spotting the right pattern makes it easy for you to confirm the nature of supply and demand before you make a trade.