Plumbing service to get Stock Funds and Bond Funds Expert Advantage Social

Post on: 20 Май, 2015 No Comment

converse all star verkauf sale Individual investors should invest profit stock funds as well as bond funds so as to give their investment portfolio balance. There exists a best time for it to invest profit both, and there’s another worst time. Mutual total funds are longer-term investments and timing just isn’t normally the major issue for investors. But imagine you suddenly get that has a lump a number of money (like inheritance, or from your 401k) that should be invested somewhere soon? This will happen if your timing is a great one, or it could actually happen at one of many worst times. Have a look at look at the best time for it to invest take advantage the last, and then enjoy 2015, 2016 and beyond.

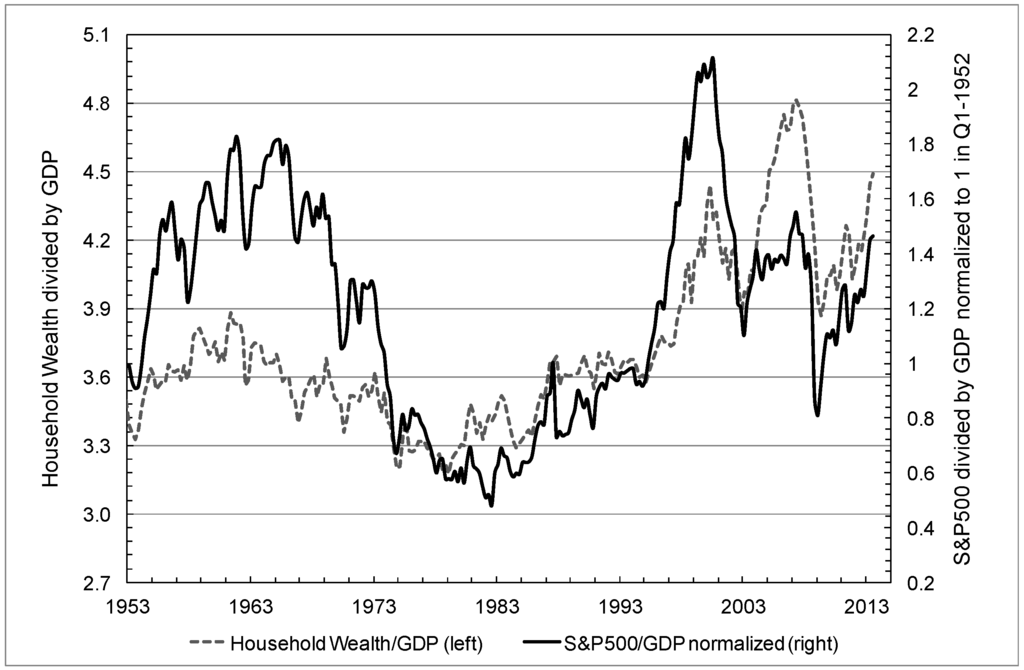

Probably the very best time for it to invest take advantage stock funds what food was in 1982 once the Dow Jones Industrial Average bottomed at 777. In 2000 (18 years later) it hit an all-time a lot of 11,723. up over 1400%, while using the NASDAQ up over 3000%! The year 1981 was optimal timing for bond funds, as interest levels peaked and in addition they were paying dividends of 14%, 15% or even more. To the majority of individuals 1981 and 1982 are ancient history, but when you realize what actually transpired then you definately might better determine what can happen in 2015, 2016 and beyond.

The optimum time to speculate make the most stock funds is after stocks are beaten up significantly; and investors Commence to go to a light by the end in the tunnel. By 1982 mortgage rates and inflation had reached record HIGHS after a very extensive period of rising and serving as a major drag both corporate profits and stock values. When rates of interest turned around and began to fall stock market trading shifted gears and headed north.

converse cons In 2015 and beyond we might find the flip side in the above scenario, because interest rates have hit record LOWS and inflation has become low. Industry has been hitting all-time highs, and has been up six years when. A tremendous reversal of rates of interest could signal changing market trend and spell bad news for investors.

The best time to invest make the most bond funds is when rates are high and initiate falling. The worst is when mortgage rates are low and beginning climb. The significance in their portfolios increases when rates fall; but goes DOWN when rates rise. By the point rates peaked in 1981, some investors in these funds were approaching losses of almost 50% as fund share prices (values) plunged. If rates of interest soar in 2015 and beyond investors could again suffer severe losses.

A lot of today’s investors are unaware of this risk because they have never personally experienced a period of rising mortgage rates. Rates have generally been falling for several years and are also now so ridiculously low that they can can’t go dramatically reduced. It’s not cheerful news when you have money you need to work in 2015 and beyond. The question now is purchasing it.

converse high tops cheap Include some safe alternatives inside your portfolio, like money market funds and short-term CDs. Select conservative, top quality intermediate-term bond funds and blue-chip stock funds that pay good dividends. Take note of your portfolio and also the financial news. If you start falling in value and rising rates start making headline news, this is your signal to cut your contact with funds and improve your holdings in safe alternatives. In the past there is little should be focused on the optimum time to invest take advantage stock funds and bond funds, because losses in one were generally offset by gains from the other. In 2015 and beyond both face the same threat: rising interest levels. Best of luck, and maintain your eyes open much more brave new world unfolds.