Pioneer Fundamental Growth Fund Why IsIt Revving Up

Post on: 16 Июль, 2015 No Comment

S tock mutual fund managers Andrew Acheson and Paul Cloonan have been kicking it into a higher gear at Pioneer Fundamental Growth Fund.

The 16.61% average annual return of their $2.4 billion fund ranked in the top 27% of its large-cap growth rivals tracked by Morningstar Inc. over the five years ended Feb. 27. And its 19.29% gain in the past 12 months was in the top 3%.

Pioneer Fundamental Growth’s Andrew Acheson likes Apple because of its products’ networking potential. View Enlarged Image

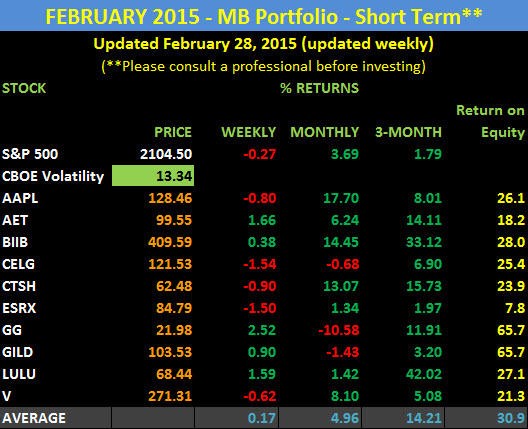

The top-performing fund. up 5% this year vs. 3% for the S&P 500, aims for stocks of companies that can maintain high rates of return on reinvested capital for many years, co-manager Acheson says.

That quest has led him and Cloonan to investments in stocks that have an average IBD Composite Rating of 73. Leading growth fund portfolio’s average Composite Ratings tend to range in the low- to mid-70s these days.

Fundamental Growth’s three-year average annual return of 18.11% puts it in the top 26% of its peers and compares with 18.12% for the S&P 500. The fund’s return is also enough to give it an IBD 36-Month Performance Rating of A.

Acheson has been a portfolio manager on the fund since 2007. Cloonan joined as co-manager in 2012.

With his distinct British accent, 51-year-old co-manager Acheson talked with IBD about his investment approach from his office in a currently frigid Boston.

IBD: You’re looking for above-average growth at the right price. Is this a growth-at-a-reasonable-price (GARP) fund?

Acheson: That’s a classification that people sometimes mistakenly use. All of our stocks are GARP types, but we are not a GARP strategy.

IBD: Explain that distinction, please.

Acheson: We try to own companies that have high returns on capital today, but it’s absolutely critical that these companies must also have what we call higher returns on incremental invested capital.

It’s not just about growing earnings per share on an accounting measure. Since these high return-on-capital businesses tend to attract competition, all of these businesses must have very sound, sustainable competitive advantages. If you like, a moat around those businesses, to protect those high returns long into the future.

IBD: How does this fund differ from the hordes of other large-cap growth funds ?

Acheson: It’s about how a company grows, the quality of growth.

Take, for example, if you’ve got a great business that has high returns on capital. Management in most businesses will redeploy that capital back into the business to grow the business. If they were to get a lower return on capital on that reinvestment than they’re achieving on their existing business, then they can grow earnings per share quite merrily for several years. But they would have turned a high return-on-capital business into a lower return-on-capital business. And it would be regarded as a lower-quality business.